Align Technology, Inc. (NASDAQ:ALGN) Q4 2023 Earnings Call Transcript January 31, 2024

Align Technology, Inc. misses on earnings expectations. Reported EPS is $1.64 EPS, expectations were $2.17. ALGN isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Shirley Stacy: Good afternoon, and thank you for joining us. I’m Shirley Stacy, Vice President of Corporate Communications and Investor Relations. Joining me for today’s call is Joe Hogan, President and CEO; and John Morici, CFO. We issued fourth quarter and full year 2023 financial results today via Business Wire, which is available on our website at investor.aligntech.com. Today’s conference call is being audio webcast and will be archived on our website for approximately 1 month. As a reminder, the information provided and discussed today will include forward-looking statements, including statements about Align’s future events and product outlook. These forward-looking statements are only predictions and involve risks and uncertainties that are described in more detail in our most recent periodic reports filed with the Securities and Exchange Commission available on our website and at sec.gov.

Actual results may vary significantly, and Align expressly assumes no obligation to update any forward-looking statements. We have posted historical financial statements, including the corresponding reconciliations, including our GAAP to non-GAAP reconciliation, if applicable, and our fourth quarter and full year 2023 conference call slides on our website under quarterly results. Please refer to these files for more detailed information. With that, I’ll turn the call over to Align Technology President and CEO, Joe Hogan. Joe?

Joseph Hogan: Thanks, Shirley. Good afternoon, and thanks for joining us. On our call today, I’ll provide an overview of our fourth quarter and full results and discuss a few highlights from our 2 operating segments, Systems, Services and Clear Aligners. John will provide more detail on our Q4 financial performance and comment on our views for 2024. Following that, I’ll come back and summarize a few key points and open the call to questions. I’m pleased to report fourth quarter results with better-than-expected revenues and earnings. As of the end of Q4, we achieved several major milestones, including 17 million Invisalign patients treated, including 4.7 million teens, plus 4 million Vivera Retainer cases and over 100,000 iTero scanners sold.

And for the full year — fiscal year 2023, total revenues exceeded our prior outlook, and we delivered fiscal 2023 non-GAAP operating margin above 21%. For Q4, total revenues were up 6.1% year-over-year, reflecting increased Systems and Services revenues. Strength in Clear Aligner volumes for teens and international doctors as well as continued growth from Invisalign touch-up cases, under our Invisalign Doctor Subscription Program, or DSP. Our Q4 Systems and Services revenues were up year-over-year, primarily due to increased services, CAD/CAM and nonsystems revenues, including scanner leasing and rental programs and certified preowned scanner sales. Q4 total Clear Aligner shipments were slightly lower year-over-year. On a year-over-year basis, Clear Aligner volumes were down for the Americas and EMEA regions and were up for the APAC region.

For Q4, Clear Aligner shipments include approximately 20,000 Invisalign DSP touch-up cases, primarily in North America, an increase of more than 60% year-over-year from Q4 ’22. DSP continues to be well received by our customers and is currently available in the U.S. and Canada, Iberia and Nordics and most recently, the U.K. We’re excited that DSP is proving helpful to doctors and their patients as we continue to expand the program. For fiscal 2023, total Invisalign DSP touch-up cases shipped were 73,000, up 85% year-over-year. For non-case revenues, Q4 was up 13.3% year-over-year, primarily due to continued growth from Vivera Retainers along with Invisalign DSP retainer revenues. On a sequential basis, Q4 total revenues were down slightly, 0.4%, primarily reflecting anticipated seasonally lower teens case starts, especially in the U.S. ortho channel and unfavorable foreign exchange offset somewhat by increased revenues from System and Services as well as an increase in Clear Aligner volume for adults and noncomprehensive cases and stronger volumes from Canada and the EMEA region.

Q4 total Aligner shipments were slightly lower sequentially. On a sequential basis, Clear Aligner volumes were down for the Americas and APAC regions and were up sequentially for the EMEA region. The December gauge practice analysis tool that collects and consolidates data from approximately 1,000 orthodontic practices across the U.S. and Canada reported year-over-year decline for new patients, total exams and total starts, particularly among teens and kids. It also shows a year-over-year decline for wires and brackets and total Clear Aligner starts with Invisalign case starts better than the Clear Aligner brand. And the teen segment for Q4, a 197,000 teens and younger patients started treatment with Invisalign Clear Aligner Systems, up 6% year-over-year and were a record number of teen cases shipped compared to prior fourth quarters.

