Tesla Motors Inc (NASDAQ:TSLA) has been on the rise in the past 4 months. Mostly because of the Q1 earnings, but more recently due to some optimist analysts predicting better than expected Q2 results released on July 22. One of those optimists is Elaine Kwel from the research firm Jefferies. In her report, she estimated that the company is poised to deliver 5,000 cars in the second quarter. 500 more than the 4,500 Tesla planned to deliver.

Now that this report (among others) set the bar at 5,000 deliveries for Q2 and that Musk did not deny the possibility, Tesla has to deliver in order to keep its momentum.

Tracking sells

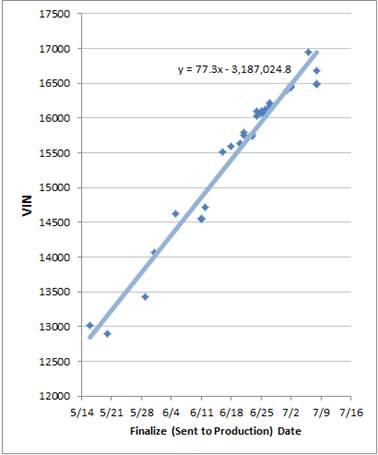

It is difficult to track Tesla Motors Inc (NASDAQ:TSLA)’s sales, since unlike most car companies, they do not release monthly numbers. The best way I found to get a ballpark number is by following the VINs release by buyers in forums. A VIN (Vehicle Identification Number) is a unique code including a serial number, used by the automotive industry to identify individual motor vehicles.

Keep in mind that this is not an exact science, but it can give us a general idea of the deliveries in Q2 and help us track the speed of the growth to identify any signs of an upcoming peak. We also need to remember that Tesla will only include in its earnings the cars that have been delivered, not the ones sold or reserved.

Starting from the end of Q1, the last VINs delivered were in the mid-7,000. At the end of June they were in the mid-14,000. It indicates around 5,500 delivered vehicles after taking out 500 cars possibly on their way to Europe and a generous 1,000 cars buffer for the last couple weeks of attributed VINs that were not delivered. Even if this number is off by a couple hundred, it would still be higher than most optimistic estimates and could send the stock price higher.

Tesla Motors Inc (NASDAQ:TSLA) enthusiast and forum contributor Craig Froehle followed the VINs in the past 7 weeks and he ended up with this chart:

From Craig’s own admission, those numbers are bold, but in my opinion they clearly indicate a ramping up of the production with no precursor of a peak coming soon. As you can see, Tesla Motors Inc (NASDAQ:TSLA) past the 14,500 mark in mid-June, but I did not included in my equation the VINs issued after this threshold because there were simply no chance that those cars would have been delivered before the end of the quarter.

In perspective

According to Inside Evs, General Motors Company (NYSE:GM) sold 2,698 Volts in June while Nissan Motor Co., Ltd. (ADR) (OTCMKTS:NSANY) managed to delivered 2,225 LEAFs. Those numbers are good news for General Motors Company (NYSE:GM) and Nissan Motor Co., Ltd. (ADR) (OTCMKTS:NSANY), but when comparing the Volt and the LEAF with the Model S, we have to keep in mind that both cars are half the starting price of the S while their range reach about 25% of Tesla Motors Inc (NASDAQ:TSLA)’s 85kWh version. We can’t really compare Tesla to anyone on the market right now, but those sales give us some perspectives.

Frédéric Lambert is long on TSLA. The Motley Fool recommends Tesla Motors Inc (NASDAQ:TSLA) . The Motley Fool owns shares of Tesla Motors .

The article An Opportunity Coming With Tesla’s Q2 Earnings originally appeared on Fool.com.

Frédéric is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.