We recently published a list of Top 10 AI News You Shouldn’t Miss. In this article, we are going to take a look at where Micron Technology Inc (NASDAQ:MU) stands against other top AI news you shouldn’t miss.

JPMorgan Asset Management’s Kerry Craig said in a latest program on CNBC that investors are looking beyond the top AI companies amid valuation and spending concerns following the launch of DeepSeek. The analyst said he remains bullish on the “secular theme” of AI and believes there are still opportunities for the market.

“I think playing it now through the market could be a little bit more of less around the hyperscalers and the producers of this technology and then thinking a little bit further along the AI value chain so the users of this technology, the software companies, maybe utilities, and thinking about energy providers and those further opportunities that may be a little bit better valued when it comes to the prospects and the equity market and where you might see better upside. It’s very difficult to keep repeating these very large returns we’ve seen across these names for the last couple of years.”

READ ALSO 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In

For this article, we picked 10 AI stocks currently making moves on the back of the latest news. With each stock, we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

Micron Technology Inc (NASDAQ:MU)

Number of Hedge Fund Investors: 107

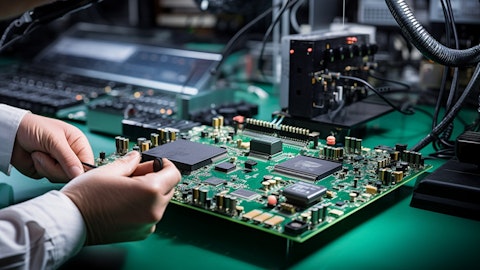

Joe Tigay from Rational Equity Armor said in a latest program on Schwab Network that the market is underestimating the importance of memory chips sold by Micron Technology Inc (NASDAQ:MU) in the backdrop of the AI boom.

“I think people are just kind of forgetting. Everyone’s talking about the semiconductor chips — that’s the most important, it’s the most expensive, it’s the most high-tech component of a data center. But people will need to have memory cards as a part of this whole picture, and Micron Technology Inc (NASDAQ:MU) is right there. They’re going into these data centers. I think this is just a critical component of the whole ordeal, and I think being down on the weakness from some of the semiconductors is just kind of wrong, in my opinion. There’s a need, there’s a demand for these products, for all the money that is being dumped out of these chips and into some of the companies.”

Delaware Ivy Core Equity Fund stated the following regarding Micron Technology, Inc. (NASDAQ:MU) in its Q3 2024 investor letter:

Micron Technology, Inc. (NASDAQ:MU) – Fundamentals here also appear solid though concern about global demand for handsets and PCs drove the shares down during the quarter. We expect Micron to be a significant beneficiary of growth in AI demand as investment in new data centers is extremely memory (semiconductor) intensive.”

Overall, MU ranks 7th on our list of top AI news you shouldn’t miss. While we acknowledge the potential of MU, our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than MU but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.