Q4 teens starts were down sequentially, consistent with historical seasonality, primarily in China as well as seasonally fewer teen starts in North America compared to Q3. For fiscal 2023, total Invisalign Clear Aligner shipments for teens and younger patients reached a total of 809,000 cases, up 8% compared to the prior year and made up 34% of total Clear Aligner shipments. During Q4, we announced that the U.S. Food and Drug Administration cleared the Invisalign Palatal Expander System, we call it IPE, Invisalign Palatal Expander for commercial availability in the United States. The FDA 510(k) clearance is for broad patient applicability, including growing children, teens and adults. Full early intervention treatments such as Phase I or early interceptive treatment, makes up about 20% of the orthodontic case starts each year and is growing.

Together with Invisalign First Aligners, IPEs provide doctors with a solution set to treat the most common skeletal, dental malocclusions in growing children. The addition of mandibular advancement features to Invisalign aligners also provides doctors with more options for treating skeletal, dental joint balances and bite correction and for their growing patients during their teenage years. Essentially, we now have an Invisalign digital treatment solution for every phase of treatment. IPE is currently available on a limited basis in Canada and the United States, and we recently received regulatory clearance in Australia and New Zealand where we anticipate commercialization in Q2. We expect IPE to be available in other markets pending future applicable regulatory approvals.

We’re also launching ClinCheck smile video, the next generation of In-Face digitalization with AI-assisted video that is expected to be available to all doctors who use the Invisalign Practice App and ClinCheck treatment planning software. This new tool is designed to help improve patients’ understanding and of the confidence in Invisalign treatment and is based on iTero Intraoral Scanner and doctors ClinCheck plan for Invisalign treatment. ClinCheck smile video simulates the doctor’s ClinCheck treatment plan with a short video of a patient’s face, and they talk and smile, which helps patients visualize their potential new smile and can lead to a higher patient treatment acceptance. We expect to roll out ClinCheck smile video in Q1 ’24 in North America and EMEA, followed by APAC later in the year.

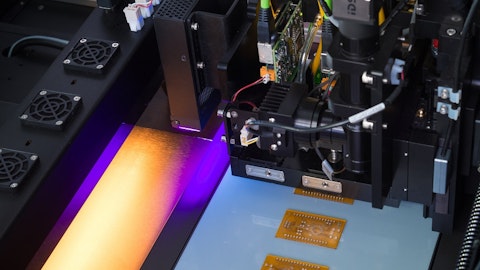

Before I turn the call over to John for our fourth quarter financial review, I want to share one more exciting news. Today, we introduced the latest innovation in the iTero family of inter-oral scanners. The iTero Lumina inter-oral scanner designed to meet the needs of doctors and their patients by offering smaller wand with unparalleled data capture capabilities for effortlessly scanning by clinical members. The iTero Lumina Inter-oral scanner is a breakthrough technology. With 3x wider field of capture and a 50% smaller wand that delivers faster scanning, higher accuracy and superior visualization for greater practice efficiency. iTero Lumina quickly, easily and accurately captures more data while delivering exceptionally scanned quality and photorealistic images that eliminate the need for inter-oral photos altogether.

Doctors can now scan at twice the speed with a wide field of capture, multi-angled scanning and large capture distance, meaning they can capture more dentition in greater detail throughout the scanning process. To date, Align has filed over 30 patent applications covering technology related to the iTero Lumina inter-oral scanner. I believe iTero Lumina has the potential to set a new standard of care for dental practices by simplifying the scanning of complex oral regions while offering superior chairside visualization and more comfortable experience for patients, especially kids. Initial doctor feedback has been very positive, noting that iTero Lumina scanner is much faster, clear, less invasive for their patients and the imaging and visualization translates to better communications and patient experience.

The iTero Lumina inter-oral scanner is available now with orthodontic workflows and will be available in the second half of 2024 restorative workflows, although we expect that GP practices can benefit now from the new scanning technology. A global broadcast to unveil iTero Lumina and provide attendees with insights and detailed information from our iTero team and early customer users is planned for February 15. Registration will open on February 1 and the link has been provided in our financial slides as well as in today’s press release. With that, I’ll turn the call over to John.

