Joseph Hogan: Jeff, the easy answer and the quick answer is yes. I mean it’s just a brand-new platform. Now we set up — I mentioned in my script about we have 100,000 units out there that we’ve sold so far. About 1/3 of those are 5D pluses, which are upgradable by just wand switch out. This is the way we’ve designed Lumina. And so that part’s easy. Also, we’ve been really aggressively upgrading our installed base between E1 and E2 out there too to better position it for this kind of a move. So as we develop Lumina, we had exactly in mind what you just questioned, and we think we’re in a good position to do that.

Jeffrey Johnson: And if you switch out that wand from the 5 to the Lumina, there is a fee there, right? It’s not like, hey, you bought this knowing that you could always upgrade at no charge to Lumina?

Joseph Hogan: There’s no charity here at Align. There will be a charge.

Jeffrey Johnson: I like to hear that. God bless capitalism.

Operator: Our next question comes from Jon Block with Stifel.

Jonathan Block: So Joe, maybe this one’s for you. Video 1Q ’24 IPE some markets today, but more in the common IPE should have longer term with team, docs might take a little bit of a wait-and-see approach. You talked about the new scanner. In your opinion, like is innovation are we seeing that in the ’24 guide? Or is that more of like a ramp in the ’25? And maybe even to take that a step further, John, for you, is there a way to sort of quantify out of that mid-single-digit revenue growth, what can you attribute to these new products coming on board in ’24? I’m just trying to think about the impact of ’24, is this more the ramp or the slope in the ’25 for the innovation hitting?

Joseph Hogan: Jon, I like the way you set that up. It’s a ramp, it really is. But we feel good that we can play offense with these product lines. Now we still have to scale IPE. We have a great team that knows how to scale, and we’ll get through that. Obviously, Lumina is a completely different set of outside of the computer itself. The wand itself is we feel good about the scale part of that as we sell through the marketplace. But overall, I think the way you described it is a ramp of this new technology really beginning in 2024 is a good foundation for that kind of thought process.

Jonathan Block: And any way to quantify what’s in there from the current guide or no? Is that just too difficult to tease out?

Joseph Hogan: It really is just too…

Jonathan Block: Okay. Okay. So second one is maybe a multipart. But just first on the CapEx, $100 million. I mean I was really surprised on how low that number was for this year. It’s $400 million in ’21, $300 million in ’22 million, and I was maybe even more surprised when I think about the direct fabrication initiatives. So I know the slides say hoping to print Invisalign Clear Aligner “next couple of years”. Do we still think retainers 2H ’24, 1H ’25? When do we feel like you proved it out, so to say? And do we start to see gross margin benefits from this as early as next year, turning accretive in 2025. And then admittedly just a jump to another question. For the guidance, can you just help us what’s embedded in there? And I bring that up because we’ve seen this big move in U.S. consumer confidence. Europe still seems very choppy. So when we tie back to your guidance for the year, what are you extrapolating out, if you would, for the current macro?

John Morici: I’ll start with that, Jon, in terms of the current guidance. Look, we’re looking at the environment that we’re all in. It’s not a great economy, most places, but it is more stable, and we’re building off of that. And then as Joe said, we’re doing things to play offense. New products that we have with Lumina and IPE and so on, which we think, can help us grow in this environment.

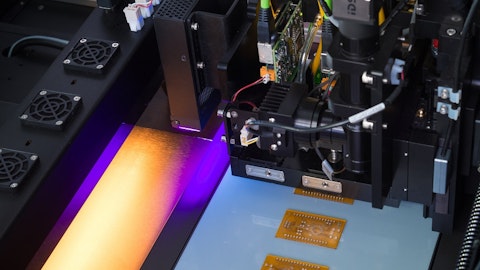

Joseph Hogan: Jon, your question about the ramp up, the margin piece or part of that, what’s that mean in 2025 or whatever. Look, we feel confident, and as you know from our discussions and our analyst presentation last year is 3D printing is foundationally, it can be less expensive as we scale. And so I mean, we’ll start to see that come through as we scale that. But we need time to scale this. No one’s ever had this polymer before that has a scale. No one’s ever used the Cubicure system to the degree that we need to use it. Now we did this with 3D systems years ago because we basically scaled those systems through our team and team knows how to do that. I just can’t tell you specifically within those in the next 1 to 3 years, with this being the first year, exactly when that really hits that hyperbolic side.

John Morici: And just to close on the CapEx, those prior years, that was — a lot of that was — it was equipment. Of course, we are always adding capacity, but a lot of that was very much unique for buildings, adding buildings for our locations, manufacturing and so on. And when we add some of the capacity that we’re adding for our manufacturing, it will go in existing buildings. So we don’t have to add another building in most cases for this. So that’s why the CapEx is where it is.

Operator: Our next question comes from Brandon Vazquez with William Blair.