Tim Cook Salary: On December 27, 2012, Apple Inc. (NASDAQ:AAPL) filed a preliminary proxy statement with the SEC. A copy of the 50+ page statement can be found here.

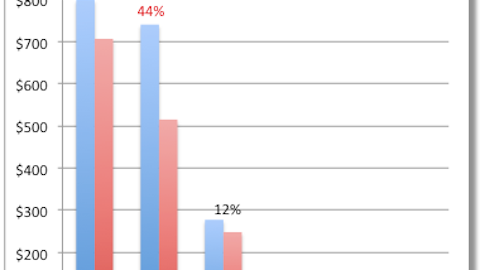

When compared to compensation of $378 million in 2011, the $4.17 million earned by Cook in 2012 would seem to be an error. However, this is exactly how much the high-powered CEO earned over the past 12 months.

With all this in mind, there is one question that needs answered: why did Cook earn so much less in 2012? In short, this comes down to one thing and one thing only: stock option awards.

According to a breakdown on TechCrunch, “Cook was granted a number of in both 2010 ($52 million worth) and 2011 ($376 million), but which he received none of in 2012. Those stock awards include a large number, which will vest in 2014, 2016, and 2021 respectively, and which now total over $750 million at today’s current market value, according to the filing.”

On page 23 of the SEC filing, Apple Inc. (NASDAQ:AAPL) shares information on how the company determines compensation for the Chief Executive Officer. Here is the process, as far as the current employment of Cook is concerned:

Mr. Cook was promoted to CEO in August 2011. At that time, the Board granted Mr. Cook 1,000,000 RSUs as a promotion and retention award. Fifty percent (50%) of Mr. Cook’s award is scheduled to vest on August 24, 2016 (five years after the award date) and fifty percent (50%) of Mr. Cook’s award is scheduled to vest on August 24, 2021 (ten years after the award date), subject to Mr. Cook’s continued employment with the Company through the applicable vesting dates. In light of the RSU award granted to Mr. Cook in connection with his promotion to CEO, the Compensation Committee did not grant Mr. Cook an RSU award in 2012.

Mr. Cook did not participate in the Compensation Committee or the Board’s deliberations or decisions with regard to his own compensation. However, in modifying the Company’s RSU awards to allow dividend equivalents to accrue on outstanding RSUs held by the Company’s employees generally, the Compensation Committee considered Mr. Cook’s request that none of his RSU awards be modified to participate in dividend equivalents. As of May 24, 2012, the date the Committee modified the Company’s outstanding RSU awards, Mr. Cook held 1,125,000 unvested RSUs. Assuming a quarterly dividend of $2.65 per share over the vesting periods of his RSUs, Mr. Cook will forgo approximately $75 million in dividend equivalent value that would have otherwise been paid to him if and when his RSUs vested.

Mr. Cook also recommended to the Compensation Committee that the Company adopt stock ownership guidelines for the CEO and the Non-Employee Directors. The stock ownership guidelines were reviewed and approved by the Compensation Committee, and subsequently adopted by the Company. Under the guidelines, Mr. Cook is expected to own shares of Company common stock that have a value equal to ten times his base salary. Non-Employee Directors are expected to own shares of Company common stock that have a value equal to five times their annual cash retainer for serving as a director. Shares must be owned directly by the individual acquired through open market purchases or upon the vesting of RSU awards, or owned jointly with or separately by the individual’s spouse, or held in trust for the benefit of the individual, the individual’s spouse or children. Each individual is expected to satisfy the applicable stock ownership guideline within five years.

In November 2011, the Compensation Committee determined that it was appropriate to increase Mr. Cook’s base salary to $1,400,000 from $900,000. Mr. Cook’s cash compensation is set at a higher level than the cash compensation for the other members of the executive team to reflect his responsibilities for the overall leadership of the Company. Mr. Cook participates in the same performance-based bonus program as the other named executive officers and has the same target and maximum bonus opportunities of 100% and 200%, respectively, of his base salary.

In deciding to increase the cash compensation for Mr. Cook, the Compensation Committee considered the Company’s financial results, Mr. Cook’s responsibilities as CEO, and his total cash compensation opportunities as compared to the total cash compensation opportunities of the other named executive officers as well as the total cash compensation opportunities of CEOs at peer companies. Despite this increase, the target annual cash compensation for Mr. Cook remains significantly below the median annual cash compensation level for CEOs at peer companies.

What do you think of Tim Cook’s compensation package in 2012? Should he be earning more, based on Apple Inc. (NASDAQ:AAPL)’s value?

Check back here for more updates on Tim Cook Salary.

Visit these links to learn more about Tim Cook:

Tim Cook Just Dropped This Bombshell About Apple Inc. (AAPL)

Apple Inc. (AAPL) CEO Tim Cook – Comfortable With His Position

Why Does Apple Inc. (AAPL)’s Tim Cook Prefer the Virtual Keyboard?