John Morici: Thanks, Joe. Now for our Q4 financial results. Total revenues for the fourth quarter were $956.7 million, down 0.4% from the prior quarter and up 6.1% from the corresponding quarter a year ago. On a constant currency basis, Q4 ’23 revenues were impacted by unfavorable foreign exchange of approximately $12.8 million or approximately 1.3% sequentially and were favorably impacted by approximately $13.8 million year-over-year or approximately 1.5%. For Clear Aligners, Q4 revenues of $781.9 million were down 1.6% sequentially, primarily from lower volumes. On a year-over-year basis, Q4 Clear Aligner revenues were up 6.9% and primarily due to higher ASPs and non-case revenues slightly offset by lower volumes. For Q4, Invisalign ASPs for comprehensive treatment were up sequentially and up year-over-year.

On a sequential basis, ASPs reflect higher additional aligners, partially offset by the unfavorable impact from foreign exchange, higher sales credits and higher discounts. On a year-over-year basis, the increase in comprehensive ASPs reflect higher additional aligners, price increases and favorable impact from foreign exchange partially offset by higher discounts in product mix to lower ASP products. For Q4, ASPs for noncomprehensive treatment were down sequentially and up year-over-year. On a sequential basis, the decline in ASPs reflect the unfavorable impact from foreign exchange, a product mix shift to lower ASP products and higher net revenue deferrals, partially offset by price increases and lower discounts. On a year-over-year basis, the increase in ASPs reflect price increases, the impact from favorable foreign exchange and higher additional aligners, partially offset by a product mix shift to lower ASP products and higher discounts.

Last quarter, we announced about a 5% global price increase for some Invisalign products across most markets effective January 1, 2024. Invisalign Comprehensive Three and Three product is available in North America and certain markets in EMEA and APAC, most recently launching in China, Korea, Hong Kong and Taiwan. We are pleased with the continued adoption of the Invisalign Comprehensive Three and Three product and anticipate it will continue to increase, providing doctors the flexibility they want and allowing us to recognize more revenue upfront with deferred revenue being recognized over a shorter period compared to our traditional Invisalign comprehensive product. Q4 ’23 Clear Aligner revenues were impacted by unfavorable foreign exchange of approximately $10.7 million or approximately 1.4% sequentially.

On a year-over-year basis, Clear Aligner revenues were favorably impacted by foreign exchange of approximately $12 million or approximately 1.6%. Clear Aligner deferred revenues on the balance sheet increased $14.9 million or 1.2% sequentially and $74.6 million or up 6.1% year-over-year and will be recognized as the additional aligners are shipped. Q4 ’23 Systems and Services revenues of $174.8 million were up 5.8% sequentially primarily due to higher ASPs and an increase in CAD/CAM and services revenue, partially offset by lower volumes and were up 2.9% year-over-year, primarily due to higher services revenues from our larger base of scanners sold and increased nonsystem revenues related to our CPO and leasing rental programs mostly offset by lower ASPs and scanner volume.

CAD/CAM and services revenues for Q4 represent approximately 50% of our Systems and Services business. Q4 ’23 Systems and Services revenues were unfavorably impacted by foreign exchange of approximately $2.1 million or approximately 1.2% sequential. On a year-over-year basis, Systems and Services revenue were favorably impacted by foreign exchange of approximately $1.9 million or approximately 1.1%. Systems and Services deferred revenues on the balance sheet were down $4.3 million or 1.6% sequentially and down $13.1 million or 4.8% year-over-year, primarily due to the recognition of services revenue which is recognized ratably over the service period. As our scanner portfolio expands and we introduce new products, we increased the opportunities for customers to upgrade, make trade-ins and purchase certified preowned scanners in certain markets.

Developing new capital equipment opportunities to meet the digital transformation needs of our customers and DSO partners is a natural progression for our equipment business with a large and growing base of scanners sold. Moving on to gross margin. Fourth quarter overall gross margin was 70%, up 0.9 points sequentially and up 1.5 points year-over-year. Q4 non-GAAP gross margin was 70.5% up 0.9 points sequentially and up 1.2 points year-over-year. Overall, gross margin was unfavorably impacted by foreign exchange by approximately 0.4 points sequentially and favorably impacted by approximately 0.4 points on a year-over-year basis. Clear Aligner gross margin for the fourth quarter was 71.1% up 0.4 points sequentially primarily due to lower manufacturing spend, partially offset by higher freight costs.

Clear Aligner gross margin for the fourth quarter was up 0.3 points year-over-year, primarily due to higher ASPs and favorable foreign exchange, partially offset by higher manufacturing spend and freight costs. Systems and Services gross margin for the fourth quarter was 64.8%, up 3.8 points sequentially due to higher ASPs, partially offset by higher service and freight costs. Systems and Services gross margin for the fourth quarter was up 6 points year-over-year due to improved manufacturing efficiencies and favorable foreign exchange, partially offset by lower ASPs. Before I go into the details, I want to note that during Q4 ’23, we incurred a total of $14 million of restructuring and other charges, primarily related to post-employment benefits.

