The strong U.S. dollar managed to wipe out $0.07, or 5% of the company’s EPS in the first quarter. The company also sold 6.5% fewer cigarettes as both the economic situation in Europe and higher taxes in the Philippines sent customers away from its brands.

Philip Morris International Inc. (NYSE:PM) is not dead though, excluding the effect of currency, earnings grew 8%. Meanwhile, excluding the fall in cigarettes shipped to the Philippines, the company’s volume of cigarettes shipped only contracted 2%.

The problem is that Philip Morris International Inc. (NYSE:PM) used to be the best in the tobacco business. Indeed, since its spin off in 2008, any investor looking for a long-term investment in tobacco would turn to the company for global exposure and seemingly unstoppable growth.

However, now with changing tobacco opinions worldwide and a rising dollar, the company is starting to feel the pressure and it is possible that Philip Morris could be losing it crown as the best tobacco company on the market.

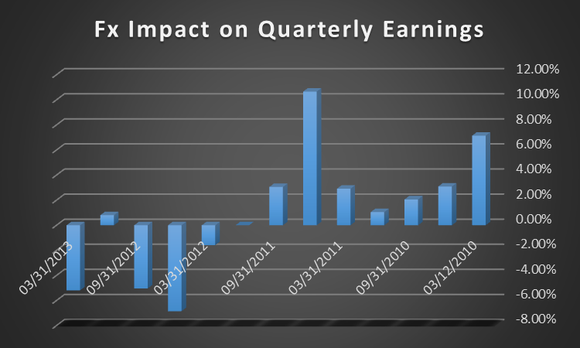

Currency movements are having a significant effect on Philip Morris’ earnings.

Indeed, Altria Group Inc (NYSE:MO) and Philip Morris USA could offer investors something that Philip Morris International (NYSE:PM) does not — predictability. Philip Morris International’s most recent earnings report highlights the fact that erratic policies by foreign governments and adverse forex movements can suddenly affect the company’s outlook.

While Altria Group Inc (NYSE:MO) is not totally immune from sudden changes in government regulation, the company isn’t exposed to any exchange rate risks. Furthermore, declining tobacco consumption rates within the U.S. are somewhat predictable, meaning that Altria is able to offset declining consumption with marginal increases in the price of its products — allowing the company to constantly maintain margins and profitability without sudden swings like Philip Morris International Inc. (NYSE:PM).

That said, Altria’s main problem is its growth. Since the divorce in 2008, Altria Group Inc (NYSE:MO)’s earnings have grown 47% or around 10% per year. Meanwhile, Philip Morris’ earnings have grown 55%, nearly 15% per year. On the other hand, Altria does offer a strong dividend yield and has returned to investors an average of 6.5% over the last five years. Philip Morris, on the other hand, has offered an average return of about 4%.

Additionally, Altria would have given investors a total return of 90.5% over the past five years; while Philip Morris would have given investors a return of 105% (right now Philip Morris is trading at a higher valuation than Altria Group Inc (NYSE:MO), if the valuations were the same, Altria’s total return would be about the same as that of Philip Morris’).

Not just Altria

Investors are not just limited to Altria. Lorillard Inc. (NYSE:LO) offers investors a play on the U.S. tobacco market and exposure to the rapidly growing E-cig market.

Unfortunately, Reynolds American is not included within this analysis as the company has not been able to achieve the same kind of steady earnings growth as Lorillard and Altria Group Inc (NYSE:MO).

| Company | 5-Yr Compounded Diluted EPS growth |

|---|---|

| Lorillard | 75% |

| Reynolds American | -13% |