In my view, despite another quarter with disappointing results, Archer-Daniels-Midland Company (NYSE:ADM)’s stock, is still attractive.

Archer-Daniels-Midland, one of the world’s largest agricultural processors and food ingredient providers, is an excellent candidate to be included in diversified large-cap dividend stock portfolio.

The company was included in the equity portfolios of 27 of the investors tracked by Insider Monkey as of December 31, who held 4% of its outstanding shares worth over $867 million. However, ownership was down quarter-over-quarter from 33 investors with long positions at the end of September. David Harding’s Winton Capital, one of the top shareholders of the company’s stock on December 31, slashed its holding by 70% during the first quarter, to 1.35 million shares.

While waiting for a significant rebound in the price of agriculture commodities, investors can enjoy the generous dividend yielding 3.1% a year.

Despite continued low agriculture commodities prices, ADM raised its dividend by 7% on February 2. The company has increased its annual dividend payment to shareholders for 32 consecutive years. This makes Archer-Daniels-Midland one of 50 Dividend Aristocrats. Even during the global economic crisis of the years 2008-2009, ADM continued to grow its dividend.

On May 03, Archer-Daniels-Midland reported its first quarter 2016 financial results, which missed earnings-per-share expectations by $0.03 (6.7%). The company reported revenue of $14,384 million, down 17.8% year-over-year and below consensus of $15,394 million.

ADM missed expectations in its last four quarters after beating estimates in its four previous quarters, as shown in the table below.

Data: Yahoo Finance

In the report, ADM Chairman and CEO Juan Luciano, said:

“Challenging market conditions continued in the first quarter, particularly affecting Ag Services. Low U.S. export volumes and weak margins continued, and in the quarter, poor results from the global trade desk impacted results for Ag Services. Results for Corn improved compared to the first quarter one year ago, led by a strong performance in sweeteners and starches. For Oilseeds, global protein demand remained solid. However, first quarter results were impacted by weak global crush margins. WFSI results were in line with expectations.”

Source: ADM Quarterly Presentation

Follow Archer-Daniels-Midland Co (NYSE:ADM)

Follow Archer-Daniels-Midland Co (NYSE:ADM)

Receive real-time insider trading and news alerts

However, I see healthy growth prospects for the company. According to ADM, it would remain on track to achieve its 15% to 20% operating profit growth target for 2016.

In the second quarter, it expects some modest underlying growth on a year-over-year basis, and it will continue to see some additional startup costs. The company’s growth will be more concentrated in the second half based upon the pattern of new business and synergy realizations.

In my view, the company’s advance in its strategic plan – that has led to a substantial improvement in returns – is very encouraging.

During the quarter, it acquired a controlling stake in Harvest Innovations, enhancing ADM’s plant protein, gluten-free ingredient portfolio.

Also, ADM announced the purchase of a corn wet mill in Morocco that will further expand its global sweeteners footprint and opened new, state-of-the-art flavor creation, application and customer innovation center in Cranbury, New Jersey.

In addition, as part of its ongoing portfolio management efforts, the company reached an agreement to sell its Brazilian sugarcane ethanol operations. Moreover, it achieved almost $50 million of run-rate savings in the quarter and remains on track to meet its $275 million target by the end of the calendar year.

Ethanol

Archer Daniels Midland Company (NYSE:ADM) is the world’s largest corn processor, and it produces about 11% of U.S. ethanol. In the recent quarter ethanol margins continued to be impacted by high industry production levels that caused inventories to build throughout the quarter.

However, in April, ADM saw inventories come down in the month as domestic and export demand remains solid, and production levels slowed. This is due in part to seasonal maintenance programs of many plants in the industry.

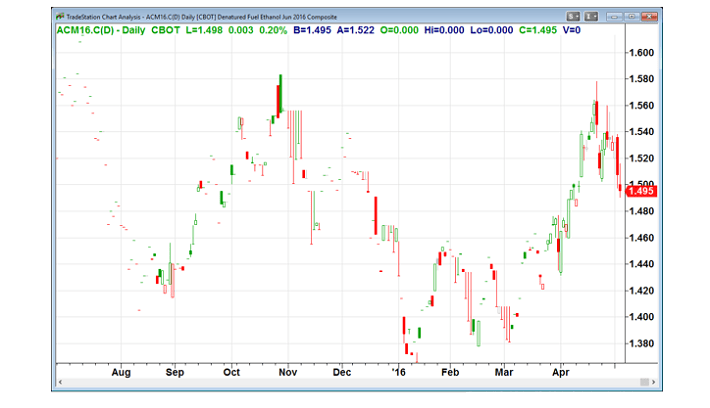

To estimate the current quarter ethanol margins compared to the previous quarter, I have calculated the average price of corn and ethanol for the current and the prior quarter. The average corn price increased about 1.6% thus far in the current quarter compared to the previous one, and the average price of ethanol rose about 6.6%. Since corn price increased less than ethanol price, ethanol production margin might increase in the current quarter.

* thus far second quarter

Corn, July 2016 Leading Contract Daily Chart

Ethanol, June 2016 Leading Contract Daily Chart

Charts: TradeStation Group, Inc.

Valuation

Since the beginning of the year, ADM’s stock is up 5.6% while the S&P 500 Index has increased 0.4%, and the Nasdaq Composite Index has lost 5.6%.

However, since the beginning of 2012, ADM’s stock has gained only 35.4%. In this period, the S&P 500 Index has increased 63.1% and the Nasdaq Composite Index has gained 81.4%.

According to TipRanks, the average target price of the top analysts is at $42, an upside of 8.5% from its May 4 close price, however, in my opinion, shares could go higher.

Regarding its valuation metrics, ADM’s stock is pretty cheap.

– Trailing P/E is very low at 12.95

– Forward P/E is also low at 13.51

– Price-to-sales ratio is extremely low at 0.34

– Enterprise Value/EBITDA ratio is low at 9.60.

Moreover, ADM’s Efficiency parameters have been much better than its industry median, its sector median and the S&P 500 median as shown in the table below:

Source: Portfolio123

You can read more about these efficiency ratios (and much more) at this list of 101 financial ratios and metrics.

ADM raised its dividend by 7% on February 02. The annual dividend yield is at 3.1%, and the payout ratio is only 37.3%.

The current yield is historically high, which indicates that the stock is undervalued, according to some dividend assessment theories.

The annual rate of dividend growth over the past three years was very high at 17.8%, and over the past five years was at 14.1%.

Source: company’s reports

*assuming same dividend rate for the year

ADM repurchased about $300 million of shares in the quarter as it continues to execute on its balanced capital allocation framework. The company returned $0.5 billion to shareholders through dividends and share repurchases.

Final Thoughts

Continued low agriculture commodities prices and challenging market conditions caused Archer Daniels Midland Company (NYSE:ADM) to miss expectations slightly in the first quarter of 2016.

However, According to the company, it would remain on track to achieve its 15% to 20% operating profit growth target for 2016.

As I see it, ADM is an excellent candidate to be included in diversified large-cap dividend stock portfolio. While waiting for a significant rebound in the price of agriculture commodities, investors can enjoy the generous dividend yielding 3.1% a year.

The average target price of the top analysts is at $42, an upside of 8.5% from its May 4 close price, however, in my opinion, shares could go higher. ADM’s combination of an above average yield, solid long-term growth prospects, cheap valuation, and long dividend history make it a favorite of The 8 Rules of Dividend Investing.

Disclosure: This article is originally published on Sure Dividend by Arie Goren.