Editor’s Note: This article has been amended to better attribute Apple Inc. (NASDAQ:AAPL)’s ROIC figures to David Trainer, not Motley Fool.

Here’s to those looking for a neutral analysis on Apple Inc. (NASDAQ:AAPL). This is the first of three articles where I introduce nine reasons to be bullish and one very important reason to be a bear. As a result, I label Apple as a neutral stock under a one year investment horizon. But before introducing my reasons, let me begin this article by looking at the statements of a very famous bear who thinks that Apple Inc. (NASDAQ:AAPL) is in great danger.

No need to panic!

In “Danger Zone For This Week: Apple”, David Trainer mentioned three reasons to believe that Apple Inc. (NASDAQ:AAPL) is in the danger zone:

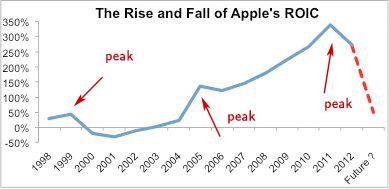

1) According to Trainer, “Apple’s ROIC of 124% is too elevated if we consider that this is “just another computer company”

2) Apple Inc. (NASDAQ:AAPL) is no longer a value stock if we assume a more “normal” ROIC, and

3) Group thinking: many fund managers own Apple because “no fund manager or ETF provider wants to have to explain to investors why they did not own Apple if the stock takes off again.”

This first article sets out to bring a counterargument to Trainer’s three reasons. In a nutshell, I will show that 1) Apple is not “another computer company”, 2) there are no reasons to assume a massive decrease in ROIC, and 3) Group thinking could have some benefits.

1) Apple’s different

To begin with, Apple is not a computer company. They produce smartphones, iPads, and Macs. They own the iTunes store, an independent payments ecosystem which recently surpassed 50 billion downloads. Comparing Apple’s ROIC to “competitors” like Microsoft Corporation (NASDAQ:MSFT), Research In Motion Ltd (NASDAQ:BBRY) BlackBerry, or Dell Inc. (NASDAQ:DELL), is therefore, not accurate. Microsoft Corporation (NASDAQ:MSFT) does not produce smartphones. Research In Motion Ltd (NASDAQ:BBRY) Blackberry does not produce computers. Dell Inc. (NASDAQ:DELL) is mainly in the business of personal computers. And none of them owns something similar to iTunes. None of them have succeeded in creating their own payments ecosystem!

I do, however, think that comparing Apple to Google Inc (NASDAQ:GOOG) in terms of ROIC makes sense, as they have similar business portfolios, specially when it comes to software. Google Inc (NASDAQ:GOOG) has its own payments ecosystem (Google Play), which is a direct competitor of iTunes. Furthermore, the war between Android and iOS in emerging markets already has a clear winner: Google. Notice, however, that a comparison against Google is far from being perfect. Google doesn’t really own hardware. This could change in the future, as Google is preparing an aggressive Google Glass release.

At any rate, according to Trainer, if Google’s 34% ROIC is the benchmark, the stock is worth only around $191. However, he also mentions that Apple’s current ROIC is 271%. In other words, he thinks that ROIC will fall from 271% to 34%. This is a very strong statement that needs to be supported with more than a reason. The only reason he provided is:

(…)Apple’s ROIC could fall if it returns to more normal levels, which

But there is no evidence that the absence of Steve Jobs will hurt Apple’s innovative culture permanently. As a matter of fact, the “Steve Jobs” effect on market capitalization and stock price is statistically insignificant, as I will show in Part 2 (for those who cannot wait, check this awesome paper titled “Do Investors Care If Steve Jobs Is Healthy?”)

If we assume that stock price and market capitalization more or less reflect the real value of a given firm in the long run, we can infer that there is no statistically significant evidence that the absence of Steve Jobs per se will hurt the firm’s value.

2) Value

Trainer justifies its $191 estimate by saying that the elevated ROIC rate invites lots of competition. I agree. Everybody is interested in high margins. However, not everybody can compete well, especially against Apple.

To my way of thinking, only Samsung and Google are important competitors, especially in emerging markets. Just like Google competes against Apple in the software arena, Samsung competes in the hardware arena. And so far, Samsung is winning in market share, mainly due to the incredible growth that emerging markets saw in smartphone penetration.

Samsung’s smartphones sell incredibly well in emerging markets due to high price sensitivity. Furthermore, the Korean giant offers budget devices and has very solid relations with some of the biggest carriers in the world, something that Apple is in great need of.

The good news is that other companies have dozens of direct competitors. Apple has only two. And, of course, they are strong competitors. But by creating its own market ( the iTunes, iPad, and iPhone concepts were fantasy before Apple introduced them in our everyday life), Apple avoided fierce competition for a long time.

Notice also that there is another explanation to the “ROIC Has Peaked“ graphic provided by Trainer. Sure, ROIC was very high in 2011, a record number. But there were so many peaks before (1998 and 2005, to say the least)!

3) Group thinking and its benefits

According to Trainer, “an astounding 664 of the 7,000 ETFs and mutual funds I cover allocate at least 5% of their value to AAPL.”

You can understand this in many ways: for example, 664 funds are trying to copy the same idea. But this could also be seen as 664 fund managers and equity researchers arriving at the same conclusion!

That being said, group thinking is not necessarily a bad thing. Even if we assume that Trainer is right and that many fund managers want to allocate a decent proportion of their capital to Apple just to follow others, that demonstrates that the demand for Apple shares is not in danger.

New fund managers will try to copy their peers. Therefore, they will also have Apple in their portfolios. This creates a stable demand for Apple’s shares! And only a very strong negative catalyst could cause everybody to start selling the same stock on the same day.

Therefore, the remaining question is: is such a catalyst on its way? Stay tuned! I take care of this and other issues in the remaining articles

Coming soon

– Apple is not another computer company: Part 2 – 9 reasons to be a bull

– Apple is not another computer company: Part 3 – 1 very important reason to be a bear

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple and Google.

The article Apple Is Not Another Computer Company: Part 1 originally appeared on Fool.com and is written by Adrian Campos.

Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.