We recently compiled a list of the 15 AI News You Should Not Ignore. In this article, we are going to take a look at where Analog Devices, Inc. (NASDAQ:ADI) stands against the other AI stocks.

Even as the United States pursues a tougher trade policy towards China, the latest indication being the tightening of export restrictions on advanced AI chips, companies from the Asian country continue to debut on the US stock market with elevated investor interest. For example, Pony AI, a China-based autonomous vehicle technology company, recently held an initial public offering that saw shares jump 15% in the market debut, pushing the valuation of the firm to more than $5.25 billion. News agency Reuters reports that the successful debut also suggested a positive investor approach to China-based firms.

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

The IPO price of the stock was $13 per share but the depositary shares opened at $15 in their Nasdaq debut, per the report. Even after the stellar debut, the new company faces several challenges, the report added, including public skepticism about autonomous vehicles, data privacy concerns, and competition from companies, including Tesla which has promised to roll out driverless ride-hailing services to the public in California and Texas next year. The company has said that its US operations will remain limited in scope for the foreseeable future.

Read more about these developments by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

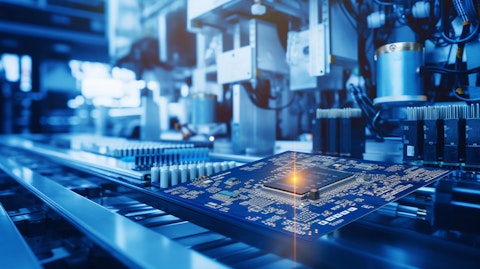

A technician working on power management in a semiconductor factory.

Analog Devices, Inc. (NASDAQ:ADI)

Number of Hedge Fund Holders: 63

Analog Devices, Inc. (NASDAQ:ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. On November 27, Evercore ISI raised the price target on the stock to $280 from $254 and kept an Outperform rating on the shares. The advisory believes guidance contemplates a cautious supply chain, which has undergone seven quarters of inventory correction and is heading to below normal levels. This, combined with its view that Analog is shipping about 22% below consumption, leads the advisory to contend that the company should be set up for a material snapback in demand starting in the January or April-end quarter.

Overall ADI ranks 9th on our list of the AI stocks that you should not ignore. While we acknowledge the potential of ADI as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than ADI but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.