Alger, an investment management firm, published its “Alger Mid Cap Focus Fund” fourth quarter 2021 investor letter – a copy of which can be downloaded here. During the fourth quarter, the largest portfolio sector weightings were Information Technology and Industrials. The largest sector overweight was Industrials. The portfolio had no exposure to the Utilities or Materials sectors and negligible exposure to the Real Estate sectors. Spare some time to check the fund’s top 5 holdings to have a clue about their top bets for 2022.

Alger Mid Cap Focus Fund, in its Q4 2021 investor letter, mentioned Advanced Micro Devices, Inc. (NASDAQ: AMD) and discussed its stance on the firm. Advanced Micro Devices, Inc. is a Santa Clara, California-based semiconductor company with a $134.2 billion market capitalization. AMD delivered a -22.77% return since the beginning of the year, while its 12-month returns are up by 17.34%. The stock closed at $111.13 per share on January 25, 2022.

Here is what Alger Mid Cap Focus Fund has to say about Advanced Micro Devices, Inc. in its Q4 2021 investor letter:

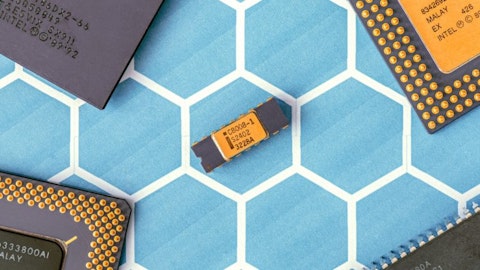

“Advanced Micro Devices (AMD) designs and sells CPUs and graphics processing units (GPUs) for desktops, notebooks and gaming consoles, as well as for datacenter and professional environments. AMD’s key product families include Ryzen processors for personal computers, Radeon processors for graphics and EPYC processors for servers. AMD is gaining market share as it is undergoing a major server product upgrade cycle while its only competitor (Intel) is struggling to deliver new offerings. AMD shares outperformed in the most recent quarter in response to the company’s third quarter results substantially exceeding consensus expectations and management providing very strong guidance despite ongoing supply chain constraints. The updated revenue guidance for full-year 2021 is nearly $600 million above consensus and $2.7 billion above the initial fiscal year 2021 guidance provided by the company in January. AMD also repurchased approximately $750 million in stock during the quarter. Management’s commentary suggests that AMD is well positioned for 2022 to be another very strong year with continued market share gains across product offerings, a strong data center market, improving traction in its enterprise segment and no slowdown in the gaming console business. Management also implied it will make further progress in the graphics business. In addition, AMD is currently positioned to generate gross margin expansion resulting from an improving product mix and strong operating expense leverage despite the company increasing its marketing budget and spending for research and development.”

jonas-svidras-e28-krnIVmo-unsplash

Our calculations show that Advanced Micro Devices, Inc. (NASDAQ: AMD) failed to obtain a mark on our list of the 30 Most Popular Stocks Among Hedge Funds. AMD was in 65 hedge fund portfolios at the end of the third quarter of 2021, compared to 63 funds in the previous quarter. Advanced Micro Devices, Inc. (NASDAQ: AMD) delivered a -9.60% return in the past 3 months.

In December 2021, we published an article that includes AMD in the Top 10 Stock Picks of Ryan Caldwell’s Chiron Investment. You can find more than 100 investor letters from hedge funds and prominent investors on our hedge fund investor letters 2021 Q3 page.

Disclosure: None. This article is originally published at Insider Monkey.