A year ago, AOL, Inc. (NYSE:AOL) was in a bind. The one-time internet king was surviving on dial-up dollars and its media properties were a mess. After it sold its patent portfolio to Microsoft Corporation (NASDAQ:MSFT), it seemed only a matter of time until AOL dried up altogether.

Then something happened. The company’s revenue grew, its share price soared and CEO Tim Armstrong revealed a strategy to make AOL a media and advertising powerhouse. The company’s winning streak continued as Wall Street greeted AOL’s latest earnings report with glee. AOL ended an eight-year money-losing slump in 2012, as all of its divisions ended the year “quasi-profitable” for the first time under Tim Armstrong’s reign as CEO.

AOL was dubbed by some the “hottest tech stock of 2012.” Here’s a 12-month look at AOL shares (in light blue, at the top) followed by Netflix (dark blue), Yahoo! Inc. (NASDAQ:YHOO) (red), Google Inc (NASDAQ:GOOG) (green), Apple (yellow), and Microsoft (purple). The shares of AOL have performed better than tech giants like Apple Inc. (NASDAQ:AAPL)’s, Yahoo’s, and Microsoft’s. Within the past six months, we have seen shares of Apple peak around $700 in September and then fall steadily, losing about $200 per share in about four months, a fall of roughly 28% in 4 months.

Source: Ycharts.com

A gain on an asset sale helped AOL increase net income 57% in the fourth quarter, despite lower profits from its core businesses. AOL reported what it said was its first overall growth in revenue in eight years, as a 13% increase in ad sales offset a 10% drop in Internet-access subscription revenue. Total revenue was up 3.9% at $599.5 million, topping Wall Street estimates of $574 million.

When it comes down to how different divisions are pulling in revenue, AOL still attributes the most revenue on its income statement to its Membership group, which includes AOL Mail, subscription services, AIM and related items. These were at $231 million, a decline of 9%. Second in line was the Brand group, which includes properties like the Huffington Post and TechCrunch, whose revenue was up by 4% to $213 million.

Growth in ad revenue was driven by a 31% increase in third-party network revenues, the sale of ads on sites that AOL doesn’t own. AOL’s global display advertising fell 0.5%, due to lower domestic display revenue. International display revenue was up.

Overall, AOL reported a profit of $35.7 million, or 41 cents a share, compared with year-earlier income of $22.8 million, or 23 cents a share. The results included a $16.8 million gain on disposal of assets, related to the past sale of German and U.K. businesses. The company also unveiled a $100 million stock-buyback program.

During this time, AOL has also become number two in online video thanks to products like HuffPo Live; this is significant because video is one of the most lucrative forms of online advertising. AOL now plans to draw on its fancy ad tools to create automated buying for its own video inventory while, at the same time, offering those tools to other companies who are still catching up on the video front.

But some of the core problems that have vexed investors over the past few years have remained. Operating income before depreciation and amortization, excluding one-time items, fell 7% to $123.3 million. The segment containing the media properties like the Huffington Post and Patch showed a 34% drop in EBITDA despite modest revenue growth of 4% to $213 million for the quarter. The earnings drop reflected the high investment costs of new ventures like Patch and HuffPost Live. The bulk of adjusted operating income before depreciation and amortization came from the company’s declining subscription business.

AOL and its competitors-

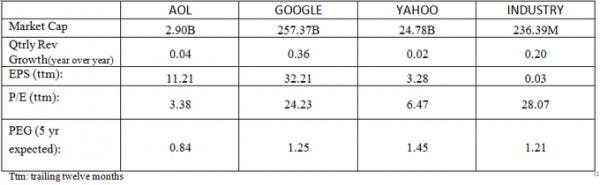

AOL faces tough competition from tech giants like Google Inc (NASDAQ:GOOG) and Yahoo! Inc. (NASDAQ:YHOO). While Google reported robust results for the fourth quarter with a net income of $2.89 billion as compared to $2.71 billion for the fourth quarter of 2011, things were going bleak for Yahoo before the new CEO Marissa Mayer took charge. It has been expected that under her guidance Yahoo will gradually pick up its market share, which it has been losing to its competitors including Google. The following table shows a comparative analysis of AOL with its competitors Google and Yahoo. Even though Google marches way ahead of AOL in EPS and P/E comparison, a low PEG works in favor of AOL. With a low PEG as compared to its rivals and the industry standards, AOL proves to be an attractive investment.

The bottom line is that AOL has three major revenue streams, all of which look viable. There are still danger signs, of course: AOL’s display ad business looks shaky and even though the company’s revenue may come from three streams, nearly all of the profit is still coming from the legacy subscriber businesses.

“What exactly is AOL?” you might ask yourself. As a consumer product, it’s a bunch of websites. As a business strategy, it’s an ad company. As a growth business, it’s a third-party digital advertising network. And as a profitable business, it’s mostly none of those things, but rather, overwhelmingly, an anachronistic online membership service.

People looking for 2013′s turnaround story should stop fussing over Yahoo! — it’s AOL that is poised to be this year’s comeback kid!

The article It’s Time To Take This Stock Seriously! originally appeared on Fool.com and is written by usha patodia.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.