Should you add AT&T Inc. (NYSE:T), Amazon.com, Inc. (NASDAQ:AMZN), Veeva Systems Inc (NYSE:VEEV), and Cyberark Software Ltd (NASDAQ:CYBR) to your portfolio? One strategy that can help you decide is to look at what the smart money investors think about these stocks. One fund that amassed substantial positions in all four companies is Ryan Frick and Oliver Evans’ Dorsal Capital Management.

Dorsal Capital Management held an equity portfolio worth $1.36 billion at the end of June. Over a half of its portfolio was invested in technology stocks and the rest was mainly spread among utilities and communications, consumer discretionary and industrial stocks. At Insider Monkey, we analyze the performance of a fund’s portfolio by calculating the weighted average returns of its long positions in companies with market caps over $1.0 billion. Dorsal posted a gain of 11.60% from its 23 “relevant” holdings for the third quarter.

violetkaipa/Shutterstock.com

Let’s start with AT&T Inc. (NYSE:T), in which Dorsal reported ownership of 3.0 million shares, up by 50% over the quarter; the stake was valued at $129.63 million at the end of June. However, during the third quarter, AT&T’s shares declined by 5%. Heading into the third quarter of 2016, a total of 55 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the previous quarter. Among these funds, Soroban Capital Partners held the most valuable stake in AT&T Inc. (NYSE:T), which was worth $1.28 billion at the end of the second quarter. On the second spot was Adage Capital Management which amassed $458 million worth of shares. Moreover, Tourbillon Capital Partners, AQR Capital Management, and Balyasny Asset Management were also bullish on AT&T Inc. (NYSE:T).

Follow At&T Inc. (NYSE:T)

Follow At&T Inc. (NYSE:T)

Receive real-time insider trading and news alerts

Then there’s Amazon.com, Inc. (NASDAQ:AMZN), whose stock surged by 17% during the third quarter, while Dorsal entered the period with a $107.34 million position containing 150,000 shares, up by 66% on the quarter. The stock was included in 145 funds’ portfolio at the end of June, up from 133 funds a quarter earlier. More specifically, among the funds in our database Viking Global was the top shareholder of Amazon.com, Inc. (NASDAQ:AMZN), with a$2.35 billion stake at the end of the second quarter. On the second spot was Fisher Asset Management which amassed $1.50 billion worth of the company’s stock. Moreover, Lansdowne Partners, Eagle Capital Management, and Lone Pine Capital were also bullish on Amazon.com, Inc. (NASDAQ:AMZN).

Follow Amazon Com Inc (NASDAQ:AMZN)

Follow Amazon Com Inc (NASDAQ:AMZN)

Receive real-time insider trading and news alerts

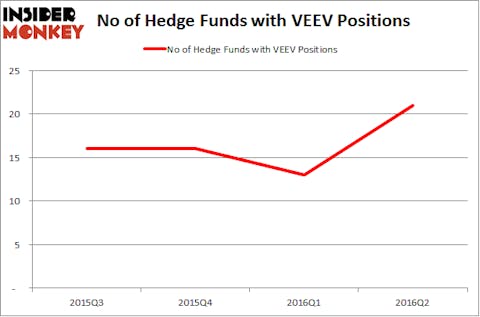

In Veeva Systems Inc (NYSE:VEEV), Dorsal Capital trimmed its stake by 20% to 1.60 million shares worth $54.59 million during the second quarter. Nevertheless, the stake had a positive impact on Dorsal’s returns as Veeva’s shares appreciated by 21% during the third quarter. At the end of June, 21 investors followed by our team were bullish on this stock, up by 62% over the quarter. The largest stake in Veeva Systems Inc (NYSE:VEEV) was held by Renaissance Technologies, which reported holding $55.8 million worth of stock at the end of June. It was followed by Dorsal Capital Management with a $54.6 million position. Other investors bullish on the company included Two Sigma Advisors, Millennium Management, and PEAK6 Capital Management.

Follow Veeva Systems Inc (NYSE:VEEV)

Follow Veeva Systems Inc (NYSE:VEEV)

Receive real-time insider trading and news alerts

Finally, Cyberark Software Ltd (NASDAQ:CYBR) represented a new position in Dorsal’s equity portfolio, as the fund amassed 800,000 shares worth $38.87 million at the end of June. In the third quarter, the stock inched up by 2%. There were 22 investors from our database long Cyberark at the end of June, down by three funds over the quarter. The largest stake in Cyberark Software Ltd (NASDAQ:CYBR) was held by Brookside Capital, which reported holding $41.5 million worth of stock at the end of June. It was followed by Dorsal Capital Management with a $38.9 million position. Other investors bullish on the company included Polar Capital, Marshall Wace LLP, and Elliott Management.

Disclosure: none