Acasti Pharma Inc. (NASDAQ:ACST) Q3 2023 Earnings Call Transcript February 14, 2023

Company Representatives: Jan D’Alvise – President, Chief Executive Officer Brian Ford – Chief Financial Officer Pierre Lemieux – Chief Operating and Scientific Officer, Co-Founder Prashant Kohli – Chief Commercial Officer Robert Blum – Lytham Partners

Operator: Good day, and welcome to the Acasti Pharma Reports Third Quarter of Fiscal Year 2023 Financial Results and Business Update Call. All participants will be in listen-only mode. . After today’s presentation, there will be an opportunity to ask questions. Please note this event is being recorded. I would now like to turn the conference over to Robert Blum with Lytham Partners. Please go ahead.

Robert Blum: All right, thank you very much Jason. Welcome to Acasti Pharma’s third quarter fiscal 2023 conference call. On the call with us this afternoon is Jan D’Alvise, President and CEO; Brian Ford, Chief Financial Officer; Pierre Lemieux, Chief Operating and Scientific Officer, and Acasti Co-Founder; and Prashant Kohli, Chief Commercial Officer. Following management’s prepared remarks, there will be a Q-&-A session. Should any questions remain after the call, please contact me at 602-889-9700. I’d also like to remind everyone that statements on this conference call that are not statements of historical or current facts constitute forward-looking information within the meaning of Canadian Securities Laws and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and the Securities and Exchange Act of 1934.

Such forward-looking statements involve known and unknown risks and uncertainties that could cause the actual results to be materially different from those expressed or implied by such forward-looking statements. In addition to statements which explicitly describe such risks and uncertainties, listeners are urged to consider statement labeled with terms belief, expects, intends, anticipates, potential, should, may, will, plans, continue, targeted or other similar expressions to be uncertain and forward-looking. Listeners are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this conference call. Forward-looking statements during this conference call may include, but are not limited to the success and timing of regulatory submissions of Acasti planned, pre-clinical and clinical trials, regulatory requirements or developments in the outcome of meetings with the FDA, changes to clinical trial designs and regulatory pathways, legislative, regulatory, political, and economic developments and actual costs associated with Acasti’s pre-clinical and clinical trials as compared to management’s current expectations.

The forward-looking statements made during this conference call are expressly qualified in their entirety by the cautionary statements. The cautionary note regarding forward-looking information section and the risk factors contained in documents that have been filed and are filed by Acasti from time-to-time with the Securities and Exchange Commission and Canadian securities regulators, which are available on EDGAR at www.sec.gov on SEDAR at www.sedar.com and on the Investors section of the Acasti website at www.acasti.com. In addition, any forward-looking statements represent Acasti’s views as of today and should not be relied upon as representing our views of any subsequent date. Acasti undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date in which they were made, except as required by applicable securities law.

I’d now like to turn the call over to Jan D’Alvise, President and CEO of Acasti. Jan, please proceed.

Jan D’Alvise: Hey! Thank you, Robert, and thank you to everyone joining the call today. We’re very excited to update you on the significant progress made to advance our three clinical programs over the last few months. Let me start with a high level overview and then I’ll provide more detail. First, in late December 2022 we announced successful results following the completion of two pharmacokinetic or PK trials in human volunteers for both GTX-101 and GTX-102. In both cases the top line results met all primary outcome measures, allowing us to advance both programs to the next stage of clinical development in 2023. I’ll expand more on each of these programs in a moment. Further, with GTX-104, we submitted a letter to the FDA to request a Type C meeting to review and discuss the results of the PK bridging study that was reported out last May, as well as our proposed design for the Phase 3 safety study.

We anticipate receiving the FDAs clarifying guidance before the end of calendar Q1. We expect that favorable guidance will confirm our 505(b) (2) regulatory strategy and will allow us to finalize the study protocol, paving the way for the initiation of our Phase 3 safety study in patients with subarachnoid hemorrhage caused by a ruptured aneurysm or aSAH. And very importantly, we finished the third fiscal quarter with $31.3 million in cash, cash equivalence and short term investment. We continue to believe that based on current projections, we have sufficient capital to fund operations into calendar Q2 of 2024, allowing for the advancement of GTX-104 well into Phase 3 and advancing GTX-102 and GTX-101 to key value inflection points. So at a high level we ended the quarter in a very strong fashion, and we expect calendar 2023 to be even more exciting with two of our drug candidates ready to enter Phase 3.

