Crescat Capital Q2 2020 letter to investors discussing the attractive valuations in the precious metals mining sector.

Dear Investors:

A New Bull Market for Precious Metals

Central banks are facing a serious predicament. After decades of ongoing accommodative monetary policy, the world is now sitting at record levels of debt relative to global GDP. In our view, there has never been a bigger gulf between underlying economic fundamentals and security prices. We are in a global recession, but equity and credit markets still trading at outrageous valuations. Markets are trading on a perverse combination of Fed life support and rabid speculative mania.

– The economy is now reaching credit exhaustion with record amounts of government and corporate debt relative to GDP worldwide.

– The debt burden ensures weak future real economic growth.

– Monetary debasement is the only way to reduce the debt burden. Fiat currencies are now engaged in a race to the bottom.

– Global monetary base expansion to suppress interest rates creates a supercharged environment for gold and silver.

– The global economy is in a severe recession with structural underpinnings beyond Covid-19.

– Unemployment has spiked an historic 6.7% in just five months from 3.5% to 10.2% even after settling back from temporary 14.7% Covid-19 lockdown levels.

– US equities today trade at truly record valuations, a full-blown mania. Ongoing policy rescue has perverted both free market accountability and price discovery creating a simultaneous zombie economy and stock market bubble which is unsustainable. Speculative asset bubbles are ripe for bursting.

– During the 1970s precious metals bull market, 10-year real yields got as low as -4.9%. We strongly believe we are headed in that direction and again with a long runway, especially with Jay Powell’s new signaling from Jackson Hole.

– A colossal $8.5 trillion of US Treasuries will mature by the end of 2021 and will need to be refinanced. Our government’s own central bank, the Fed, is the only entity capable of swallowing its debt guaranteeing new record levels of money printing to top today’s already historic levels.

– Precious metals and miners have became a forgotten class among large allocators of capital in the extended expansion phase of the last business cycle.

– With $15 trillion of negative yielding bonds, equities’ earnings real yields at a decade low, and corporate bonds near record prices, gold and silver are being rediscovered for their tactical as well as strategic risk reducing and return generating properties in prudently balanced portfolios.

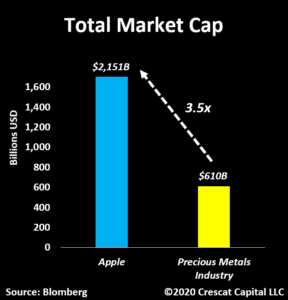

– The precious metals mining industry is the one clear industry to directly benefit from this monetary and fiscal indulgence. The aggregate market value of this industry still is almost 3 times smaller than Apple’s market cap.

– Precious metals are now trading at historically depressed levels relative to money supply; overall stocks, on the other hand, are the complete opposite.

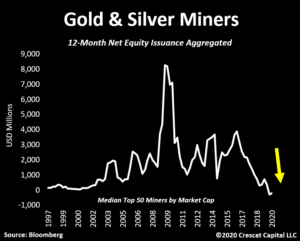

– After a decade-long bear market, precious metals miners have been reluctant to spend capital. Now, they have historically low equity dilution, clean balance sheets, and record free cash flow growth.

– The lack of investment in exploration and new gold and silver discoveries is setting up an incredibly bullish scenario for metals as supply is likely to remain constrained for an extended period at the same time while demand is poised to explode.

– The year-over-year change in gold prices just broke out from a decade-long resistance. Last time we saw such strong appreciation was at the early stages of the 1970s gold bull market.

Financial markets simply cannot withstand higher interest rates. We believe the Fed has been forced into a new mandate, to suppress yields at all cost. This dynamic of expanding the monetary base to purchase assets and manipulate rates lower is an explosive mix for precious metals and mining stocks.

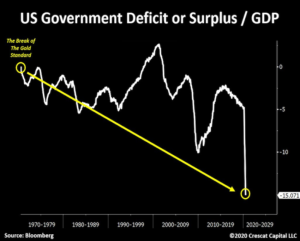

The break of the gold standard in 1971 was just as impactful as the Fed’s recent unlimited QE policy. Back then, it marked a period of lack of financial and fiscal discipline that triggered a frenetic 10-year bull market for gold. This time, we have arguably even stronger macro drivers for precious metals. As we show in the chart below, we have been in a clear trend of structurally increasing government deficits.

