Apollo Group Inc (NASDAQ:APOL), the for-profit education company that is the parent of University of Phoenix, looks like a great deal on the surface. At 7.9 times TTM earnings and over $1.2 billion in net cash, it almost looks like a “too good to be true” situation. It is. The company’s business model is no longer viable and I believe that Apollo’s recent downsizing efforts are just the beginning.

Apollo Group Overview

Apollo Group Inc (NASDAQ:APOL) owns several for-profit educational institutions, which include Western International University, Axia College, the Institute for Professional Development, and their flagship University of Phoenix, which accounts for over 90% of the company’s enrollment.

The University of Phoenix is one of the largest higher education institutions in the United States by enrollment, and offers degrees on the associates, bachelors, masters, and doctoral levels. The school has an open-enrollment admissions policy, requiring only a high-school diploma or GED for admissions.

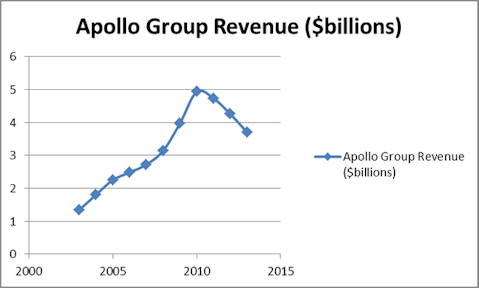

The company’s student enrollment (and revenues) peaked at the tail end of the financial crisis, when a record number of students were returning to school as a result of the difficult job market at the time. Enrollment was 470,800 students at the end of 2011, which has dropped sharply to just over 300,000 as of February of this year. This steep dropped has greatly alarmed shareholders (rightly so), and Apollo Group Inc (NASDAQ:APOL)’s share price has plummeted 75% since 2009.

Restructuring Efforts

In the midst of their rapidly declining enrollment, Apollo announced that the University of Phoenix is planning to close 115 of its campuses, about half of the total, and to lay off about 1,000 of its 17,000 employees. These moves will leave the company with 112 campuses and are expected to reduce Apollo’s operating costs by about $350 million annually. Sounds great, right?

For-Profit Education: Are There Any Winners?

The problem of declining enrollment is not unique to Apollo Group Inc (NASDAQ:APOL)’s schools. All across the for-profit sector, enrollments have been declining sharply for the past two years amid a steady stream of bad publicity having to do with for-profit schools’ low graduation rates, high student loan default rates, and low opinions of a lot of for-profit programs from prospective employers. In response to this, several companies, including Apollo Group Inc (NASDAQ:APOL), started a three-week orientation program that became a prerequisite for enrollment, which has hurt enrollment even more. The company has publicly stated that about 20% of the students who enroll in the orientation don’t make it through, or decide not to enroll in more coursework.

Additionally, the competition from other online education providers has grown tremendously in recent years, particularly from nonprofit and public universities. Virtually every major university now offers some type of distance education, and these programs are generally more highly regarded by both students and employers.

DeVry Inc. (NYSE:DV), which offers career-oriented programs, is in the same boat. DeVry Inc. (NYSE:DV) has seen declining enrollment numbers for eight consecutive semesters. One particularly negative catalyst is the Department of Education’s “gainful employment” regulations, which requires schools to report graduation and job placement rates. This data has been particularly negative for for-profit educators, with DeVry Inc. (NYSE:DV)’s data showing a 40% loan repayment rate, which indicates approximately how many students found gainful employment after their program.

ITT Educational Services, Inc. (NYSE:ESI) has performed the worst of the three. Shares have plummeted from $133.75 to a low of $11.69 earlier this year before rebounding a bit. ITT Educational Services, Inc. (NYSE:ESI)’s revenues peaked in 2010 and are down by about 20% in the two years since then, with operating income down by more than 60%. If the trend of declining enrollment and bad publicity continues, it is just a matter of time before these companies begin hemorrhaging money, making their very good balance sheets less of a factor.

The Numbers: How Low Could It Go?

Accounting for the projected cost savings as a result of their restructuring, Apollo Group Inc (NASDAQ:APOL) is projected to earn $2.74 per share this year, dropping to $2.22 next year, a decline of 19%. While the $1.2 billion in net cash (cash minus debt) on Apollo Group Inc (NASDAQ:APOL)’s balance sheet sets a theoretical price floor of about $10.65 per share based on the total cash divided by the number of outstanding shares, the cash may not be there for too long. Even if the restructuring is a success (which will cost the company a significant amount of cash by itself), earnings are still expected to decline further, and with the constantly deteriorating public perception of for-profit universities, who knows how much worse it could get?

Matthew Frankel has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Stay Away From For-Profit Education originally appeared on Fool.com.

Matthew is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.