With that brief summary of the quarter, let me expand on the positive results that we received on our two PK studies as announced in December, and I’ll also provide a brief reminder of the market opportunity that each of these drug candidates represent. I’ll start with GTX-101, our topical spray form of bupivacaine that we’re developing to treat patients with postherpetic neuralgia or PHN. On December 22 we announced that the top line results for our single dose PK study for GTX-101 met all its primary outcome measures for the study. This study was designed to evaluate the relative bioavailability of GTX-101, compared to a subcutaneous injection of bupivacaine, which is the reference listed drug in the United States for regulatory purposes.

This PK study was the next step in the proposed 505(b)(2) regulatory pathway for GTX-101 and the results provide us with important information on the dose and dosing frequency in humans for future planned clinical studies. As a reminder GTX-101 is a unique and patented formulation of bupivacaine hydrochloride, that incorporates a bio-adhesive film-forming polymer and is administered via a topical spray. As I mentioned, GTX-101 is being developed to relieve the severe pain associated with PHN, the persistent and often debilitating neuropathic pain caused by nerve damage from the varicella zoster virus, the virus that causes shingles and Chickenpox. PHN pain may persist for months or even years, and based on our primary market research, there are still significant unmet medical needs for this indication.

The single dose PK study enrolled 48 healthy adult subjects with 24 males and 24 females, having a mean age of 36 years, and they were randomized into four separate cohorts with 12 subjects in each cohort. Subjects in cohorts one, two and three received 50 milligram, 100 milligram or 200 milligrams of GTX-101 respectively in adjacent and overlapping sprays on the lower back. Subjects in cohort four received a single 10 milligram subcutaneous injection of the active bupivacaine comparator. The primary objective of this PK study was to assess the pharmacokinetics of three different dose levels of GTX-101 at 50 milligrams, 100 milligrams and 200 milligrams. Each dose of GTX-101 was administered to a separate cohort of 12 subjects as a single dose topical application in a metered spray.

For clarity, 50 milligrams was delivered as 5 sprays, 100 milligrams in 10 sprays and 200 milligrams of 20 sprays. These sprays were not administered one on top of the other, but rather adjacently to cover the entire targeted area. An additional 12 subjects in cohort four received a single 10 milligram subcutaneous injection of the active comparator. A secondary objective of this study was to compare the bioavailability of these two very different modes of administration. The data from this study provides us now with key information that helps us to further characterize the PK parameters and with safety and tolerability of GTX-101 and will support additional future clinical development. We expect that the full clinical study report will be received from the CRO in the first half of calendar 2023 and we intend to publish this data.

We plan to follow this successful PK study with a multiple ascending dose study. Results from both of these Phase 1 clinical studies once completed, will be required before we can initiate our Phase 2 program in PHN patients. As background, the current treatment of PHN most often starts with oral gabapentin, prescribed as a first line therapy, and when that fails as it often does due to poor efficacy and unpleasant side effects, lidocaine patches are typically prescribed as a second line therapy. According to our recent market research with more than 250 physicians who regularly treat these patients, up to 40% of patients do not experience satisfactory pain relief from the patch, and these refractory patients may end up being prescribed opioids to address their persistent pain.

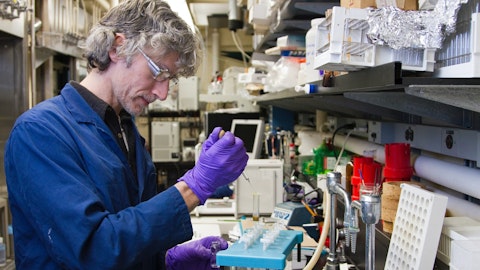

Photo by Roberto Sorin on Unsplash

Gabapentin and opioid abuse have continued to proliferate and lidocaine patches are sub optimal for many reasons. The lidocaine patch can only be worn for 12 hours at a time. They are difficult to use as they fall off and can cause skin sensitivity and irritation, especially in older individuals. And depending on their placement, they can be inconvenient, uncomfortable and unattractive. Prescription lidocaine patches are currently only approved for PHN and the market is made up of both branded and generic offerings. You can certainly see the many issues with the current treatment options that we hope GTX-101 will address. It’s important to note that the potential benefits of GTX-101 could include faster onset of actions and a longer duration of pain relief as compared to the lidocaine patch.

GTX-101 can be conveniently sprayed on the skin wherever the pain is located and based on the PK profile of bupivacaine, we believe that GTX-101 may only need to be applied to the affected area once a day are possibly even less frequently to get 24/7 pain relief, although this dosing schedule will be confirmed in additional clinical studies. Based on this product profile and assuming a successful development program, we believe GTX-101 has the potential to be a game changer as a non-opioid alternative to the lidocaine patch for PHN patients who suffer from this debilitating pain. In terms of market size, it’s estimated that PHN affects approximately 130,000 patients per year in the United States. And according to the third party market research report commissioned by Acasti, the total addressable market for GTX-101 could be as large as 2.5 billion, consisting of approximately $200 million dollars for PHN pain and $2.3 billion for non-PHN pain.

