In the first part, I explained why Apple Inc. (NASDAQ:AAPL) is not in the “danger zone.” Now, as promised, it’s time to introduce 9 bull cases. From fundamentals to potential catalysts, there are plenty of reasons to be long Apple!

1. Valuation

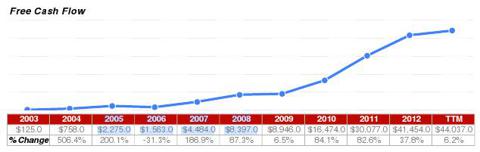

Fact: Apple Inc. (NASDAQ:AAPL) has strong fundamentals and an amazing historic cash flow generation record, especially in the 2009-2011 period, a time frame well known for the rapid and global expansion of the iPhone and iPad.

Whether the ability of Apple Inc. (NASDAQ:AAPL) to deliver amazing growth and generate consistent cash flows remains intact or not, is a crucial issue. I prefer to take a moderate view: a 10% average growth rate for the next 10 years and a 3% terminal growth rate.

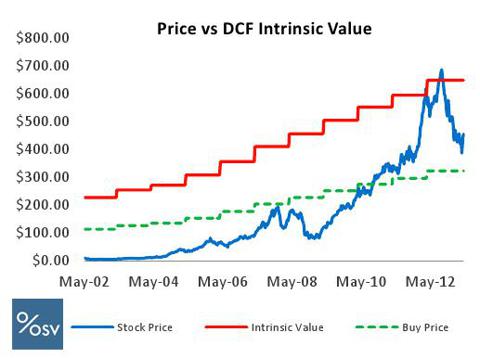

This is extremely conservative if you take into consideration the fact that the average 10 year revenue growth rate is approximately 15%. Using Old School Value for the DCF valuation, I obtain a fair estimate of $650 per share. I attach the valuation template below so you can see more details.

These results are not unique. Most professional analysts have a price target above the current market price. These results are also robust in the sense that if we change the valuation model, the fair price will not change significantly. For example, if I use the Katsenelson Absolute PE model to estimate the fair value, I obtain $660.55 per share. This suggests a strong buy. If there is something that the history of markets has taught us is that any stock cannot stay either overvalued or undervalued for too long.

2. Buybacks and dividends

Apple announced on Apr. 23 a massive capital return program: $60 billion in share repurchases and a 15% increase in dividends, which will be financed partially with $17 billion in debt. The announcement had an immediate positive effect on the stock’s momentum. Since the announcement, the stock is up +12%.

3. User loyalty

The emotional link between Apple Inc. (NASDAQ:AAPL) and its customers is a competitive advantage that is often left forgotten nowadays. It allows Apple to have a high retention rate for its products, as Apple customers are less likely to switch to another provider and more likely to buy another Apple product.

An early survey conducted by UBS in late 2011 confirmed that Apple Inc. (NASDAQ:AAPL)’s brand loyalty is the highest in the industry. According to this source, in a sample of 515 customers, a disproportionately large number of Apple customers – 89% – said they will stick with the company when the time comes to upgrade their device.

4. M&A activities will increase

Steve Jobs did not like

acquisitions

. This is why Apple has historically avoided such activities. But Tim Cook is not Steve Jobs. And the Apple we see now is not the pre-iPhone Apple. This is now a company with a $425 billion market cap increasingly worried about future growth prospects. The perfect scenario for M&A! Well-sounded deals could replace organic growth, if needed. They have enough cash to buy any early star in the Valley. So, even if Apple fails at delivering “the next big thing,” they can buy those who will succeed at doing so.

5. A favorable adjustment of expectations

The higher the stock, the higher the expectations of investors and analysts on the next “big product” and the next earnings announcement, and the harder it is for a firm to beat the Street’s consensus.

Luckily for Apple, there has been a favorable adjustment of expectations in the past 6 months. Everybody saw the stock price go from $705 a share to $385 in less than 6 months!

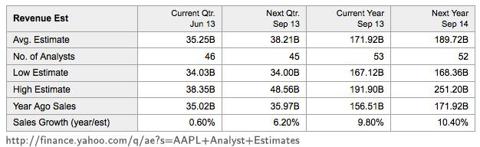

According to Yahoo! Finance, the Street’s consensus for Apple’s revenue next quarter is $35.25 billion, about $750 million above the official outlook of $34.5 billion. The official forecast is itself very conservative. The upside is that now it is easier to beat the consensus by a significant percentage.

6. Catalyst: The launch of, in the words of Tim Cook, some “really great stuff coming in the fall.”

A new product concept, combined with the release of the iPhone 5S (or even better, the iPhone 6) is on its way. Although we do not know how innovative this new product will be, Apple’s stock performance usually reacts favorable to releases, at least in the short term. A release could take the stock price back to the 600s level. However, the sustainability of such an increase in stock price will depend on the intrinsic features of the new device.