3. Eaton Corporation plc (NYSE:ETN)

TTM Net Income: $3.65 Billion

5-Year Net Income CAGR: 10.61%

Number of Hedge Fund Holders: 93

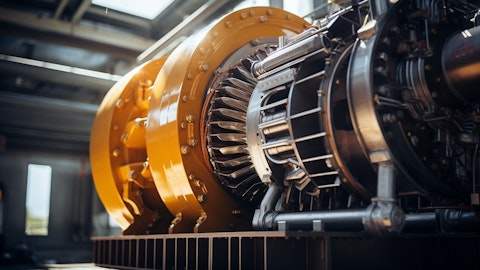

Eaton Corporation plc (NYSE:ETN), headquartered in Dublin, Ireland, is a global power management company that ranks among the top 3 on our list of the 8 most profitable large-cap stocks to invest in. Operating in over 175 countries, the corporation provides innovative technologies and energy-efficient solutions that help customers manage electrical, hydraulic, and mechanical power effectively. It makes products for the data center, utility, commercial, industrial, residential, machine building, aerospace, and mobility markets.

Founded in 1911 and listed on the New York Stock Exchange for over a century, Eaton Corporation plc (NYSE:ETN) has adapted to changing markets while maintaining a strong commitment to shareholder value, consistently paying dividends on its shares every year since 1923.

The company is making significant strides by expanding its operations and enhancing its product offerings. Recently, Eaton Corporation plc (NYSE:ETN) opened a new state-of-the-art campus in Helsinki, which will boost its capacity for manufacturing uninterruptible power supply (UPS) systems, including the latest energy-efficient models that are 30% smaller than competitors. Additionally, the company has signed an agreement to build a new electrical campus in Dubai, aimed at strengthening its commercial and manufacturing functions in the rapidly growing Middle East market.

Eaton Corporation plc (NYSE:ETN) is also focusing on the European data center market through a strategic investment in NordicEPOD, which designs standardized power modules for data centers. These pre-engineered systems allow for quicker market responses and are designed to operate in harsh conditions while supplying up to 2 megawatts of power.

Driven by its strategic focus on electrification and sustainability, the company is well-positioned to capitalize on the rising demand for electric power solutions across various industries. By investing in innovative technologies and expanding its product offerings in areas like e-mobility and renewable energy, Eaton Corporation plc (NYSE:ETN) is well-positioned for significant growth.

The company reported impressive results for the second quarter of 2024, achieving record sales of $6.4 billion, which reflects an 8% increase compared to the previous year. The company experienced strong organic growth of 9%, marking nine consecutive quarters of growth. Operating profit surged by 90%, and adjusted earnings per share reached a record $2.73, up 24% year-over-year. Additionally, Eaton generated a record operating cash flow of $946 million and a free cash flow of $759 million, demonstrating robust financial health.

In its e-mobility segment, Eaton Corporation plc (NYSE:ETN) saw sales rise by 18%, driven by new program launches in Europe. The company has managed to grow its bottom line by 10.61% over the past 5 years.

According to Insider Monkey’s database, Eaton Corporation plc (NYSE:ETN) has gained significant interest from institutional investors, with the number of hedge fund holders increasing to 93 in Q2 2024, up from 85 in the previous quarter.

Ave Maria World Equity Fund stated the following regarding Eaton Corporation plc (NYSE:ETN) in its first quarter 2024 investor letter:

“Eaton Corporation plc (NYSE:ETN) is an intelligent power management company. The company is a long-term beneficiary in the trend towards electrification, energy transition and digitalization. Eaton is also benefiting from unprecedented global stimuli such as the Inflation Reduction Act, Infrastructure Investment and Jobs Act, the Chips and Science Act and the EU recovery plan known as the NextGenerationEU.”