So this certainly represents a large addressable market opportunity for Acasti. Now I’d like to transition to GTX-102 and on December 28 and only a week after we reported our positive clinical study results for GTX-101, we announced that the top line results of our GTX-102-001 PK bridging study met all primary outcome measures and represented an important milestone in the advancement of this program. The PK bridging study was a Phase 1 randomized, open label, crossover study in healthy adult subjects designed to evaluate the comparative bioavailability, pharmacokinetics and safety of GTX-102 administered as an oral spray compared to intramuscular betamethasone, which is expected to be the reference products for regulatory bridging purposes, as well as to an oral solution of betamethasone, which is available in Europe, but not in the United States.

A total of 48 healthy adult subject comprised of 27 males and 21 females were enrolled in a single center five treatment, eight sequence, two period crossover study. Our new and patented formulation of betamethasone is intended to improve the neurological symptoms of Ataxia Telangiectasia or A-T, in a pediatric population, for which there are currently no FDA approved therapies. GTX-102 can be sprayed conveniently over the tongue of A-T patients who often have difficulty swallowing. As a reminder, the beta methods on oral solution that we’re comparing to GTX-102 was shown to reduce neurological symptoms in children with A-T in a multicenter, double-blind, randomized, placebo controlled crossover trial conducted in Italy by Dr. Zannolli and this study was published in 2012.

As I mentioned, our PK bridging study met all primary outcome measures, providing us with confidence that the expected final development step for GTX-102 will now be to conduct a Phase 3 safety and efficacy trial in A-T patients using the treatment regimen and a dosing range comparable to the one already shown to be effective in Dr. Zannolli’s studies. As background, I’ll remind you that A-T is a progressive, genetic, neurodegenerative disorder that primarily affects young children, causing severe disability, impairment of the immune system, and an increasing susceptibility to infections and cancers. The hallmark symptoms of A-T are cerebellar ataxia and other motor dysfunction, as well as dilated blood vessels or telangiectasia, that occur in the sclera of the eyes and on the skin.

Children begin to experience balance and coordination problems when they begin to walk at a toddler age, and ultimately they become wheelchair bound in their second decade of life. In preadolescents around five to eight years of age, patients experience oculomotor apraxia. This is difficulty moving their eyes in a desired direction, and they also experience a weakness in the muscles of the face used for speech, caused slowed or slurred speech as well as dysphagia or difficulty in swallowing. They often develop compromised immune systems and are at an increased risk of developing respiratory tract infections in cancers, typically lymphomas and leukemia. Patients typically die in their second decade of life from complications of lung disease or cancer.

Unfortunately, there’s no known treatment to slow the disease progression of A-T and treatments that are used are strictly aimed at symptoms or conditions secondary to the disease. A third party market research study that we commissioned found A-T affects approximately 4,300 patients per year in the United States and has a potential addressable market of $150 million based on the number of treatable patients. Duchenne Muscular Dystrophy or DMD is another rare, inherited and progressive muscular disorder that typically affects boys, and like A-T, it is often diagnosed at a young age. Emflaza is the first and only FDA approved corticosteroid for treating boys with DMD over the age of two. Like GTX-102, the dosing amounts of Emflaza is determined for this pediatric population based on their weight.

Emflaza which is sold by PPC Pharmaceutical’s was launched back in 2017 and it’s reached more than $200 million in sales last year. Given the many similarities with GTX-102, we believe that Emflaza could serve as an excellent analog for successful commercialization of our drug. In terms of next step, following the receipt of the full PK data – study data set from our CRO, which is expected sometime in the first half of calendar 2023, we plan to request a Type B meeting with the FDA to confirm our proposed Phase 3 study design and the 505(b)(2) bridging strategy with the listed intramuscular form of the drug. If all proceeds as plans, the study startup activities for Phase 3 safety and efficacy study are expected to be initiated by the end of calendar 2023.