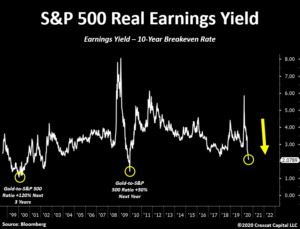

The S&P 500 real earnings yield is at its lowest level in a decade. Prior lows were also times that gold outperformed equities. In the early 2000s, for instance, the gold-to-S&P 500 ratio went up by 120% over 3 years. Even in 2010, a bull market for stocks, gold outperformed by 50%. The difference this time is that stocks have never been so overvalued at the same time as the economic growth outlook has been so challenged. We believe strongly this is the perfect time to buy gold and sell stocks. And when we say “buy gold”, we also include silver and precious metals mining stocks where there is even more upside exposure (both alpha and beta) to a macro move up in gold.

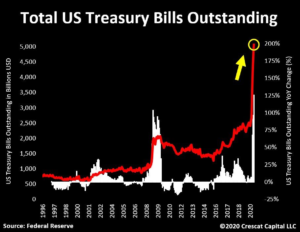

The debt quandary the US government faces also adds tremendously to our views on precious metals. From a funding perspective, 71% of all Treasuries issued in the past year matures in less than 12 months, resulting on Treasury Bills outstanding to surge to $5 trillion! The US Treasury is hoarding a record of $1.79 trillion of this cash.

A similar buildup happened back in 2008-9. A major difference this time is the fact that Treasury Bills outstanding are almost $3.3 trillion higher than their cash balance. In such scenario, average maturity of government debt has dramatically declined to 64 months. As a result, there is a tsunami of $8.5 trillion of Treasuries that will be maturing by the end of 2021 ensuring astronomic levels of money printing in the near term.

Skeptics of Crescat’s long gold thesis often say real yields can’t move any lower. This is often because this are looking at the TIPS market which only dates back to 1997 and real yields are already at their lows for this time frame. Therefore, some investors assume interest rates when adjusted for inflation expectations have never been lower. That, unfortunately, fails to include one of the most important analogs to today’s set up, the decade of the 1970s. Back then, 10-year yields less inflation measured by CPI twice reach as low as about -4.9%.

Those moments of large and declining negative real interest rates drove two of the US most significant surges in gold, silver, and precious metals mining stocks in US history. In today’s conundrum, corporations and governments are historically indebted and can’t take higher nominal yields, ensuring that strong monetary stimulus is here to stay to drive real yields lower, just like Jay Powell has promised.

A major narrative shift is underway. The old times of precious metals being perceived just as haven assets are probably over. With $15 trillion worth of negative yielding bonds, record overvalued stocks and a historically leveraged global economy, investors will likely begin to look at gold and silver, especially mining companies, with a fresh pair of eyes: growth and value.

Precious metals miners are the only industry where we are seeing strong and sustainable growth in revenues and future free cash flow at still incredibly low valuations today. Investors are starting to take note. Silver mining stocks, for instance, have already started to outperform even the market darlings, tech stocks. We believe this is only the beginning of a new era for precious metals.

The mining industry built a reputation of being capital destroyers since it peaked in 2011. But today this skepticism is no longer warranted. It is mind blowing that gold prices have just hit record highs and the larger mining companies have barely engaged in share dilution. In aggregate, the top fifty gold and silver miners by market cap that trade in Canadian and US exchanges have only issued close to $266 million in equity in the last twelve months. That was the second lowest amount of 12-month equity issuance in the last 3 decades. These companies have also just paid down $200 million of debt in the last quarter.

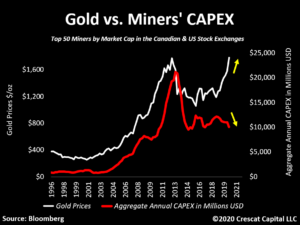

We have also noticed extremely conservative capital spending by miners. Throughout history, the CAPEX cycle for the industry tends to follow gold and silver prices incredibly close. Logically, this makes sense. As metal prices move higher, these businesses become more optimist and therefore focus on advancing their projects. This time, however, even though gold and silver prices have moved significantly higher, companies remain reluctant to spend capital. This level of divergence never happened in prior bull markets for precious metals. This is fundamentally bullish for entire asset class as we expect the supply of gold and silver to stay constrained for longer. It is also fundamentally bullish for Crescat’s activist investment strategy in the industry where we we can deploy capital into undervalued companies with big, highly economic projects that are ripe to move forward in current macro environment.

