The COVID-19 pandemic dealt a severe blow to both cruise and air travel industries. The mere thought of traveling in a closed compartment with people from all over the world scared travelers. Hospitality businesses like hotels and restaurants were less affected but still felt the heat.

Over the last year, the air travel industry has recovered to the pre-pandemic levels. Cruise passengers have grown in numbers for the second successive year in 2024, and are likely to post a record in 2025 as well.

On the back of this recovery, travel services stocks have performed well and are likely to continue performing well in the future. We looked at the top 7 travel services stocks by screening them based on sales growth since the pandemic.

To come up with the list of 7 high-growth travel services stocks, we only considered stocks with a market cap of at least $10 billion and a 5-year sales growth rate of over 20%.

7. Booking Holdings Inc. (NASDAQ:BKNG)

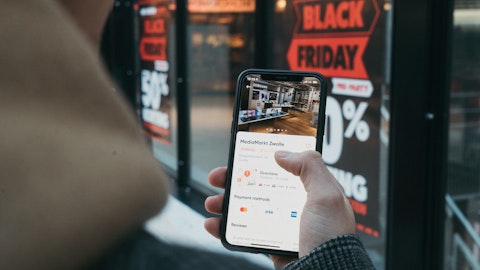

Booking Holdings Inc. offers reservation and related services for traditional and digital restaurants and travel. It operates the booking.com website that provides online accommodation reservations and Priceline, a hotel, flights, and rental cars booking service.

The company recently entered into a strategic partnership with Antom, a trade payment and digital transformation services provider to improve the payment process for Asian customers. The main purpose of this partnership is to leverage Antom’s multi-currency solutions and worldwide payment processing expertise to enhance its cross-border transactions. On top of that, the company announced strong Q3 2024 financial results indicating an 8.9% revenue growth as compared to the previous year and 36.44% revenue growth as compared to the previous quarter. As per the report, the net income of the company also rose by 65.48% QoQ while 0.24% YoY.

BKNG stock has performed well in the recent past, posting a gain of 29% over the past year. This strong performance and the company’s potential for growth in upcoming years make it a worthy option for investors.

6. MakeMyTrip Limited (NASDAQ:MMYT)

MakeMyTrip Limited is a digital travel company that supplies travel products and services. It operates in hotels & packages, air ticketing, and bus ticketing segments. The company provides a range of products and services including rail tickets, bus tickets, car hire, and other products and services.

As India’s domestic tourism is increasing and the government is supporting the travel industry by investing in travel infrastructure, the company’s profitability is poised to grow. In addition to domestic tourism, government investments will encourage the global audience and give rise to international tourism. Comparing the travel industry growth in different countries, India is leading the list with 6.7% YoY growth in 2024 and a projected 6.5% YoY growth in 2025.

The firm recently delivered positive earnings for the first time in 10 years. On the back of this profitability and the industry growth, the company is set to be a big gainer in 2025.