If the Phase 3 program meets the primary endpoints and NDA filing for GTX-102 under section 505 (b) (2) is expected to follow. Transitioning now to GTX-104, our lead development program. As previously discussed, we submitted a Type C meeting package to the FDA back in November. That package included the data from our PK bridging study, as well as our proposed design for our Phase 3 safety study. We anticipate receiving the FDAs clarifying guidance before the end of calendar Q1. This should allow us to benefit from the FDAs buy in and should allow us to begin recruiting clinical sites and initiate the Phase 3 safety study as planned. We’ve already selected our CRO and clinical trial site selection is currently underway. For those of you who may not already be familiar with our lead drug candidate, GTX-104 is a novel patented formulation of nimodipine for IV infusion designed specifically for patients with Aneurysmal subarachnoid hemorrhage aSAH, which is a condition caused by bleeding on the brain due to a ruptured aneurysm.

aSAH presents a life threatening emergency for the patient and our new proprietary IV drug formulation addressed a vital need in the critical care market that’s seen little innovation over the last 30 years. The condition of aSAH patients is so critical that 10% to 15% of them die before ever reaching the hospital, and about one-third ultimately do not survive. Another third of these patients require dependent care for the rest of their lives. As a reminder, we completed a Phase 1 PK bridging study in May of 2022, which successfully met all of its endpoints. The primary objective of the study was to evaluate the relative bioavailability of our GTX-104 administered as a continuous IV infusion compared to oral nimodipine capsules in healthy adult male and female subjects, while the secondary objective was to assess its safety and tolerability.

Importantly, the inter and intra subject variability was much lower for GTX-104 as compared with oral nimodipine. We believe that because of its better absorption profile, and more consistent and predictable blood levels, GTX-104 may provide physicians with a more reliable and effective treatment for patients with aSAH. This could be a major advantage as GTX-104 could help to reduce the incidence of hypertensive events and vasospasm, which require immediate and costly interventions, such as balloon angioplasty or the use of intra-arterial vasopressors, which can lead to worse outcomes for the patients. As I mentioned, while we wait for the guidance from the FDA on our proposed Phase 3 study design, we continue to plan and prepare for the initiation of this study.

We have engaged a CRO to manage the study for us, and we are qualifying and recruiting sites now to enroll patients. We expect the study to take about 18 months to complete once the first patient is enrolled, and if the trial is successful, it is expected to be the final clinical step required to seek market approval under the 505 (b) (2) regulatory pathway. We’re eager to hear back from the FDA and we look forward to providing a market update once we receive their guidance. Before I turn it over to Brian to review our Q3 financials, I think it’s important to mention that the strategy that we’re undertaking to leverage Acasti’s unique drug delivery capabilities by reformulating and repurposing marketed drugs for new orphan indications, where significant unmet medical need exists, is advancing nicely according to our plans.

The well understood efficacy and safety profiles of the currently marketed forms of these drugs provide the opportunity for us to utilize the FDA section 505 (b) (2) regulatory pathway for the expedited development of our reformulated drug candidates, and therefore may provide €“ potentially provide a shorter, less risky and less costly path to regulatory approval. And as I’ve mentioned before, all three of our drug candidates have already received orphan drug designation from the FDA and have the potential to be considered for fast track review and approval. Orphan drug designation provides for seven years of marketing exclusivity in the United States post launch, provided certain conditions are met and 10 years in Europe. These rare diseases also typically involve clinical trials with fewer patients and provide market opportunities that often require a much smaller, more targeted commercial infrastructure.

It’s important to point out that the orphan diseases that Acasti has targeted for drug development are well understood, although these patient populations may remain poorly served by available therapies or for example, in the case of our GTX-102 for children with A-T, approved drug therapies do not yet exist. Our aim is to effectively treat the debilitating symptoms that result from these underlying diseases with the ultimate goal of improving quality of life and outcomes for these patients and their families. We believe that leveraging the Section 505(b) (2) regulatory pathway for the development of our reformulated versions of these drugs provides us with highly attractive opportunities in orphan disease indications with little or no current competition.

With that, I’d like to turn the call over now to Brian Ford, our CFO to review our financial results. I’ll then quickly wrap things up and we can then open the call up for questions. Brian.

Brian Ford: Thanks, Jan. Please note that unless otherwise indicated, all financial numbers that we discuss are just denominated in U.S. dollars and the financials are reported conforming to U.S. GAAP guidelines. We should also note that we are a clinical stage company, thus we do not yet generate revenues or have any cost of goods expenses. Research and development expenses, net of government assistance for the three months ended December 31, 2022 totaled $2.5 million compared to $2.2 million for the three months ended December 31, 2021. Our research and development during the quarter ended December 31, 2022 was focused primarily on advancing our clinical development programs for GTX-104, 102 and 101, the drug candidates. General and administrative expenses for the three months ended December 31, 2022 were $1.6 million compared to $1.8 million for the three months ended December 31, 2021.

