The story of Corning Incorporated (NYSE:GLW)‘s Gorilla Glass dates back over six decades. The glass maker accidentally made a product that no one was interested in using, and for years it was known as Chemcor and simply had no addressable market. In the early ’70s, Corning gave up trying to sell the stuff and the formula gathered dust for 40 years.

That was until Steve Jobs came around and wanted to cover Apple Inc. (NASDAQ:AAPL)‘s iPhone with the material, since most smartphone displays predating Apple Inc. (NASDAQ:AAPL)’s device were covered in plastic that was easily scratched. In the years since, Gorilla Glass has grown to become one of Corning Incorporated (NYSE:GLW)’s most important growth businesses, thanks in large part to smartphone adoption and Apple Inc. (NASDAQ:AAPL) effectively standardizing the material’s use in high-end mobile devices.

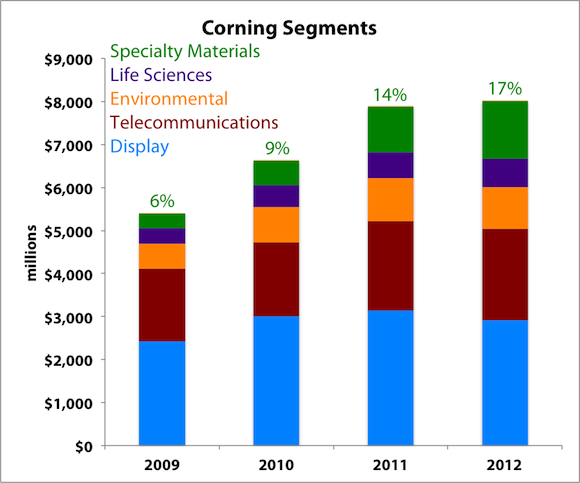

Source: SEC filings. “Other” segment not shown due to negligible sales.

Gorilla Glass is included in Corning’s specialty materials segment and is the primary reason why that operating segment has grown from just 6% of sales in 2009 to an impressive 17% of revenue in 2012.

In November, Corning Incorporated (NYSE:GLW) guided the Gorilla Glass business to $1 billion in annual revenue, a target that it subsequently hit. That was up 44% from 2011, and the majority of the $1.3 billion in revenue that specialty materials generated in 2012. Gorilla Glass also carries gross margins that are much higher than the corporate average.

It turns out that there may be a threat on the horizon to Gorilla Glass, and one that Apple Inc. (NASDAQ:AAPL) may be catalyzing. Should Corning Incorporated (NYSE:GLW) be scared of sapphire?

Monkey business

Last week, MIT Technology Review published a report on the possible future use of sapphire in smartphone screens, which could potentially replace Gorilla Glass eventually. This threat isn’t at all imminent, as the cost differential remains very high, so most smartphone vendors wouldn’t yet consider adopting it.

A Gorilla Glass display cover currently costs less than $3, which is much cheaper than the $30 that a similar sapphire display would set an OEM back. Eventually, the cost of sapphire could decline to below $20 due to competition and technological advances.

Such a pricey component would put a serious damper on margins. For example, the iPhone 5’s bill of materials excluding manufacturing was estimated at $199, so an extra $27 for the display’s cover material would be a 14% increase in component costs that would represent a gross margin reduction of 4%. While Apple Inc. (NASDAQ:AAPL) is one of the few smartphone OEMs that could technically afford this type of hit, it certainly doesn’t want to.

Sapphire is much stronger and more scratch resistant than glass, which would make it an ideal candidate if costs permit. At the same time, Corning Incorporated (NYSE:GLW) isn’t resting on its laurels and has now launched Gorilla Glass 3, which includes what the company calls Native Damage Resistance for improved durability. The first smartphone to be unveiled with Gorilla Glass 3 was Samsung’s Galaxy S4 that was shown off earlier this month.

It begins?

Apple Inc. (NASDAQ:AAPL) has already started using sapphire, but only to a small extent, likely due to cost constraints. The newest iPhone 5 features a sapphire camera lens cover on the back, which is much smaller than the large piece of Gorilla Glass found on the other side.

Sapphire camera lens covers used in the iPhone 5. Source: Apple.

Some analysts believe that 2013 will be the year that some smartphone OEMs begin using sapphire in their flagship devices. Apple Inc. (NASDAQ:AAPL) is an obvious possibility as the biggest company that’s publicly marketing its use of the material, but Google Inc (NASDAQ:GOOG) is also rumored to use sapphire in the upcoming Motorola “X Phone.”