“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards American Midstream Partners LP (NYSE:AMID) and see how it was affected.

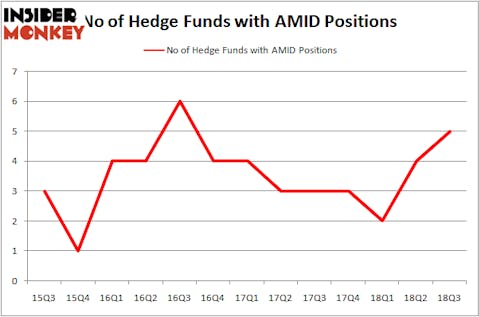

American Midstream Partners LP (NYSE:AMID) was in 5 hedge funds’ portfolios at the end of the third quarter of 2018. AMID investors should pay attention to an increase in hedge fund sentiment of late. There were 4 hedge funds in our database with AMID positions at the end of the previous quarter. Our calculations also showed that AMID isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a peek at the fresh hedge fund action regarding American Midstream Partners LP (NYSE:AMID).

Hedge fund activity in American Midstream Partners LP (NYSE:AMID)

At Q3’s end, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from one quarter earlier. On the other hand, there were a total of 3 hedge funds with a bullish position in AMID at the beginning of this year. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, MFP Investors held the most valuable stake in American Midstream Partners LP (NYSE:AMID), which was worth $4.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $1.1 million worth of shares. Moreover, Caspian Capital Partners, Renaissance Technologies, and Citadel Investment Group were also bullish on American Midstream Partners LP (NYSE:AMID), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers have jumped into American Midstream Partners LP (NYSE:AMID) headfirst. Caspian Capital Partners, managed by Mark Weissman, Adam Cohen and David Coleto, created the most valuable position in American Midstream Partners LP (NYSE:AMID). Caspian Capital Partners had $0.4 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.1 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks similar to American Midstream Partners LP (NYSE:AMID). We will take a look at Daqo New Energy Corp (NYSE:DQ), Howard Bancorp Inc (NASDAQ:HBMD), Nebula Acquisition Corporation (NASDAQ:NEBU), and Southern Missouri Bancorp, Inc. (NASDAQ:SMBC). This group of stocks’ market caps match AMID’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DQ | 6 | 33107 | -3 |

| HBMD | 3 | 14577 | 0 |

| NEBU | 18 | 130551 | 1 |

| SMBC | 3 | 13648 | 0 |

| Average | 7.5 | 47971 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $7 million in AMID’s case. Nebula Acquisition Corporation (NASDAQ:NEBU) is the most popular stock in this table. On the other hand Howard Bancorp Inc (NASDAQ:HBMD) is the least popular one with only 3 bullish hedge fund positions. American Midstream Partners LP (NYSE:AMID) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NEBU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.