This decrease was the result of decreased legal, tax, counting and other professional fees that had been incurred in connection with the Grace acquisition. The decrease in professional fees was partly offset by an increase in salaries and benefits due to the reinstated accruals for our employee incentive bonus programs. Loss from operating activities for the three months ended December 31, 2022 was $4.2 million compared to a loss of $4.5 million for the three months ended December 31, 2021. For the three months ended September 30, 2021, a financial gain of $0.7 million resulted mostly from the decrease in the fair value of the derivative warrant liabilities. Net loss and total comprehensive loss for the three months ended December 31, 2022 was $3.9 million or a loss of $0.09 per share, which was pretty much identical to the net loss of $3.8 million or a loss of $0.09 per share for the three months ended December 31, 2021.

Cash, cash equivalents and short term investments totaled $31.3 million as of December 31, 2022 compared to $34.9 million in cash, cash equivalents and short-term investments as at September 30, 2022. As Jan mentioned, we continue to believe that we have sufficient capital to fund operations in the calendar Q2, 2022 €“ or 2024, which would include the ability to fund our lead asset GTX-104 well into Phase 3 and GTX-102 and 101 to additional important milestones. With that, I’ll now turn the call back over to Jan.

Jan D’Alvise: Thank you, Brian. So to quickly wrap things up, we ended calendar 2022 in a very strong fashion with the completion of three successful clinical trials, two that reported out in December alone. We look forward to receiving clarifying guidance from the FDA before the end of Q1 on the Phase 3 study design for our lead program GTX-104, which should pave the way for the initiation of our Phase 3 safety study later this year. With Phase 3 studies for both GTX-104 and GTX-102 expected to be initiated in calendar 2023, we believe this could be our most exciting year yet, and we look forward to keeping you all appraised of our progress towards our many milestones this year. So with that, I’ll turn the call back over to the operator. Jason, can you open it up for questions for us.

See also Jim Cramer’s Top Stock Picks for 2023 and 15 Dividend Growth Stocks with Highest Rates.

Q&A Session

Follow Grace Therapeutics Inc. (NASDAQ:GRCE)

Follow Grace Therapeutics Inc. (NASDAQ:GRCE)

Receive real-time insider trading and news alerts

Operator: Yes, we will now begin the question-and-answer session. Our first question comes from Leland Gershell from Oppenheimer. Please go ahead.

Leland Gershell: Thanks Jan for the update. Just a question from me. As you get 102 into its next trial this year, wondering if you could share with us any of you on enrollment timelines and potential timing for the top line data. Thank you.

A – Jan D’Alvise: Yeah, thanks Leland. Well, you know as I mentioned, we are really now waiting on the final clinical trial report. We need to submit that to the FDA before we can start the Phase 3 and we have always felt that it’s a good idea to make sure that we get the FDAs input into you know the Phase 3 plans before we move forward. So we do plan to, once we get our final clinical trial report, submit a draft protocol to the FDA, you know with our proposed study design, and we really want the FDA’s feedback on that. And so what we’re doing now is we’re working with our key opinion leaders and our regulatory experts to really draft the design of the study. We’re well into that. We’re really you know looking to get a lot of really good input here over the next couple of months from our key opinion leaders, and then we’ll plan to submit all of that, and I would expect given the kind of time clock on this, that the Type B meeting would be sometime this summer.

And once we get their feedback, you know of course we’ll be planning the study in parallel, so we’re again hoping that we can initiate startup activity certainly in the second half of this year.

Leland Gershell: Great! Thanks very much for the update.

A – Jan D’Alvise: Thanks, Leland.

Operator: Our next question comes from Oren Livnat front H.C. Wainwright. Please go ahead.

Oren Livnat: Thanks for taking my question, and congrats on the progress. I actually have a few. On 104, are you able to clarify if you already did have that Type C meeting with the FDA, and if so, I know we’re waiting on the minutes of course, but are you able or allowed to give us any sort of color there, if there’s any surprises or as far as you can tell, things going according to plan for just a strictly safety Phase 3 study. And I have a few follow-ups, thanks.

A – Jan D’Alvise: Yeah sure, thanks Oren. And so no, we are waiting on guidance from the FDA. We’re asking them to clarify a number of things. So you know based on our positive results from our PK study, we’ve asked them to confirm whether we are eligible to use the 505(b)(2) regulatory pathway. You know we’ve showed bioequivalence with the oral, so we believe that’s straightforward, but we want to get that confirmation from them. We also want them to confirm our proposed dosing regimen. You know we are recommending a 3.6 milligram bonus delivered over 30 minutes and that followed by a continuous infusion. Again, we’re proposing a rate of 1.2 milligrams per hour. This was the dosing regimen that matched the Cmax on day one and the AUC at day three of the oral.