We recently compiled a list of the 15 AI Stocks on Wall Street’s Radar. In this article, we are going to take a look at where Analog Devices, Inc. (NASDAQ:ADI) stands against the other AI stocks.

Uber, the ride-hailing company that has yet to catch onto the AI boom, is reportedly expanding its fleet of gig workers for a new project aimed at AI annotation and data labeling. According to a report by news publication Bloomberg, the ride-hailing company has started hiring contractors for a new AI and data labeling division called Scaled Solutions. The report adds that these workers complete projects for internal business units at the ride hailing company but are also serving outside customers, including self-driving vehicle company Aurora Innovation and video game developer Niantic. The company has started recruiting contractors in countries including the US, Canada, and India, among others.

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

Over the past few years, even though the firm is yet to launch an eye-catching AI product, it has incorporated AI internally to streamline operations. For example, the AI algorithms of the firm efficiently match riders with drivers to minimize waiting times and maximize driver utilization. These algorithms predict demand, analyze traffic patterns, and estimate trip durations to offer real-time ride assignments. Similarly, the company heavily invests in AI for self-driving car technology. AI systems in these vehicles process data from LiDAR, cameras, and sensors to navigate roads, identify objects, and make decisions in real time.

Read more about these developments by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

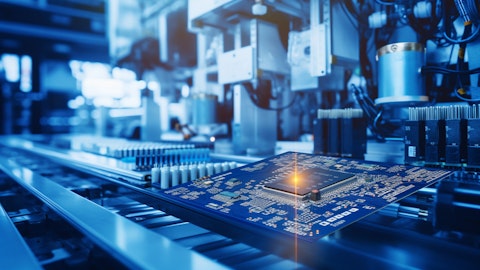

A technician working on power management in a semiconductor factory.

Analog Devices, Inc. (NASDAQ:ADI)

Number of Hedge Fund Holders: 63

Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. On November 27, Truist lowered the price target on the stock to $227 from $233 and kept a Hold rating on the shares. Truist says it’s tough to get excited about buying the stock here, even though the advisory loves the company. Analog Devices beat above-seasonal expectations for Q3 on both revenue and EPS, but January guidance is mixed versus consensus, the advisory says.

Overall ADI ranks 9th on our list of the AI stocks on Wall Street’s radar. While we acknowledge the potential of ADI as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ADI but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.