We recently published a list of 10 AI Stocks Everyone is Talking About These Days. In this article, we are going to take a look at where Broadcom Inc. (NASDAQ:AVGO) stands against other AI stocks everyone is talking about these days.

President Donald Trump’s $500 billion investment plan to build AI infrastructure, Stargate, is making waves as analysts believe the project provides a new growth catalyst for major tech companies. Sasha Ostojic, Playground Global venture partner, said in a latest program on CNBC that the plan is just the beginning of AI “renaissance” in the country:

“Stargate is just the beginning, I think, of this renaissance of AI technology in this country, even though it seems like we’ve been in it for a few years. And, you know, it reminds me of the Apollo program from the 50s and 60s. In that case, it was a government-run program that created a bunch of technology, propelled the world forward, created a bunch of companies, and set us up for a lot of prosperity in the decades to follow.”

Ostojic also talked about the Jensen Huang-led company and said its stock has been going “sideways” and the market is waiting for the next big “trigger.” He is bullish on the company and thinks the $500 billion plan with the company at its center could be the next growth catalyst investors were waiting for.

READ ALSO: 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In

For this article, we picked 10 AI stocks currently trending on the back of the latest news. With each stock, we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

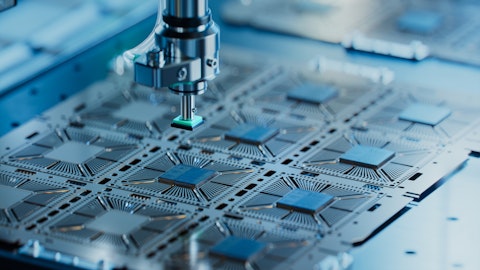

Broadcom Inc. (NASDAQ:AVGO)

Number of Hedge Fund Investors: 128

Sara Kunst from Cleo Capital said in a latest program on CNBC that Broadcom will remain a key AI player in the chips space. When asked whether Nvidia’s continuous rise would impact Broadcom Inc (NASDAQ:AVGO) negatively, the investor said:

“What we’ve seen over the last year or so is that once the market finds a new old—in most cases, these aren’t new companies—you know, AI companies, they tend to double down on it for a while. So I would guess that Broadcom Inc (NASDAQ:AVGO) is going to have a good run as long as their fundamentals can continue to be good. I think that the market has a lot of appetite for new AI names, and I suspect that those are going to remain kind of the darlings for a while.”

Baron Opportunity Fund stated the following regarding Broadcom Inc. (NASDAQ:AVGO) in its Q3 2024 investor letter:

“We continued to build our position in Broadcom Inc. (NASDAQ:AVGO), a global technology leader that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. As AI continues to proliferate, we believe hyperscalers – such as Meta, Microsoft Azure, Google Cloud Compute, and Amazon Web Services, to name just a few – will increasingly deploy custom accelerator chips for their AI workloads as they can be more cost-effective and energy-efficient than using NVIDIA’s general-purpose GPUs. Broadcom has a leading position partnering with hyperscalers to develop these custom chips, with its AI customer accelerator business up 3.5-times year-over-year in its most recently reported quarter, and a goal of at least $8 billion in custom accelerator revenues for this fiscal year. Additionally, VMware continues to perform better than expected as Broadcom is implementing its product simplification and subscription revenue model strategy. Further, its non-AI related semiconductor business, which tends to be more cyclical, is in the early stages of a recovery. Combined, all these factors will drive strong revenue and earnings growth over the next several years.”

Overall, AVGO ranks 4th on our list of AI stocks everyone is talking about these days. While we acknowledge the potential of AVGO, our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than AVGO but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.