Aristotle Atlantic Partners, LLC, an investment advisor, released its “Core Equity Strategy” third quarter 2024 investor letter. A copy of the letter can be downloaded here. The U.S. equity market continued to climb to new record highs, with the S&P 500 Index increasing by 5.89% during this time. Ten of the eleven sectors in the S&P 500 Index experienced gains, with Utilities and Real Estate at the forefront. Conversely, Energy and Information Technology were the least successful sectors. Aristotle Atlantic’s Core Equity strategy returned 3.19% gross of fees (3.09% net of fees) in the quarter underperforming the S&P 500 Index’s 5.89% total return. The relative underperformance was due to security selection. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Aristotle Core Equity Strategy highlighted stocks like Applied Materials, Inc. (NASDAQ:AMAT), in the third quarter 2024 investor letter. Applied Materials, Inc. (NASDAQ:AMAT) offers manufacturing equipment, services, and software to the semiconductor, display, and related industries. The one-month return of Applied Materials, Inc. (NASDAQ:AMAT) was -5.35%, and its shares gained 28.81% of their value over the last 52 weeks. On November 7, 2024, Applied Materials, Inc. (NASDAQ:AMAT) stock closed at $194.09 per share with a market capitalization of $160.009 billion.

Aristotle Core Equity Strategy stated the following regarding Applied Materials, Inc. (NASDAQ:AMAT) in its Q3 2024 investor letter:

“Applied Materials, Inc. (NASDAQ:AMAT) detracted from performance in the third quarter as the stock was part of the general investor pullback in AI-related semiconductor names due to concerns about overall AI market growth in the near-term and profitability of the massive capex investments being made in AI infrastructure. The company delivered an inline quarter with solid execution and it continues to benefit from a secular shift to highly complex semiconductors design and manufacturing, but there continue to be pockets of weakness and concerns that include weaker NAND manufacturing and potential for further trade restrictions on Chinese equipment purchases.”

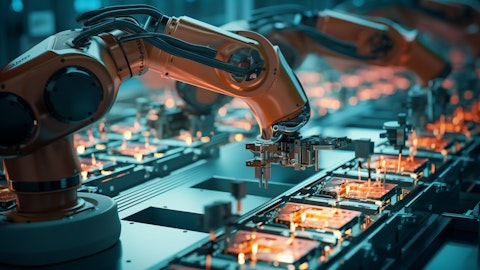

A technician in a clean room assembling a semiconductor chip using a microscope.

Applied Materials, Inc. (NASDAQ:AMAT) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 77 hedge fund portfolios held Applied Materials, Inc. (NASDAQ:AMAT) at the end of the second quarter which was 79 in the previous quarter. In the fiscal third quarter, Applied Materials, Inc. (NASDAQ:AMAT) delivered $6.78 billion in revenues, up 5% year-over-year. While we acknowledge the potential of Applied Materials, Inc. (NASDAQ:AMAT) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Applied Materials, Inc. (NASDAQ:AMAT) and shared AI news and ratings you should not miss. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.