White Falcon Capital Management, an investment fund manager, released its fourth-quarter 2024 investor letter. A copy of the letter can be downloaded here. It was a good year for the fund on an absolute basis. However, the fund was unable to keep up with a fast charging market despite outperforming the popular indices for two years. It didn’t witness any notable increases, and didn’t suffer any large losses. In the quarter, the fund returned 5.5% compared to an 8.9% return for the S&P 500 (CAD), 5.0% for the MSCI All Country (CAD), and 3.8% for the S&P TSX TR. In addition, please check the fund’s top five holdings to know its best picks in 2024.

White Falcon Capital Management highlighted stocks like Advanced Micro Devices, Inc. (NASDAQ:AMD) in the fourth quarter 2024 investor letter. Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company that operates through Data Center, Client, Gaming, and Embedded segments. The one-month return of Advanced Micro Devices, Inc. (NASDAQ:AMD) was1.89%, and its shares lost 30.29% of their value over the last 52 weeks. On January 17, 2025, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock closed at $121.46 per share with a market capitalization of $197.106billion.

White Falcon Capital Management stated the following regarding Advanced Micro Devices, Inc. (NASDAQ:AMD) in its Q4 2024 investor letter:

“During the year, we sold half of our stakes in Advanced Micro Devices, Inc. (NASDAQ:AMD) and Nu Holdings as they reached their intrinsic values. However, the decline in these stocks toward the end of the year provided us with an opportunity to add to our positions. In AMD’s case, the market has been disappointed by the company’s potential shortfall in AI chip revenues, which were previously forecasted to reach $10 billion in 2025. However, the factors required to justify the investment when the stock is priced at $220 per share are vastly different from those needed when the stock is at $120 per share. Yes, AMD’s AI chips and associated software are not competitive with Nvidia but this is now known and in the valuation. We believe this hyperfocus on AI ignores AMD’s other businesses where they continue to take advantage of Intel’s missteps. Importantly, AMD retains the potential to capture a small share of the AI chip market, which, given the market’s massive size, could be highly impactful for the company.”

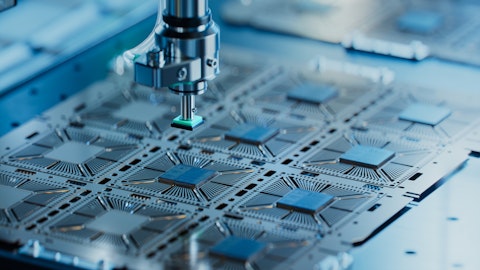

A close up of a complex looking PCB board with several intergrated semiconductor parts.

Advanced Micro Devices, Inc. (NASDAQ:AMD) is on 19th position in our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 107 hedge fund portfolios held Advanced Micro Devices, Inc. (NASDAQ:AMD) at the end of the third quarter which was 108 in the previous quarter. While we acknowledge the potential of Advanced Micro Devices, Inc. (NASDAQ:AMD) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Advanced Micro Devices, Inc. (NASDAQ:AMD) and shared the list of most important AI stocks according to BlackRock. Advanced Micro Devices, Inc. (NASDAQ:AMD) detracted from the performance of Ithaka US Growth Strategy in Q4 2024. In addition, please check out our hedge fund investor letters Q4 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.