Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does eBay Inc (NASDAQ:EBAY) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

What we’re looking for

The graphs you’re about to see tell eBay Inc (NASDAQ:EBAY)’s story, and we’ll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

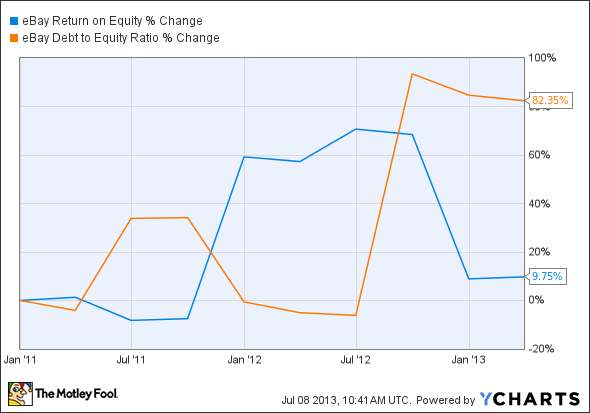

- Opportunities: is return on equity increasing while debt to equity declines?

What the numbers tell you

Now, let’s take a look at eBay Inc (NASDAQ:EBAY)’s key statistics:

EBAY Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 63.4% | Pass |

| Improving profit margin | (31.6%) | Fail |

| Free cash flow growth > Net income growth | 44.4% vs. 11.8% | Pass |

| Improving EPS | 11.3% | Pass |

| Stock growth (+ 15%) < EPS growth | 98.4% vs. 11.3% | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

EBAY Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 9.8% | Pass |

| Declining debt to equity | 82.4% | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we’re going

eBay Inc (NASDAQ:EBAY) doesn’t quite come through with the flawless performance, as it’s only earned four out of seven possible passing grades. eBay has enjoyed significant growth in revenue, but net income has failed to keep pace, and the company’s net margin has actually declined. eBay has had a tough time keeping its costs down, despite this apparent inadequacy, eBay’s shares have made an impressive comeback, and the stock has quietly become one of Silicon Valley’s best dot-com rebounds. Is this rebound sustainable, or will eBay shareholders fall victim to rising costs in the end

With 112 million active users and more than 350 million listings globally, eBay Inc (NASDAQ:EBAY) certainly qualifies as a world-leading e-commerce company. eBay’s advantage isn’t measured in dollars but in people, and it’s that trust and loyalty that gives eBay a huge moat. The same could be said of Amazon.com, Inc. (NASDAQ:AMZN), but the mechanisms behind each company’s success differ in subtle but critically important ways. The art of negotiation can still be found on eBay (where it hasn’t been replaced with Buy It Now), but Amazon prefers to focus on simple cost comparisons — what you see as the lowest price on Amazon is what you’re going to get. Amazon also lacks the built-in payment mechanism eBay bought years ago and has slowly built into a world-class online payments processor.

One of the biggest risk factors relating to eBay Inc (NASDAQ:EBAY)’s business is that, outside of its auction niche, there aren’t any exceptionally compelling reasons to buy anything on the site rather than on Amazon.com, Inc. (NASDAQ:AMZN), or at any one of a variety of competing online retail portals. PayPal, while highly touted as the real crown jewel of the eBay empire, is also not immune to competition. In most cases, PayPal simply imposes an additional layer of processing between the credit (or debit) card and the seller. Streamlined options like Google Inc (NASDAQ:GOOG) Wallet, which Fool contributor Tim Beyers suggests could be tied to an eBay-like barter system via Google+, would simply need to offer lower processing fees and similar (or greater) levels of convenience to cause a major shift in users. Of course, PayPal has the advantage of a recently announced outer-space payment system, which may or may not be a delayed April Fool’s joke. Google, of course, is already in on the space race — it sponsors the Lunar X Prize to be awarded for a privately funded moon landing. It stands to reason that Google would be ready for space-based payments, too.

Putting the pieces together

Today, eBay Inc (NASDAQ:EBAY) has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is eBay Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Amazon.com, eBay, and Google.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.