Polen Capital, an investment management company, released its “Polen Focus Growth Strategy” second-quarter 2023 investor letter. A copy of the same can be downloaded here. The fund returned 10.51% gross of fees and 10.36% net of fees in the second quarter compared to a 12.81% return for the Russell 1000 Growth Index and an 8.74% return for the S&P 500 Index. Year-to-date, the fund returned 26.29% and 25.88 %, gross and net of fees respectively, compared to 29.02% and 16.89%, respectively, for the benchmarks. Internet and technology-oriented stocks continued their outperformance in the quarter, while last year’s outperformers like energy and utilities detracted. In addition, please check the fund’s top five holdings to know its best picks in 2023.

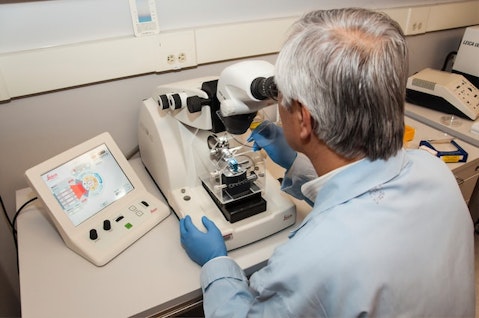

Polen Focus Growth Strategy highlighted stocks like Illumina, Inc. (NASDAQ:ILMN) in the second quarter 2023 investor letter. Headquartered in San Diego, California, Illumina, Inc. (NASDAQ:ILMN) is a life science tools and integrated systems manufacturer. On August 7, 2023, Illumina, Inc. (NASDAQ:ILMN) stock closed at $187.22 per share. One-month return of Illumina, Inc. (NASDAQ:ILMN) was 1.30%, and its shares lost 12.84% of their value over the last 52 weeks. Illumina, Inc. (NASDAQ:ILMN) has a market capitalization of $29.599 billion.

Polen Focus Growth Strategy made the following comment about Illumina, Inc. (NASDAQ:ILMN) in its second quarter 2023 investor letter:

“The top absolute detractors were Illumina, Inc. (NASDAQ:ILMN), Thermo Fisher Scientific, and PayPal. With respect to detractors, the ongoing headache with Illumina’s acquisition of Grail continues to pressure the company’s share price, in our view. It seems increasingly likely that the company will have to divest the early-stage, cancer-testing company soon, as a divestiture order from the European Commission appears inevitable in the coming months. While we believe regulators far overreach on antitrust concerns, our opinions don’t matter here. We would prefer that Illumina own Grail and better position the company to bring potentially lifesaving cancer screenings to patients across the globe. Our investment thesis is based on Illumina’s competitive position in its core, next-generation genomic sequencing business. We remain sanguine on the company’s ability to compound earnings growth at attractive rates for many years to come, and as such, we find today’s valuation quite attractive. We expect the Grail drama to be in the rearview mirror within the next few quarters.”

Photo by National Cancer Institute on Unsplash

Illumina, Inc. (NASDAQ:ILMN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 44 hedge fund portfolios held Illumina, Inc. (NASDAQ:ILMN) at the end of first quarter which was 44 in the previous quarter.

We discussed Illumina, Inc. (NASDAQ:ILMN) in another article and shared Ensemble Capital Management’s views on the company. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Best EV, Battery and Autonomous Driving ETFs

- 20 Best Burger Chains in the US

- 10 Oversold Blue Chip Stocks To Buy

Disclosure: None. This article is originally published at Insider Monkey.