We at Valuentum continue to monitor developments at business development companies (BDCs), particularly industry bellwether Main Street Capital Corporation (NYSE:MAIN). In February, we penned a profile of Main Street, and we added the firm to our Dividend Growth Newsletter watch-list (not portfolio) at the time. With shares of Main Street getting clobbered in the past few days, let’s take a deeper dive into the sector’s opportunities and risks.

What are BDCs?

How Do BDC’s Make Money?

BDCs may seem like complex structures since we compare them to private equity, but the business model is pretty simple: borrow cheap, lend high, and collect the difference. This is commonly referred to as a net interest margin (NIM) in banking. In this sense, the business is really no different from any other lending…except BDCs specialize in “junk” debt and high-risk equity.

Image Source: MAIN Investor Presentation, 2013

Along with the cost of financing, the other major cost endured by BDCs is overhead. Therefore, it is crucial for investors willing to dabble in this industry to find BDC managers with interests aligned with shareholders such that costs are adequately controlled and savings are passed to shareholders. This includes executive compensation that isn’t outrageous and limited G&A expense growth.

BDCs play an important role in providing financing to both financially strapped companies and small businesses that need capital. While this implies that lending is exceptionally risky, it isn’t always the case.

We like Main Street Capital Corporation (NYSE:MAIN) founder and CEO Vincent Foster’s thoughts on putting capital to work, and from some recent comments by the firm, we gather that there will continue to be a very steady pipeline of deals going forward. Foster said on the firm’s fourth-quarter 2012 conference call:

“…There’s a continuous supply demand imbalance of the amount of businesses that need capital, that need to exit, aging on or partners that don’t get along, you name it. There’s no shortage of it. And we just — we try to pick the ones that are most likely to make it through.”

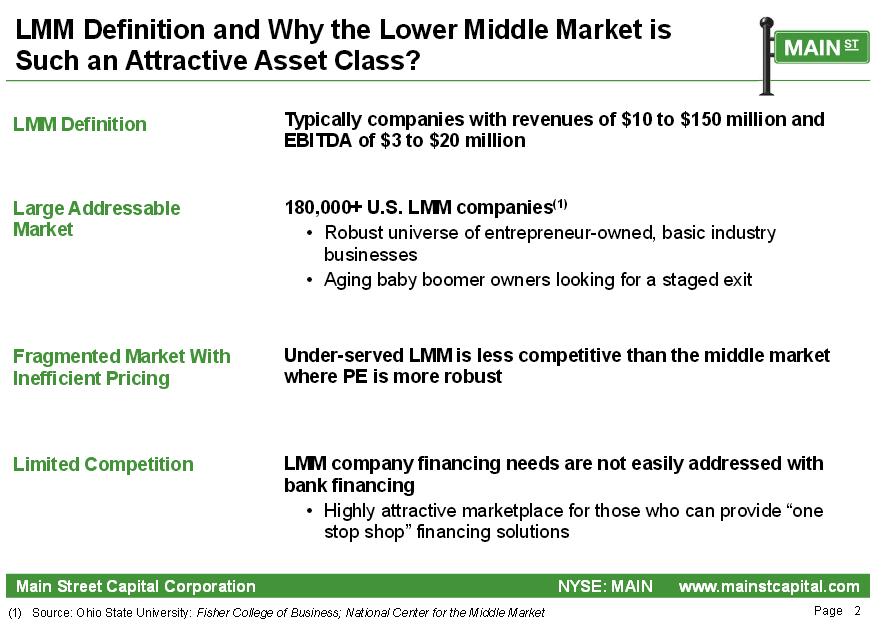

The Attractiveness of the Lower Middle Market

The chart below shows the lower middle-market that is often the bread-and-butter of BDCs. Revenue and EBITDA at these companies are often small enough to fall under the radar of large companies and private equity funds.

Source: MAIN Investor Presentation, 2013

Several of these middle-market businesses are relegated to junk status, though these loans don’t necessarily carry high default rates. However, some are also over-leveraged, high-risk situations. In addition to credit, BDCs can make equity investments (though much equity comes through convertible debt). These equity investments can be a tremendous source of profits not only because small businesses often have potential for blockbuster success, but also because BDCs can often purchase small businesses at mid-single digit PEs and attractive free cash flow yields (making it easier to achieve robust investment returns). There simply aren’t a lot of small business buyers out there, making the market less liquid and less efficient. Nevertheless, BDCs themselves are highly leveraged vehicles.

With substantial leverage comes a lot of capital to invest. The allocation decision comes down to the individual management teams. Prospect tends to invest heavily in financial services, while some firms like ACAS may choose to focus on technology.

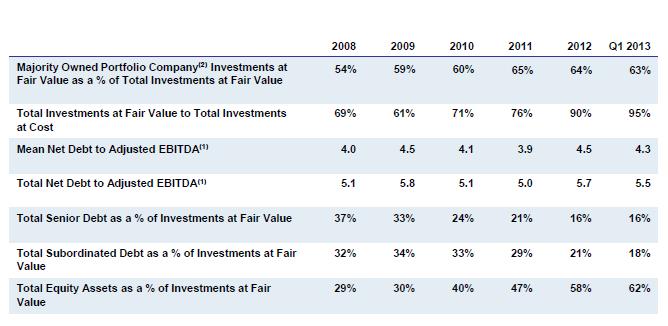

Other companies prefer more or less diversification. In fact, debt versus equity investments varies by company. Take American Capital Ltd. (NASDAQ:ACAS), which increasingly shifted away from senior debt to equity over the past few years (shown below):

Image Source: ACAS Q1 2013 Presentation