Q4 operating expenses were $498 million, roughly flat sequentially and down 1.4 points year-over-year. On a sequential basis, operating expenses were up slightly due — primarily due to restructuring and other charges, offset by lower employee compensation. Year-over-year operating expenses decreased by $7.1 million primarily due to controlled spend on advertising and marketing as part of our efforts to proactively manage costs, partially offset by employee-related costs and slightly higher restructuring charges. On a non-GAAP basis, excluding stock-based compensation, restructuring and other charges and amortization of acquired intangibles related to certain acquisitions, operating expenses were $446.7 million, down 2.5% sequentially and down 2.8% year-over-year.

Our fourth quarter operating income of $171.5 million resulted in an operating margin of 17.9%, up 0.6 points sequentially and up 5.4 points year-over-year. Operating margin was unfavorably impacted by approximately 0.6 points sequentially primarily due to foreign exchange. The year-over-year increase in operating margin is primarily attributed to operating leverage and proactively managing our costs as well as favorable impact from foreign exchange by approximately 0.6 points. On a non-GAAP basis, which excludes stock-based compensation, restructuring and other charges, the amortization of intangibles related to certain acquisition, operating margin for the fourth quarter was 23.8%, up 2 points sequentially and up 5.5 points year-over-year.

Interest and other income and expense net for the fourth quarter was an income of $1.3 million compared to a loss of $4.2 million in the third quarter and income of $2.7 million in Q4 2022, primarily driven by favorable foreign exchange. The GAAP effective tax rate for the fourth quarter was 28.3%, higher than the third quarter effective tax rate of 25.1% and lower than the fourth quarter effective tax rate of 63.8% in the prior year. The fourth quarter GAAP effective tax rate was higher than the third quarter effective tax rate primarily due to onetime benefit related to tax guidance issued in Q3, partially offset by lower U.S. taxes on foreign earnings in Q4. As a reminder, in Q4 2022, we changed our methodology for the computation of our non-GAAP effective tax rate to a long-term projected tax rate and have given effect to the new methodology from January 1, 2022.

Our non-GAAP effective tax rate for the fourth quarter was 20%, reflecting the change in our methodology. Fourth quarter net income per share was $1.64, up sequentially $0.06 and up $1.10 compared to the prior year. Our EPS was unfavorably impacted by $0.07 on a sequential basis and favorably impacted by $0.08 on a year-over-year basis due to foreign exchange. On a non-GAAP basis, net income per diluted share was $2.42 for the fourth quarter up $0.28 sequentially and up $0.69 year-over-year. Moving on to the balance sheet. As of December 31, 2023, cash, cash equivalents and short and long term marketable securities were $980.8 million, down sequentially $321.2 million and down $60.8 million year-over-year. Of our $980.8 million balance, $196.1 million was held in the U.S. and $784.7 million was held by our international entities.

In October 2023, we purchased approximately 1 million shares of our common stock at an average price of $190.56 per share through a $250 million Accelerated Share Repurchase. And in November and December 2023, we purchased approximately 466,000 shares of our common stock at an average price of $214.81 per share through a $100 million open market purchase, both under Align’s current $1 billion stock repurchase program. We have $650 million remaining available for repurchase of our common stock under this stock repurchase program. Q4 accounts receivable balance was $903.4 million, slightly down sequentially. Our overall days sales outstanding was 85 days, flat sequentially and year-over-year. Cash flow from operations for the fourth quarter was $46.9 million.

Capital expenditures for the fourth quarter were $33.4 million, primarily related to our continued investments to increase aligner manufacturing capacity in facilities. Free cash flow, defined as cash flow from operations less capital expenditures, amounted to $13.5 million. Now turning to our outlook. Assuming no circumstances occur beyond our control, we provide the following framework for Q1 and fiscal 2024. For Q1 2024, we expect our worldwide revenues to be in the range of $960 million to $980 million, up slightly from Q4 of 2023. We expect Clear Aligner volume and ASPs to be up slightly sequentially. We expect Systems and Services revenue to be down slightly sequentially, although less than the historical seasonal decline, given the launch of the iTero Lumina for ortho workflows in Q1 2024.

