Corning Incorporated (NYSE:GLW) started more than a century ago making glassware for kitchens and laboratories. Today, Corning no longer makes measuring cups and has transformed itself into a global, multi-billion dollar technology company, but glass is still its primary product.

Glass may not resonate “technology,” but modern high tech devices like television and computer monitors have demanding requirements for the glass panels they use (i.e. size, thickness, weight, strength, durability, etc.). Corning’s long history of glass expertise has helped it become a leading manufacturer of flat panel display glass, and the go to provider for companies including Sony and Samsung. On its way to becoming a glass giant, Corning Incorporated (NYSE:GLW) has also become a global leader in glass technology. For example, Corning Incorporated (NYSE:GLW) developed a product called “Gorilla Glass.” Thin, lightweight, and durable, the glass is ideal for mobile touch screen devices like tablets and smart phones.

In 2000 only about 360 million people had internet access. By 2012, that number grew to over 2.4 billion. Despite a compound annual growth rate of more than 205%, only 34% of the world’s population has internet access. Clearly, there is plenty of room for growth. Not only for internet users, but also for the monitors, tablets, and smart phones that people will need to view the content. That presents a world of opportunity for Corning moving forward.

Corning Incorporated (NYSE:GLW) also looks compelling based on its financials. With low debt to equity and more than $6.1 billion in cash, its balance sheet looks solid. Looking at trailing 5 year averages, Corning Incorporated (NYSE:GLW) has outperformed industry peers and the S&P 500 across revenue growth, profitability, and return on assets. Meanwhile, Corning Incorporated (NYSE:GLW) is trading below book value (0.86x) and at a significant discount to its peers, the market, and its own historical valuation. Figure 1 shows an overview of some key financial measures.

Figure 1

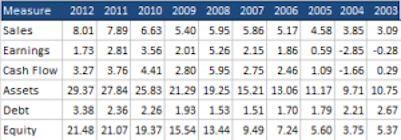

One blemish on Corning’s record, and one that has been weighing on its price, is earnings growth. Not only has average earnings growth been negative over the past five years, but it has also lagged its peers. Analysts point to narrowing margins and a heavy reliance on consumer electronics as reasons for concern. There is no arguing that Corning is cyclical, is sensitive to economic conditions, and is more volatile than average. Yet, looking past the obvious, what we have is a company with a strong record of increasing book value and generating sales, earnings, and cash flow. Figure 2 shows a snapshot of these figures for the past decade (in $ billions).

Figure 2

Though sensitivity to economic weakness is a justified concern, the reality is that Corning has successfully navigated through more than 150 years of economic booms and busts. I see no reason to assume that Corning will not successfully manage the current business cycle. When all is said and done, I think Corning will end up trading at levels that better reflect its fundamentals. Based on an average of relative valuation and discounted cash flow analysis, my fair value estimate for Corning is $19. That is a 50%+ increase from here, which I expect to be reached in within 12 months. The bottom line, I think Corning is currently an attractive buy at $12.68 or better.

The article 800 Pound Gorilla (Glass) originally appeared on Fool.com and is written by Victor Lai.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.