In its recent filing with the U.S. Securities and Exchange Commission, Sanborn Kilcollin Partners LLC, managed by Robert Sanborn and Rick Kilcollin, reported its equity portfolio for the second quarter of 2014. The value of the fund’s equity portfolio jumped to around $217 million in the second quarter from $198.3 million reported for the previous quarter. Sanborn Kilcollin Partners has a strong focus on consumer, healthcare and energy, as well as technology stocks. In this article, we will talk about the fund’s top three largest holdings, including Apache Corporation (NYSE:APA), PepsiCo, Inc. (NYSE:PEP), and Intel Corporation (NASDAQ:INTC).

Apache Corporation (NYSE:APA) is represented as the top holding, in which Sanborn Kilcollin Partners disclosed owning 193,628 shares, with a reported value of $19.5 million. The stake is slightly up from 192,067 shares the fund reported in the previous quarter. Apache Corporation (NYSE:APA) is an oil and gas exploration and production company, with a market cap of $38.4 billion.

Recently, Apache Corporation (NYSE:APA) announced that it made an oil discovery in Australia’s offshore Canning Basin. This is the company’s first discovery in Canning Basin, where it confirmed at least four discrete oil columns ranging in thickness between 85 and 151 feet in the Triassic Lower Keraudren formation, within an overall sand-rich section between 13,648 and 14,763 feet below sea level, according to a statement.

Apache Corporation (NYSE:APA) is also a favorite stock of Barry Rosenstein’s JANA Partners, which owns 4.54 million shares, and William B. Gray’s Orbis Investment Management which holds 3.07 million shares of the company.

Second important holding is PepsiCo, Inc. (NYSE:PEP), in which Sanborn Kilcollin Partners disclosed 213,461 shares, worth $19.1 million. At the end of first quarter, the fund reported ownership of 211,735 shares of PepsiCo, Inc. (NYSE:PEP). Last month, UBS announced that it upgraded PepsiCo, Inc. (NYSE:PEP)’s stock to a ‘Buy’, making it the only beverage company in the ‘Buy’ rating with a target of $100.

Other hedge fund betting big on PepsiCo, Inc. (NYSE:PEP) include Donald Yacktman’s Yacktman Asset Management, which holds 31.52 million shares, and Trian Partners, led by Nelson Peltz, which owns 12.94 million shares of the company.

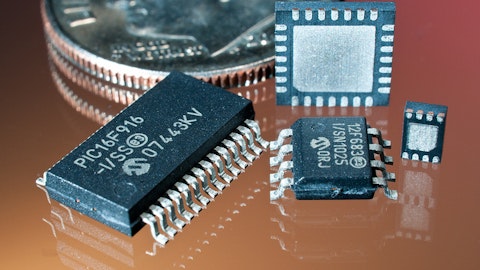

On the third position is Intel Corporation (NASDAQ:INTC), in which Sanborn Kilcollin Partners cut its stake by over 40% to 227,783 shares, worth $18.1 million, from 382,724 shares the fund held previously. Rumors predict Intel Corporation (NASDAQ:INTC) is going to strengthen its position in the mobile and internet-connected gadgets’ markets. The company is struggling with declining PC sales and slow progress in mobile. It hired Mr. Amir Faintuch, Senior Executive at QUALCOMM Inc. (NASDAQ:QCOM), in order to change the game, according to an article on Yahoo! Finance.

In its latest 13F, Hawkins Capital, run by Russell Hawkins, disclosed holding owns approximately 3.39 million shares of Intel Corporation (NASDAQ:INTC), worth more than $100 million.

Sanborn Kilcollin Partners was founded by Robert Sanborn and Rick Kilcollin in 2001. It is a value-focused long/short equity hedge fund.

Disclosure: none