We expect our Q1 2024 GAAP operating margin and non-GAAP operating margin to be slightly above Q1 2023 GAAP operating margin and non-GAAP operating margin, respectively. For full year, we expect fiscal 2024 total revenues to be up mid-single digits over 2023. We expect fiscal 2024 Clear Aligner and Systems and Services revenues to grow year-over-year in the same approximate range as our 2024 total revenues. We expect fiscal 2024 Clear Aligner ASPs to be up slightly year-over-year primarily due to price increases and favorable foreign exchange, partially offset by a higher mix of noncomprehensive products, which have lower ASPs. We expect fiscal 2024 GAAP operating margin and non-GAAP operating margin to be slightly above the 2023 GAAP operating margin and non-GAAP operating margin, respectively.

We expect our investments in capital expenditures for the fiscal 2024 to be approximately $100 million. Capital expenditures are expected to primarily relate to building construction and improvements as well as manufacturing capacity in support of our continued expansion. In summary, I am pleased with our fourth quarter and fiscal 2023 results, and I am especially proud of our continued focused execution of our product road map and innovation pipeline. We are committed to delivering on our strategic growth drivers of international expansion, patient demand, orthodontist utilization and GP dentist treatment to extend our leadership in digital orthodontics and dentistry. I believe that the next wave of innovation that we are introducing into the market will further differentiate Align and allow us to continue to increase our share of the large untapped market opportunity of 22 million annual orthodontic case starts as well as an additional 600 million consumers who could benefit from a healthy, beautiful smile using Invisalign Clear Aligners.

With that, I’ll turn it back to Joe for final comments. Joe?

Joseph Hogan: Thanks, John. In closing, while I’m pleased with our better-than-expected fourth quarter results and start to the year, I’m even more excited about Align innovation in 2024 and our next wave of growth drivers. When I spoke to you about a year ago, I discussed the innovations that we are planning to bring to market that we continue to revolutionize the orthodontic and dental industry and scanning software and direct 3D printing. We are delivering on that promise. With the introduction of iTero Lumina powered by Multi-Direct Capture technology, we are pushing the boundaries of what inter-oral scanners can do. iTero Lumina is a combination of years of research and development to offer visualization capabilities that support doctors, clinical decisions while also enhancing their patients’ comfort and overall treatment experiences.

Building on more than 20 years of expertise in revolutionizing imaging technologies, the iTero Lumina scanner elevates the standard in digital scanning to achieve exceptional clinical outcomes and increased practice efficiency. The iTero scanner is at the forefront of digital dentistry. With the closing of our acquisition of Cubicure, a pioneer of direct 3D printing solutions for polymer additive manufacturing, we will enable the next generation of 3D printed products, helping to create more unique configurations for aligners that are more sustainable and also efficient solutions. We also expect it to extend and scale our printing materials and manufacturing capabilities for our 3D printed product portfolio, which now includes the Invisalign Palate Expander System.

And with the introduction of IPE, we have expanded the clinical applicability of the Invisalign system to nearly 100% of the orthodontic case starts. The ability to direct 3D print, IPE will eventually lead to other direct printed products with the goal of direct 3D printed Invisalign Clear Aligners, which we hope to achieve in the next couple of years. As a company, Align has multifaceted competitive advantage, technology innovation, where we invest up to $300 million in R&D per year to bring in some of the most disruptive products in digital dentistry and orthodontics to the market in a highly regulated industry. A direct sales force that consists of 5,000 highly trained specialists, a doctor-centered model because we understand the importance of doctor-directed care, a $1 billion brand trusted by over 17 million patients worldwide and global scale and manufacturing to deliver millions of customized Clear Aligner parts every day.

We are extremely pleased with our latest innovations and commercialization of products to better serve our doctors, customers and their patients. Our belief in the future business overall is unwavering. Before we turn the call over to the operator, I want to address an important matter regarding DTC or direct to consumer Clear Aligners in our industry. Align has always believed that a doctor-centered model for orthodontic treatment is the safest for patients, and we’re always looking for new and better ways to support doctors as they work to create better smiles for their patients. Recent news regarding the bankruptcy of a DTC clear aligner company has led many consumers to reach out to Invisalign providers to address their unmet needs, including helping those DTC patients with incomplete treatments.

To support these former DTC patients who are seeking help from Invisalign providers and practices, in Q4 we introduced a program in the U.S. and select other markets, offering up to a 50% off Invisalign case submission in Vivera Retention to help offset any additional cost to finish their treatment. We want to help everyone achieve a healthy beautiful smile and strongly recommend that individuals who are impacted by this matter seek the advice of a licensed orthodontist or dentist. Our concierge team is always available to answer questions and help connect consumers with Invisalign practices. With that, I’ll thank you for your time today. We look forward to updating you on our next earnings call. Now I’ll turn the call over to the operator for questions.

