David Zapico: Yes. We’re currently investing just under 5.5% of sales on research, development and engineering. And as we buy higher technology businesses, that number will increase modestly. I think this year, we expect to spend $400 million on RD&E, which is up a good healthy double-digit amount on the total R&D spend. So our R&D is a key part of our business. We have a lot of industrial technology products that we want to maintain leadership positions in. It allows us to get the pricing that we can get because we’re providing unique value to our customers. I don’t think you’re going to see a big jump anywhere, but it’s happening as we naturally evolve our portfolio to higher technology products.

Allison Poliniak: Great. And just any color on M&A. You obviously had a record year last year, still in a good position from a leverage standpoint. What are you seeing or what are we expecting? I know you mentioned med tech is sort of a vertical you want to go into? Where are you seeing the greatest opportunities? Any difference in terms of size that we should be thinking through? Just any thoughts there.

David Zapico: No, I think we’re looking at the more traditional size deals. And we’re also — we have a few of the larger size deals in our pipeline, and I would characterize Paragon on the outer edge of the larger size. We’re very happy with the 5 deals that we got done. We deployed $2.25 billion. We did it across our business in different parts of it. They were high-quality additions. They expanded our presence in attractive growth markets. We have a very clear path to add value to these companies. Each business has a strong technology position. The deals will meet our traditional financial hurdles. Remember, it’s a 10% return on invested capital in year 3. In terms of our pipeline, our pipeline remains very strong. And we are actively looking at a number of high-quality deals across a broad set of markets.

As always, we’ll remain disciplined when we do this. And I really think that we have the opportunity to differentiate our performance with the M&A element of our growth strategy, combined with our balance sheet and cash flow positions. I mean we excel and the markets are slowing or choppy because we had great OpEx and great M&A, and we see tremendous values in the market that we’re tracking. The way the market is evolving, it’s probably going to be 2, 3, 4 — second quarter, third quarter, fourth quarter, with the bulk of the opportunities are. So — but really, this year, the pipeline looks good, and we’re optimistic.

Operator: Our next question will be coming from Jeffrey Sprague. of Vertical Research.

Jeffrey Sprague: Hi, thank you. Good morning, everyone. Just on deals, Dave. I think on Paragon, you’re expecting most or the accretion to really kick in, in 2025, not so much ’24. But can you just give us a little color on what is the EPS impact embedded in your guide for Paragon in ’24 and the other deals also?

David Zapico: Well, sure. Related to Paragon specifically, during the first half of the year, we’re going to be doing some — expect some muted growth for a couple of reasons. One, there is an inventory correction going on in the medtech market and we’re going to look at the portfolio and potentially prove some less product — less profitable product areas. So there’s a whole process that we’re going to go through during this first half. And — but all that said, we’re expecting the second half to be very strong because they got some new product introductions that are very exciting. But we continue to expect within the — in our guidance is 8% to 10% accretion in 2024. And this is back-end loaded as we layer in the integration costs.

Bill Burke: Is that what clarifying? $0.08 to $0.10?

Jeffrey Sprague: Yes, $0.08 to $0.10. Yes. And then just drilling a little bit further into some of the end markets, thanks for kind of going and doing it around the world. But kind of the semi-related markets in particular, which have kind of been the vein of a lot of people that exist in here recently kind of looking for the bottom and the turn. Like what are you seeing in those markets? What do you see in the quarter specifically? And how does 2024 look?

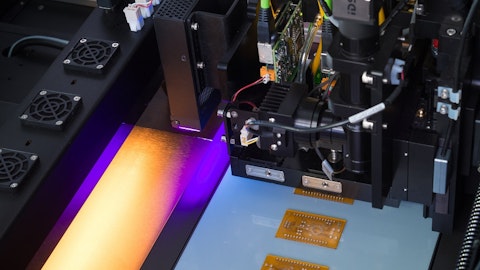

David Zapico: We have a little different dynamic in semiconductor, and I talked about it on a couple of past calls because we have the memory downturn that a lot of people are seeing. We saw that too. But at the same time, we have some exceptional technology in our CAMECA business. It’s a next-generation technology that’s really is in demand in just about all fabs. And we also have our Zygo business. We’re one of the few companies that can manufacture EUV, extreme ultraviolet optics and semiconductor fabrication. So those are two growing dynamics. It’s a good place to be. They were able to offset some of the weakness we had in the — I’ll call it, the core memory part of the portfolio. And for 2023, we ended up 10%. So it was a growing market for us. And for 2024, we expect to additionally grow another plus mid-single digit. So largely because of the technology, we were able to grow in ’23, and we think we’ll continue to grow in ’24.

Operator: Our next question will come from Nigel Coe of Wolfe Research.

Nigel Coe: Thanks. Good morning, everyone. And, Bill, congratulations on your retirement. So just a few border lines for me for ’24. The guidance for revenue growth of low double digits I’ve got high single digits coming in from M&A, obviously, mainly Paragon. Is that the right kind of ballpark about 9% coming in from M&A, which implies sort of 2%, 3% organic. Is that the right level?

David Zapico: You’re in the ballpark, Nigel.

Nigel Coe: Okay. Great. That’s helpful. And then just anything to call out on incremental margins across both segments. We’re coming off some pretty tough comps in EIG. So just curious, how we should think about maybe overall margins, but more importantly, core incremental margins.

David Zapico: Are you talking about for 2024 or 2023?

Nigel Coe: 2024.

David Zapico: 2024?

Nigel Coe: Yes.

David Zapico: Yes. I mean we had a fantastic margin year in 2023 and margins were up. Core margins were up 200 basis points in the fourth quarter, reported margins are up 120 basis points. EIG had a great quarter. EMG, it was dilutive because of acquisitions. And when you peel away what was going on, they’re actually up 100 basis points. So really good margins, really good incremental. And we think for 2024, they’re going to moderate a bit. They’re going to continue to grow them, but they’re going to moderate a bit. And for 2024, we believe that core margins are going to be up 30 basis points. We think that the core incremental are going to be up about 30 basis points. And we have built on our model cost reductions and pricing and things like that, but the whole thing that’s to the core margins being up 30 and the core incremental is up 30 basis points.