The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Advantage Oil & Gas Ltd (USA) (NYSE:AAV).

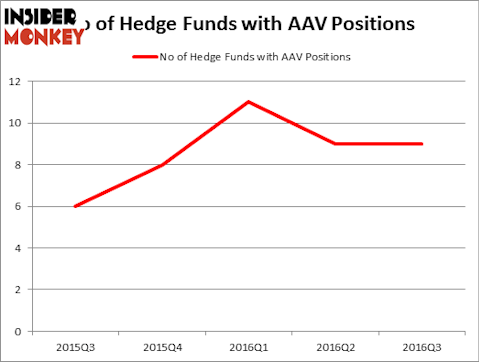

Advantage Oil & Gas Ltd (USA) (NYSE:AAV) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare AAV to other stocks including Infinera Corp. (NASDAQ:INFN), Natus Medical Inc (NASDAQ:BABY), and CVR Refining LP (NYSE:CVRR) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Corepics VOF/Shutterstock.com

How have hedgies been trading Advantage Oil & Gas Ltd (USA) (NYSE:AAV)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in AAV at the beginning of this year. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Steve Cohen of Point72 Asset Management holds the largest position in Advantage Oil & Gas Ltd (USA) (NYSE:AAV). Point72 Asset Management has a $5.9 million position in the stock. The second most bullish fund manager is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital which holds a $2 million position. Remaining professional money managers that hold long positions consist of Renaissance Technologies, which is one of the largest hedge funds in the world, Eric Sprott’s Sprott Asset Management and D. E. Shaw’s D E Shaw. We should note that Sprott Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.