Operator?

See also Jim Cramer is Bullish on These 10 Stocks and 15 Cheapest Countries to Get Second Citizenship.

Q&A Session

Follow Align Technology Inc (NASDAQ:ALGN)

Follow Align Technology Inc (NASDAQ:ALGN)

Receive real-time insider trading and news alerts

Operator: [Operator Instructions]. Our first question comes from Elizabeth Anderson with Evercore ISI.

Elizabeth Anderson: Congrats on the quarter. I was wondering if you could walk us through the components of the mid-single-digit guide. I got — for 2024. I understand what you said that like Systems and Services and Clear Aligners would be in the same range. I guess I’m just sort of thinking about like how to think about that. It seems like maybe it’s like low single-digit ASP improvement and then sort of low to mid-single-digit case growth. Is that the right way to think about it? Like what else can you — is there anything else you can sort of clarify on that? And sort of how do you expect at least currently, the sort of pacing of the year to progress.

John Morici: Yes. Elizabeth, this is John. You haven’t framed the right way. We’re looking at the segments up mid-single digits and then ASPs because of the price increase. We have some offset due to some of the lower-stage products that we have, including the DSP touch-ups and so on, that you would expect then a little bit lower of ASP impact year-over-year.

Elizabeth Anderson: Got it. That makes sense. And then separately, how has the volume in sort of market in China been progressing across the fourth quarter and maybe into the first quarter so far as you can comment.

Joseph Hogan: Elizabeth, it’s Joe. We felt good about China last year. But remember, we had year-over-year comparisons that were really favorable because of the COVID shuts down over there last year. But overall, as we exited the year, we felt good about our performance there, and we feel good about as we move into 2024 about our competitive position there in — a China market that I think is a little more predictable because it’s not the overhead that we’ve seen with COVID over the last, really, several years.

Elizabeth Anderson: Got it. And sorry, maybe one last one for me. Can you just remind us the sort of 1Q dip in the operating margins and then how it sort of steps up across the year. I understand the guidance you gave for the first quarter of the year, but just why that first quarter has a sort of different perspective than the rest of the year?

John Morici: Yes. So we wanted to give to prior year because in that prior year, when you start the year, you have certain expenses that you incur right at the beginning, payroll, taxes and other things that you incur initially some of the investments that you make that you then get leverage on as you go through the year. So it’s similar to how we position things from last year in 2023.

Operator: Our next question comes from Jeff Johnson with Baird.

Jeffrey Johnson: Can you hear me out there?

Shirley Stacy: Yes. We hear you fine.

Jeffrey Johnson: John, maybe I want to — I’ll follow up on Elizabeth’s margin question there beyond just the 1Q. Let’s say, you hit your guidance this year on operating margin is up nominally from 2023 level. It’d be 3 years in a row kind of in that low to mid-21% range. I think pre-COVID you were up in the 25% range or so. What’s it going to take to get those margins moving back towards those pre-COVID. You’ve taken price increases 2 years in a row. It feels like your R&D should be coming down a little bit. Obviously, with Cubicure and that, I know you’re continuing to invest aggressively, but IPE is out, Lumina now out, things like that. So just help us understand when could we start to see a path back towards getting those margins maybe up a few points from where they’ve settled in the last few years?

John Morici: Yes, Jeff, this is John. Really, when you start to get some of that volume leverage, we’re positioned as having our manufacturing and the organization that we have that’s really set to drive more growth. And once we get some of that volume leverage, we should see that benefit showing up in our numbers. And it’s really what we saw as we went through the quarters last year where you see some of that volume benefit. You get that benefit as well when you go through the year, but really looking to try to drive as much volume as we can and you’ll start to see some of that leverage that shows up in our numbers.

Jeffrey Johnson: All right. Fair enough. And then, Joe, I think we’ve talked for many years now how iTero is carved out such a commanding, strong competitive position. You’ve sold a ton of iTeros over the last 5, 6 years or so. They’re all probably getting, I don’t know, close to their end of their useful life or so. Lumina for the first time feels like that kind of product with a better form factor, especially things like that, that could really cause some of these docs to say, I got to get rid of this big iTero and go back down to this much smaller one, and things like that, just things that would actually matter to the docs, and I’m sure the technology does this, too, I don’t want to just put it on the size. But just thinking there, is this the kind of product that can finally kick off that multiyear upgrade strategy or path in iTero that we’ve kind of been waiting to see?