It is difficult to get a man to understand something, when his salary depends on his not understanding it.

— Upton Sinclair

When Apple Inc. (NASDAQ:AAPL) announced its second-quarter earnings on April 23, a flurry of news reports cited Wall Street analyst forecasts to help explain the company’s results. This is how the bottom lines of companies and stocks are ordinarily explained to the public.

An analyst from Goldman Sachs Group, Inc. (NYSE:GS) noted that the March quarter was better than expected, but the June quarter guidance was “far worse than feared.” He ultimately lowered his price target to $500 from $575, while maintaining a “buy” recommendation on the stock.

An analyst from JPMorgan Chase & Co. (NYSE:JPM) also lowered his target price, in this case to $480 from $575, and advised he expected “AAPL to remain range-bound” until there was more visibility into new product launches. More bullishly, the analyst from Piper Jaffray Companies (NYSE:PJC) felt Apple Inc. (NASDAQ:AAPL) might trade higher in late 2013, and maintained his $688 price target and “overweight” rating.

Analyst opinions such as these routinely drive coverage of the stock market. But a new study, “Inside the ‘Black Box’ of Sell-Side Financial Analysts,” by professors Lawrence Brown (Temple University), Andrew Call (Arizona State University), Michael Clement (University of Texas), and Nathan Sharp (Texas A&M), suggests that ordinary investors should look elsewhere for insights into their favorite companies.

Sharp and Call, who we interviewed about their findings, told us they wanted to understand what went on behind closed doors when analysts were putting together their research. The professors received completed surveys from 365 sell-side analysts, and later followed up with 18 of them to better understand their decision-making processes. “Sell-side” analysts produce research that’s purchased by their firms’ “buy-side” clients. They’re the group that’s often cited in stories about “Wall Street analysts.”

Countless studies have shown that the forecasts and stock recommendations of sell-side analysts are of questionable value to investors. As it turns out, Wall Street sell-side analysts aren’t primarily interested in making accurate stock picks and earnings forecasts. Despite the attention lavished on their forecasts and recommendations, predictive accuracy just isn’t their main job.

Analysts are not that into you

Any time you want to really understand the financial industry, it’s helpful to first look at what people are actually paid to do.

The survey found that “accurate earnings forecasts and profitable stock recommendations have relatively little direct impact on their compensation.” Instead, industry knowledge and connections are what count.

The chart below ranks the main factors that play into analyst compensation:

Sharp and Call told us that ordinary investors, who may be relying on analysts’ stock recommendations to make decisions, need to know that accuracy in these areas is “not a priority.” One analyst told the researchers:

The part to me that’s shocking about the industry is that I came into the industry thinking [success] would be based on how well my stock picks do. But a lot of it ends up being “What are your broker votes?”

A “broker vote” is an internal process whereby clients of the sell-side analysts’ firms assess the value of their research and decide which firms’ services they wish to buy. This process is crucial to analysts because good broker votes results in revenue for their firm. One analyst noted that broker votes “directly impact my compensation and directly impact the compensation of my firm.”

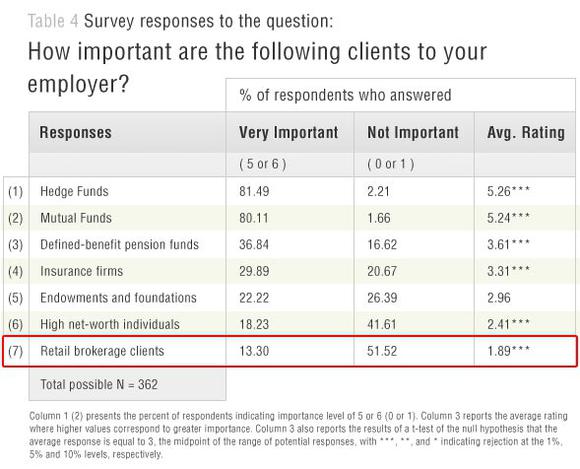

So who are these clients that analysts are paid to cater to? Mainly hedge funds and mutual funds. Individual — aka “retail” — investors are the least important:

Congratulations on another great quarter, Mr. CEO

So if forecasts and stock picks aren’t important, what exactly are these valuable institutional clients after?

Sharp and Call told us that institutional clients value analysts’ access to the management of the companies they cover more than anything else. One analyst admitted that “one of the biggest things the buy-side compensates sell-side research firms for is corporate access: road shows, meetings, access to management teams.” Another said:

As an analyst, if I call up a money manager, a hedge fund, whoever, and I’ve got a call to make on a stock, and I’m able to say, ‘Hey, by the way, we were able to spend 20-30 minutes talking to senior management,’ boom! Their ears are just straight up.