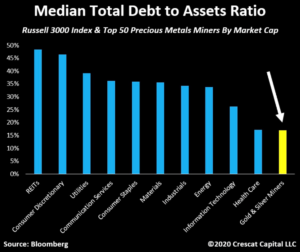

Precious metals miners have never looked so financially strong. If the industry were a sector, it would have the cleanest balance sheet among all sectors in the S&P 500. The median company in the S&P 500 today has historically high total debt to assets of 35%. Top miners, on the other hand, have only 12%. For such capital-intensive businesses, today’s healthy industry-wide capital structure is nice set-up to kick off a new secular bull market in precious metals mining.

We think it is important to get a sense of the both the value and growth opportunity today to see the incredible appreciation potential ahead of us. When we look at the ratio of gold and silver miners to global equities, it is still is near all-time lows and appearing to form a very bullish base, similar to what we saw back in early 2000s. Mining stocks meanwhile are about to become free cash flow growth machines. Juniors with a large scale, high grade new deposits, carry mind-blowing NPVs and IRRs. It is far and away the industry with the strongest combination of deep value and high growth opportunity for today’s macro environment.

In contrast to the value and growth prospects for miners, it is shocking to see Apple’s market cap still about 3.5 times the size of the entire precious metals industry. If anything, this reflects the level of skewness to the upside for gold and silver stocks in the near and medium term. This is the only industry to truly benefit from today’s world of unlimited QE and deficits.

Market cap of precious metals mining vs Apple

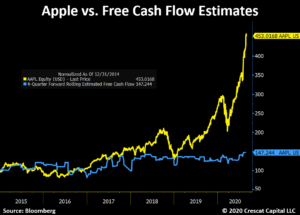

As we show below, Apple’s (AAPL) stock price appreciated at a much faster growth rate than its underlying free cash flow on a rolling twelve-month, forward-looking basis. The stock price is way ahead of its fundamentals. Apple is just one the many poster children for the manic speculation and excess in today stock market at large. Stocks like Microsoft (MSFT), Tesla (TSLA), and Netflix (NFLX) show similar looking disconnect.

With stock market indices making new highs, the narrowing breadth is ominous, especially in the tech-laden NASDAQ Composite.

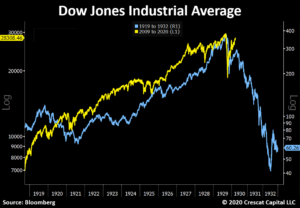

The valuation of US stocks at large based a combination of eight factors compiled by Crescat is the most over-valued ever. We believe that the stock market is more over-valued than in it was in 1929 and higher than 2000.

To think that the stock market does not have any downside risk because the Fed has its back is absurd. False hope in the Fed’s ability to sustain these market valuations is perhaps the sole remaining illusion holding this market up. If your are in the crowded investor camp that believes easy monetary policy can prevent a market crash this time around because the Fed is engaged in easy monetary policy unlike the Great Depression, do yourself a favor and look up what happened to stock prices and multiples during the 1973-1974 bear market.

Silver and precious metals and mining

Easy monetary policies, as we have shown herein, are much more likely to drive investors out over-valued stocks and into under-valued precious metals. One precious metal that we are most excited about today is silver. Throughout history silver has played an important role in the monetary system. Its recent price surge made a lot of investors question the sustainability of this move, but in the grand scheme of things, silver remains near all-time lows relative to size of the US M2 money supply. The chart below is analytically important as it zooms out the still-early stages of what could be an incredible upsurge.

We have also recently noted that gold prices on a year over year basis just broke out from an over decade-long resistance. This is an important validation of our precious metals’ thesis. In our view, this looks a lot like the beginning of a late 70’s bull market.

