Ariel Investments, an investment management company, released its “Ariel Global Fund” first-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the first quarter, the Ariel Global fund appreciated +7.35% lagging behind the +8.20% gain of its primary benchmark, the MSCI ACWI Index, but ahead of the +6.85% return of its secondary benchmark, the MSCI ACWI Value Index. The upward rally of developed markets continued in the first quarter of 2024. The rally was driven by investors’ excitement over artificial intelligence (AI), a rebound in bank lending growth, decreased energy costs, a rise in global manufacturing activity, recent structural reforms in Japan, and the near-term possibility of a rate-cutting cycle in the U.S. and Europe. In addition, you can check the top 5 holdings of the fund to know its best picks in 2024.

Ariel Global Fund highlighted stocks like Aptiv PLC (NYSE:APTV), in the first quarter 2024 investor letter. Aptiv PLC (NYSE:APTV) designs and manufactures vehicle components. The one-month return of Aptiv PLC (NYSE:APTV) was -9.26%, and its shares lost 26.55% of their value over the last 52 weeks. On June 13, 2024, Aptiv PLC (NYSE:APTV) stock closed at $74.51 per share with a market capitalization of $20.271 billion.

Ariel Global Fund stated the following regarding Aptiv PLC (NYSE:APTV) in its first quarter 2024 investor letter:

“We added Aptiv PLC (NYSE:APTV)) which designs and manufactures vehicle components and provides electrical/electronic and active safety technology solutions to the global automotive and commercial vehicle markets. We believe the secular trend of electrification and digitization within the automobile industry, coupled with the expansion of Chinese original equipment manufacturers (OEMs), will accelerate demand and drive long-term growth. Additionally, we anticipate APTV will grow earnings per share over the near-term through its divesture of the autonomous driving joint venture, Motional. In our view, the name is currently trading at a significant discount relative to our estimate of intrinsic value.”

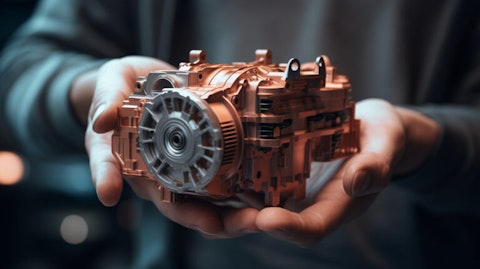

A closeup of a hand holding a car engine component, highlighting the precision of the company’s engineering.

Aptiv PLC (NYSE:APTV) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database,38 hedge fund portfolios held Aptiv PLC (NYSE:APTV) at the end of the first quarter which was 39 in the previous quarter. The first quarter revenue of Aptiv PLC (NYSE:APTV) was $4.9 billion, up 2% from Q1 2023. While we acknowledge the potential of Aptiv PLC (NYSE:APTV) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Aptiv PLC (NYSE:APTV) and shared the list of undervalued cyclical stocks to invest in according to analysts. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.