Aristotle Capital Management, LLC, an investment management company, released its “International Equity Strategy” fourth quarter 2024 investor letter. A copy of the letter can be downloaded here. Global equity markets had a modest decline at the end of the year, with the MSCI ACWI Index returning -0.99% in the fourth quarter, while, the Bloomberg Global Aggregate Bond Index fell by 5.10%. Aristotle Capital International Equity returned -6.91% gross of fees (-7.02% net of fees) in the fourth quarter outperforming the MSCI EAFE Index’s -8.11% return, and the MSCI ACWI ex USA Index’s -7.60% return. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Aristotle International Equity Strategy highlighted stocks like Cameco Corporation (NYSE:CCJ), in the fourth quarter 2024 investor letter. Cameco Corporation (NYSE:CCJ) provides uranium for electricity generation. One-month return of Cameco Corporation (NYSE:CCJ) was 1.79%, and its shares gained 12.90% of their value over the last 52 weeks. On January 21, 2025, Cameco Corporation (NYSE:CCJ) stock closed at $53.56 per share with a market capitalization of $23.346 billion.

International Equity Strategy stated the following regarding Cameco Corporation (NYSE:CCJ) in its Q4 2024 investor letter:

“Cameco Corporation (NYSE:CCJ), one of the world’s largest uranium producers, was a major contributor during the period. With the continued focus on artificial intelligence and clean energy, the demand for nuclear energy remained robust. Some of the largest companies in the world, such as Amazon, Google and Meta, announced nuclear power agreements in the quarter. Given Cameco’s tier-one assets in reliable jurisdictions, proven operating experience and strong reputation, we believe the company is in a unique position to benefit as various industries and governments pursue clean, reliable and scalable sources of energy. Correspondingly, Cameco increased its production outlook, having already secured commitments that net an average of 29 million pounds per year over the next four years. We believe Cameco’s continued ability to efficiently increase production while securing long-term contracts will lead to sustainably higher levels of normalized FREE cash flow. While its Canada-based mines and Westinghouse unit are executing well, production was recently suspended at Cameco’s Inkai joint venture in Kazakhstan. We believe production will restart soon and note that Cameco’s share of Inkai’s production amounts to less than 10% of total Cameco volumes, a figure that can be offset with increased production at the company’s MacArthur River and Key Lake mines in Canada.”

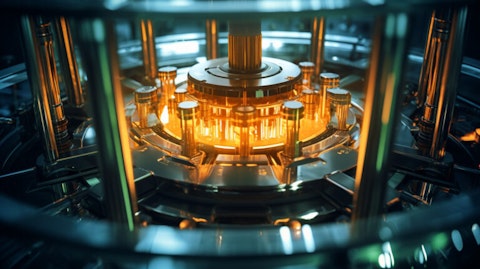

A close up of the reactor core, highlighting the complexity of the uranium power process.

Cameco Corporation (NYSE:CCJ) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 60 hedge fund portfolios held Cameco Corporation (NYSE:CCJ) at the end of the third quarter which was 60 in the previous quarter. While we acknowledge the potential of Cameco Corporation (NYSE:CCJ) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

We previously discussed Cameco Corporation (NYSE:CCJ) in another article, where we shared the list of best Uranium stocks to invest in. In addition, please check out our hedge fund investor letters Q4 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.