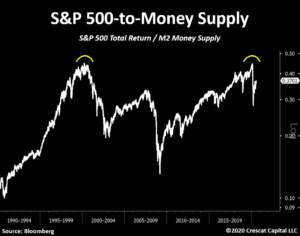

Even after the largest liquidity infusion seen in history, equity markets are not only overvalued relative to their fundamentals but also relative to money supply. On the chart below, the S&P 500-to-M2 money supply ratio recently formed a double top from the insane tech bubble levels. It also still it well above peak of the housing bubble. For investors looking for bargains, it is not in the stock market at large. In our view, precious metals are almost solely the place to be today.

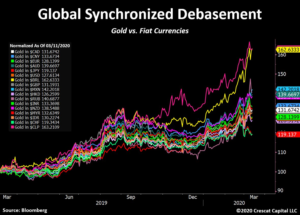

How does it all end? Colossal monetary dilution. None of us own enough gold. It is not just the US dollar that will be challenged. It is all the global fiat currencies of highly indebted countries. The Chinese yuan for instance is in an even worse predicament than the US dollar.

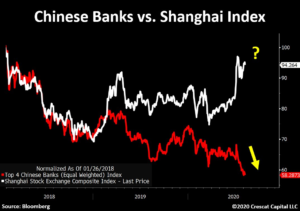

Chinese and Hong Kong banks are the most levered financial institutions in the global markets today. Chinese banks hold close to $43 trillion worth of highly inflated assets compared to China’s $14 trillion nominal GDP, an imbalance significantly greater than US and European banking imbalances that precipitated the Global Financial Crisis in 2008. Chronically troubled, the top four Chinese banks have been under pressure for years now and have significantly been diverging to the downside relative to the Chinese stock market at large, similar to US banks in 2007. We believe that China, formerly the growth engine of the global economy responsible for 60% of global GDP from 2009 to 2019, has finally reached credit exhaustion.

All fiat currencies are in a race to the bottom versus gold today. The macro environment is one of global synchronized monetary debasement.

Crescat’s Hedge Funds Top Bloomberg’s Performance Table for July

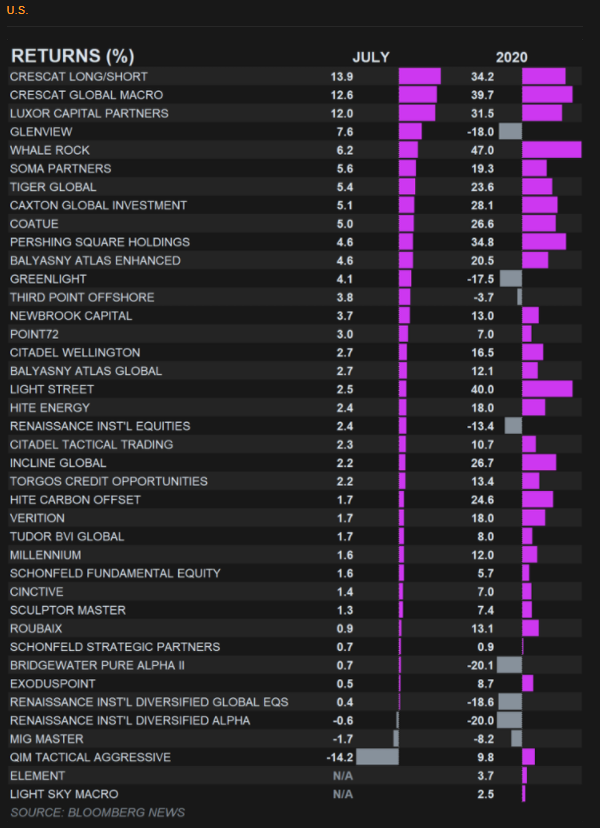

We are pleased to announce that Crescat’s hedge funds made the top of Bloomberg’s US hedge fund performance table for the second month in a row in July and the third month this year. The table below is from the Bloomberg Weekly Hedge Fund Brief, August 25, 2020, Melissa Karsh, Editor.

The first month that we stood out in the Bloomberg table this year was in March, a month in which the “sell stocks” side of our “buy gold and sell stocks” trade kicked in heavily. We continue to maintain a equity-hedged position in both our global macro and long short funds today: long precious metals mining stocks and pharmaceutical stocks combined with broad shorts of over-valued stocks across many industries and predominantly in the US. We have a substantial gross short-equity position in both of these funds still today to benefit from the re-ignition of the equity bear market that we foresee. It is important to note, that while we are still significantly gross short in both of these funds, but we are no longer “net short” like we were earlier this year because we deliberately became more aggressive on the long precious metals side of the portfolio in March and have allowed that side to grow.

