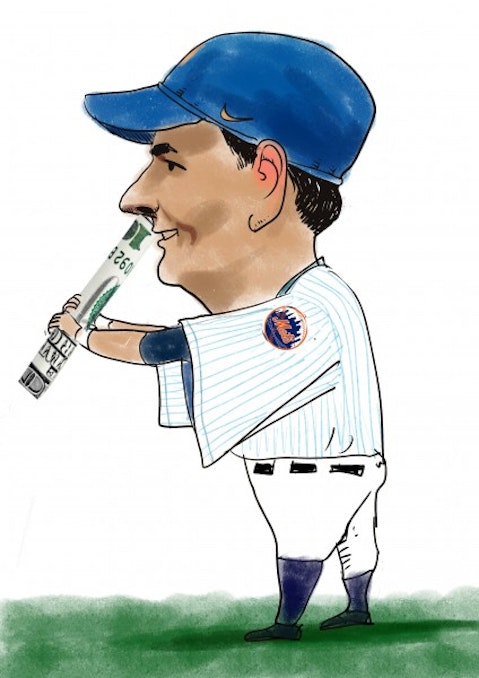

In mid May, Greenlight Capital, the hedge fund managed by billionaire David Einhorn and his team, filed its 13F with the SEC disclosing many of its long equity holdings as of the end of March. We track Greenlight’s moves alongside those of hundreds of other funds, and use 13Fs as part of our work researching investment strategies (we have found, for example, that the most popular small cap stocks among hedge funds outperform the S&P 500 by an average of 18 percentage points per year). We also like to screen top managers’ stock picks according to a number of criteria, including the PEG ratio; this metric places the P/E multiple in the context of earnings growth expectations from sell-side analysts. While analyst forecasts aren’t always correct, this is at least a way to gauge a stock’s upside potential. Here are Greenlight’s top five picks with five-year PEG ratios less than 0.9 (or see a history of Einhorn’s stock picks):

While many other billionaires were selling Apple Inc. (NASDAQ:AAPL) between January and March, Einhorn increased his holdings by over 80% to a total of 2.4 million shares. Apple regained its place as the most popular stock among hedge funds in Q1 (check out the full top ten list). Markets are pricing in further declines in Apple Inc. (NASDAQ:AAPL)’s earnings, given the fact that the trailing P/E is 11 even though a sizable share of the market cap is cash. With Wall Street analysts actually predicting growth in earnings per share over the next several years, the PEG ratio comes in well below 1.

Greenlight reported owning over 21 million shares of General Motors Company (NYSE:GM) at the end of the first quarter of 2013. GM, similarly to Apple Inc. (NASDAQ:AAPL), is a popular value stock even though its net income was down in its most recent quarter compared to the same period in the previous year. The stock is certainly in value territory at a trailing P/E of 11, however, and its PEG ratio is 0.6. We think it could be worth comparing to other automakers. Warren Buffett’s Berkshire Hathaway had 25 million shares of General Motors Company (NYSE:GM) in its portfolio according to its own 13F (find Buffett’s favorite stocks).

Sticking with the auto space, Delphi Automotive PLC (NYSE:DLPH) was another of Einhorn’s ten largest holdings by market value and currently boasts a PEG ratio of 0.7. This is based on the auto parts manufacturer currently trading at a fairly low trailing earnings multiple, but with EPS expected to rise considerably in the short to medium term (the forward P/E is only 10). However, net income was down 19% last quarter compared to the first quarter of 2012. Billionaire John Paulson cut his stake in Delphi Automotive PLC (NYSE:DLPH) last quarter but his hedge fund Paulson & Co. still owned 8.7 million shares (research more stocks Paulson owned).

Einhorn and his team disclosed ownership of 9.4 million shares of NCR Corporation (NYSE:NCR), the $5.2 billion market cap provider of self-service kiosks (including ATMs) and point of sale terminals (the company used to be known as National Cash Register). Revenue and earnings were up at double-digit rates in the first quarter of 2013 versus a year earlier. Even with the current valuation already incorporating expectations of high growth, the PEG ratio is 0.8. D.E. Shaw, managed by billionaire David Shaw, added shares during the first quarter of the year.

At the Ira Sohn conference in May, Einhorn made a long case for Oil States International, Inc. (NYSE:OIS), an oilfield service company. He claimed that, according to a sum of the parts valuation, the company is undervalued- and acknowledged that activist Barry Rosenstein’s JANA Partners had somewhat beaten him to the punch with that fund’s recent call for Oil States International, Inc. (NYSE:OIS) to spin out its oilfield accommodations business as a real estate investment trust. Read more about Einhorn’s recommendation of Oil States. Greenlight initiated a position of 2.7 million shares between January and March, and the stock’s PEG ratio is currently 0.8.

Disclosure: I own no shares of any stocks mentioned in this article.