3. Gross margins

Gross margins are the easiest answer to the question: How much did it cost a company to sell its product? Gross margins don’t take into account overhead, variable costs, depreciation, taxes, or a variety of other expenses that add up (or really subtract down) to calculate net profit.

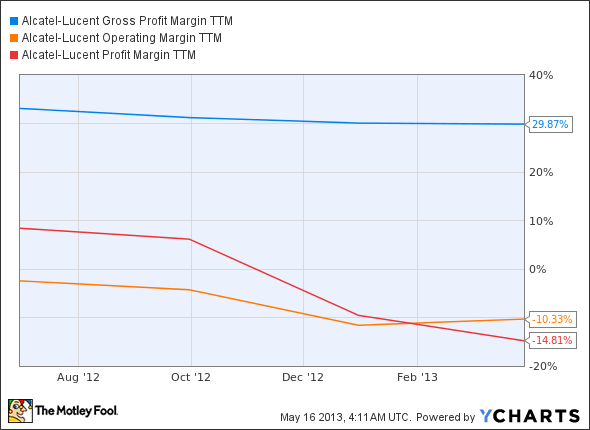

For a networking and communications company like Alcatel Lucent SA (ADR) (NYSE:ALU), its gross profit margin clocks in at 30%. That means Alcatel Lucent SA (ADR) (NYSE:ALU) spends $0.70 of every dollar in sales on selling its product. But while the company’s gross margins have slumped around 3% in the last year, operating margins have dropped nearly 10%, and profit margins are down almost 25%.

ALU Gross Profit Margin TTM data by YCharts.

Different products renders cross-sector comparison useless, and sector-specific investing decisions should ultimately have little do to with gross margins. Although they give investors an idea of each corporations’ selling “starting point,” Alcatel Lucent SA (ADR) (NYSE:ALU) clearly shows that operating margins or net profit margins ultimately provide a clearer picture of a company’s trending value proposition.

2. Employee-to-sales ratio

Every day of our lives, we see examples of inefficient labor. From loitering construction workers to extra-long coffee breaks at the office, investors know that people’s productivity matters.

But unless a company’s profits are nearly exclusively labor-dependent (think massage parlor — no, not that type of massage parlor), there are better stats to rattle off than how many sales an employee accounted for.

Take SUPERVALU INC. (NYSE:SVU) and Whole Foods Market, Inc. (NASDAQ:WFM). Both corporations are consumer-facing retail grocery stores, offering similar products through similar sales models. SUPERVALU INC. (NYSE:SVU) has 35,000 full time employees, while Whole Foods employs 74,000 people, more than double that of its competitor. Yet Whole Foods’ $11.7 billion in 2012 revenue put sales at $158,108 per head, while SUPERVALU’s $17.1 billion equates to $488,571 per employee.

And for the same year, Whole Foods Market, Inc. (NASDAQ:WFM) pulled in $466 million in net profit while SUPERVALU INC. (NYSE:SVU) reported a not-so-super $1.47 billion loss. That means Whole Foods Market, Inc. (NASDAQ:WFM) ended up making $6,297 per worker, while SUPERVALU INC. (NYSE:SVU) lost $41,996 per employee.

Many businesses have moved beyond employee-driven models. Herbalife Ltd. (NYSE:HLF)‘s sales model allows 2.5 million independent distributors to market its products across 80 countries, but the company has only 6,200 full-time employees on its books. With $4 billion in 2012 revenue, that puts sales per employee at either $1,629 per distributor or $656,827 per full-time worker — depending on your calculation.