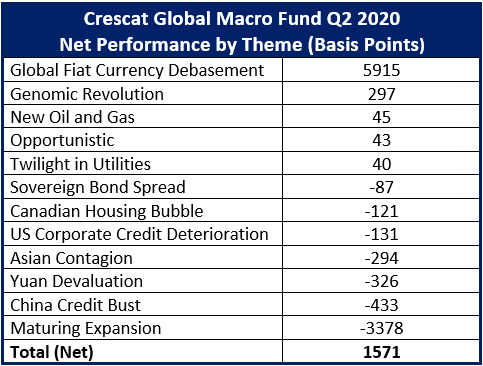

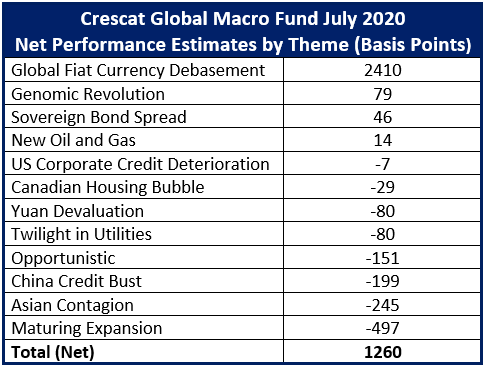

Below see Crescat’s performance by theme for our flagship global macro fund in both the last quarter and last month.

Global Macro Fund Net Profit Attribution: Q2 2020 and July 2020

Note the strong performance of our global fiat debasement theme.

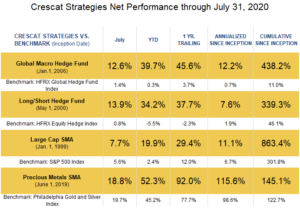

Crescat Firmwide Performance Since Strategy Inception

August Month-to-Date Performance

The Crescat Global Macro and Long/Short funds are up and estimated 5.6% and 6.7% net respectively in August month to date with short positions holding us back will our activist long precious metals and mining stock positions continue to perform. Our separately managed account strategies are roughly flat MTD.

Crescat Precious Metals Fund

Our new private precious metals focused activist fund that we launched in August is off to an incredibly strong start. The Crescat Precious Metals Fund is up 50%+ net on an estimated basis in its first month to date in August! We are encouraged that we were able to accomplish this in a flat-to-slightly-down overall market for gold and silver stocks in August, which endured a significant pullback mid-month. It is myth that there is no big and profitable new gold deposits to be found on this planet. In this new fund, we are helping to capitalize exciting growth companies with potentially large high grade gold and silver deposits in sound jurisdictions.

You can learn about some of these stocks in our Crescat Gets Activist videos on our YouTube page where we have profiled Condor Resources, Eloro Resources, Eskay Mining, White Rock Minerals, New Found Gold, Novo Resources, Cabral Gold, and NuLegacy Gold.

At Crescat, we are carefully building a diversified portfolio of the best mining properties on the planet with the help of Quinton Hennigh, PhD, a world-renowned exploration geologist who is Crescat’s geologic and technical advisor.

Gold and silver mining stocks have essentially been through a ten-year bear market since peaking in 2011. We believe that the bear market ended with the lows in March of this year, especially for smaller cap, exploration-focused mining companies. These stocks at large successfully held above their early 2016 lows in a double-bottom retest and still represent exceptional value today.

The new precious metals bull is now firmly off and running. Our analysis shows that it is still very early in the cycle as we have laid out herein. Future Fed and global central bank money printing should continue to take the world by storm to prod this bull now more than ever. We encourage you to get positioned now. Just like at the end of last month, we have a handful of new deals already on deck for funding and more coming our way soon. We would appreciate your commitment of capital now to help us seize these outstanding opportunities. We believe that the early investors in this space are the ones who will reap the big rewards.

Sincerely,

Kevin C. Smith, CFA

Founder & CIO

Tavi Costa

Partner & Portfolio Manager

By Jacob Wolinsky