Bringing this concept to today, highly leveraged mortgage real estate investment trusts (mREITs) are gaining a lot of attention. The difference is that this time around, the pooling of mortgage assets is based on tighter credit tolerances than before. However, with short-term interest rates so low, it is now possible to leverage the yields of these instruments by purchasing pools that are heavily financed with debt.

All this did was exchange credit risk of the underlying asset to interest rate risk in order to obtain a greater dollar return for further distribution. The complication of this is that individual investors’ money is used to give the equity capital to mREITs to start this process. When rates reverse, this will be the first capital contribution to evaporate.

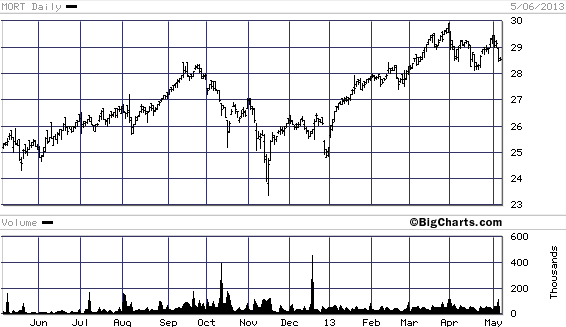

The Market VectorsMortgage REIT Income ETF is an exchange traded-fund that has concentrated its capital in such mREITs. This ETF was formed on Aug. 17, 2011, and has given a one-year return of 24.10%, It holds 26 mREITs and the price chart below may indicate change is on the way. The index is rule based and the portfolio is subject to change.

The first position by weight is a well-known mREIT that has been gaining a lot of attention lately. As of May 2, 2013, 15.7% of the Market Vectors Mortgage REIT Income ETF is held in Annaly Capital Management, Inc. (NYSE:NLY). See the price chart below and it appears that the recent fears surrounding this company are exerting downward pressure. The last time I looked at its balance sheet, I noticed a nine-to-one debt-to equity ratio.

Management of this mREIT has expanded the holdings by a huge amount of debt, and now, that fear in this sector is taking hold, selling of the shares is in progress. I suggest resisting the temptation to earning a high dividend yield in such a stock. The moment short-term interest rates move upward, the narrow 1%-plus spread earned on the assets held and the cost of debt to hold the assets will quickly cause the yield to the equity holders to drop significantly. Leverage is a double-edged sword, it magnifies both gains and losses

The number two holding by weight belongs to American Capital Agency Corp. (NASDAQ:AGNC), with 14.2% of this ETF in this mREIT. See the price chart below and a very similar story appears to be unfolding. The first-quarter earnings report revealed a comprehensive loss of $1.57 per share. Due to the REIT structure, taxation and distribution of earnings falls to the shareholders, not the corporation. Still, there are other factors in this report that cause concern.

This is another one to avoid for the time being. American Capital Agency Corp. (NASDAQ:AGNC)’s use of high levels of debt leaves the portfolio of mortgage backed securities exposed to interest rate risk. This is the same risk that Annaly Capital Management, Inc. (NYSE:NLY) faces and when short-term interest rates rise, the gross yield spread between assets and debt will narrow, causing reduced returns for equity holders.

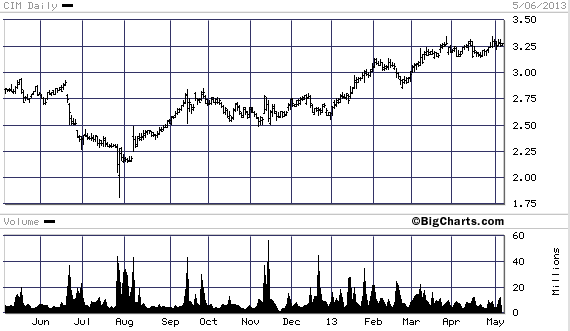

The third largest holding is Chimera Investment. Even though this stock has generate a one-year return of 31.43% and the chart below looks nice, I am not making any comments due to the share price currently around the $3 point.