The European Commission has recently issued guidelines intended to standardize rules across the AI industry in Europe. As reported by Reuters, employers will be banned from using artificial intelligence to track staff’s emotions. Similarly, websites will not be allowed to trick users into spending money. The Artificial Intelligence Act, which has been binding since last year, will be fully applicable on Aug. 2, 2026. The AI Act is deemed the most comprehensive set of rules governing AI globally. Some of these provisions, such as using the internet to create facial recognition databases, have already gone into effect on February 2nd.

“The ambition is to provide legal certainty for those who provide or deploy the artificial intelligence systems on the European market, also for the market surveillance authorities. The guidelines are not legally binding”.

-European Commission official

READ NOW: Top 10 AI Stocks Trending On Wall Street and 10 AI Stocks on Analysts’ Radar Right Now

Some practices banned under the guidelines include AI-enabled dark patterns embedded in services that are meant to manipulate users into making hefty financial commitments and AI-enabled applications that exploit users based on their age, disability, or otherwise. European Union countries have until Aug. 2 to designate market surveillance authorities to enforce the AI rules, Reuters noted.

The ban also comes with heavy fines, ranging from 1.5% to 7% of a company’s total global revenue, in case of AI breaches. However, the Financial Times has reported that Trump has threatened to target Europe in reaction to fines levied against American companies under the AI Act.

“There is definitely a worry in Brussels that the new U.S. president will raise pressure on the EU around the AI Act to ensure that U.S. companies don’t have to deal with too much red tape or potentially even fines”.

-Patrick Van Eecke, co-chair of law firm Cooley’s global cyber, data and privacy practice.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

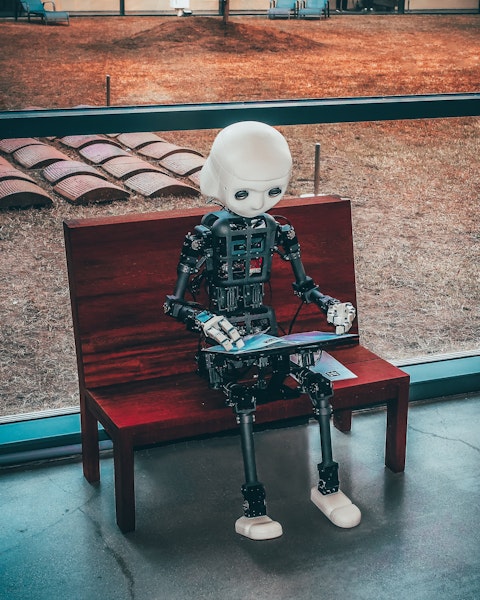

Photo by Andrea De Santis on Unsplash

9. Cardio Diagnostics Holdings, Inc. (NASDAQ:CDIO)

Number of Hedge Fund Holders: 3

Cardio Diagnostics Holdings, Inc. (NASDAQ:CDIO) is an AI-driven precision cardiovascular medicine company that makes heart disease prevention more accessible, personalized, and precise. On February 4th, the company announced that it has partnered with seven new provider organizations, highlighting the growing adoption of its AI-driven blood tests, Epi+Gen CHD™ and PrecisionCHD™. These tests are designed to revolutionize the prevention, detection, and management of coronary heart diseases. The new providers the company has partnered with can leverage Cardo Diagnostic’s AI-driven technology to obtain actionable insights into coronary heart disease and risks, helping in both early detection and management.

“We continue to make meaningful strides in our mission to enable providers with actionable clinical intelligence that goes beyond proxy biomarkers such as cholesterol. By equipping practices with our Epi+Gen CHD™ and PrecisionCHD™ tests, we’re enhancing patient care, driving better outcomes, and making Precision Cardiovascular Medicine more accessible.”

-Meesha Dogan, Ph.D., CEO and Co-Founder of Cardio Diagnostics.

8. Lantronix, Inc. (NASDAQ:LTRX)

Number of Hedge Fund Holders: 14

Lantronix, Inc. (NASDAQ:LTRX) designs and sells IoT products and services globally. On February 4th, the company announced that it will be unveiling its new LM4 AI-powered Out-of-Band Management (OOBM) platform at Stand A10 during Cisco Live, February 10–14, 2025, at Amsterdam RAI. The OOBM platform leverages AI to monitor network infrastructure remotely even if the network is down. The innovation is developed for Intermediate Distribution Frames (IDFs) and compact environments like ATMs, kiosks, and network aggregation points. The platform will enable access, nonstop monitoring, automated remediation of issues, and control of network infrastructure devices regardless of whether the network is up or down.

“We’re excited to introduce the LM4 Out-of-Band Management platform, which enables our customers to leverage rules-based AI for secure, reliable and automated network infrastructure recovery and mitigation. At Lantronix, we are committed to enabling network management automation with innovative solutions that enable our customers to be more efficient, secure and bottom-line focused.”

-Mathi Gurusamy, chief strategy officer at Lantronix.