Rumors are still swirling about a lower-priced iPhone and investors are wondering whether or not Apple Inc. (NASDAQ:AAPL) will make it a reality. If the company does debut a cheaper iPhone, it could disrupt emerging markets and grab more market share worldwide — if the price is right.

Just North of a low-cost phone

Some have said suggested that a cheaper iPhone could be priced around $330, sport a 4.5-inch screen, and have a polycarbonate body. Apple Inc. (NASDAQ:AAPL) CEO Tim Cook recently said in an interview that quality products are the company’s North star. With this mind, even if Apple Inc. (NASDAQ:AAPL) releases a lower-priced phone, it likely won’t be a cheap one.

Source: VentureBeat.

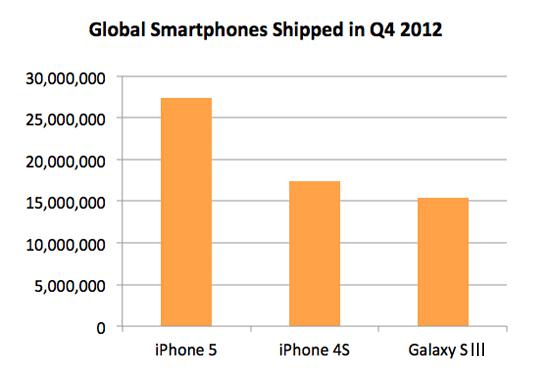

To maintain the profit margins Apple Inc. (NASDAQ:AAPL) is currently used to, the company would need to create a phone by incorporating some of its existing technology. Doing something like that has the possibility of turning into a newer, bigger iPhone with the same or similar technology that’s in the iPhone 4 or 4S. Taking that route doesn’t seem likely, considering Cook has said the iPhone 4 is still under “constant constraint” from customers, and shipments of the 4S out-shipped Samsung’s Galaxy S III in the last quarter of 2012.

Source: Strategy Analytics.

In China, the world’s largest mobile network, Android phones make up about 72% of the smartphone market share in the country, with the iPhone taking just over 23%. The average cost of an Android phone in China is around $223, compared to the iPhone 5’s launch price of $850. If Apple Inc. (NASDAQ:AAPL) were to release an iPhone priced around $330, the company would be in a much better position to steal sales away from Android-based phones in the country.

Competition from all sides

Although China is extremely important to the smartphone industry, it’s not the only market Apple needs to grow market share in. Nokia Corporation (ADR) (NYSE:NOK) and Research In Motion Ltd (NASDAQ: BBRY) are diving straight into India, a place where Samsung already has a huge lead over everyone, and where Apple only has 5% market share.

Source: Reuters.

Apple’s been selling the iPhone in India for more than four years, but its premium pricing is difficult for India’s growing smartphone customer base. About 95% of all cell phone users in India have no-contract pre-paid phones. This type of market doesn’t lend itself well to expensive iPhones, which is probably why the iPhone has a slightly smaller footprint in the country than BlackBerry. BlackBerry just brought its Z10 to India, which will cost about $800. If the company wants to gain back some of its previous footing in the country it will need to release a cheaper phone in the country, just as Apple needs to.

Meanwhile, Nokia will launch its new Lumia 720 in India in the second quarter of this year, at a price of about $323. This may not be as inexpensive as some Indian consumers need it to be, but it’s much less expensive than BlackBerry and Apple’s offerings. If Apple were to bring a $330 iPhone to India, it would be competitively priced with the Lumia 520.

Shrinking price, growing market share

With all the talk about a lower-priced iPhone, Apple could still decide it doesn’t need this type of product on the market right now. If that happens, it’s likely Android will continue growing in developing countries, with Windows Phone and BB10 following far behind. Although Apple likes to collect big profits from its products, it knows how to spread out its products to completely push out the competition as well (think iPod).

From what it looks like right now, the question is more of a when, as opposed to if, Apple will release a cheaper iPhone. The company will have to determine how long it wants to focus on high profit margins from its current offerings or spend some time developing new ones. With the iPhone 4 and 4S still selling worldwide, it will need to carve out new niche within its product line if does bring a cheaper phone to market. But investors need to see Apple do something in the emerging markets — and soon.

The article A Lower-Priced iPhone Doesn’t Mean a Low-Cost iPhone originally appeared on Fool.com and is written by Chris Neiger.

Fool contributor Chris Neiger has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.