Last year we screened US-traded biotech stocks for those trading at the steepest discount to the most pessimistic analyst target prices. The average 1-year return on that portfolio is 80%.

In our screen, we considered the following: Analyst prices tend to be inflated, so we used the most pessimistic analyst target price as the benchmark for our analysis. In addition, we only focused on companies that have more than 5 analyst target prices (to make sure we only focus on companies that have decent analyst coverage).

The result of our screen in October 2011 was a portfolio of 9 stocks:

Affymax, Inc. (NASDAQ:AFFY), Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY), Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA), Array Biopharma Inc (NASDAQ:ARRY), Complete Genomics, Inc. (NASDAQ:GNOM), Incyte Corporation (NASDAQ:INCY), Inhibitex, Inc. (NASDAQ:INHX), XOMA Corporation (NASDAQ:XOMA), ZIOPHARM Oncology Inc. (NASDAQ:ZIOP).

The average 1-year return on that portfolio is 80% with AFFY driving a huge chunk of that growth.

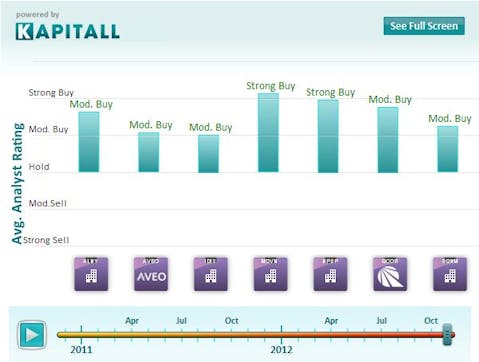

Naturally, we decided to run that screen again this year: US Biotech stocks only that have discrepancies between current price and target price. Again, we use the lowest analyst target price and companies with at least 5 analysts target prices. We found the 7 stocks below with Alnylam Pharmaceuticals making an encore.

Compare the analyst ratings of this portfolio:

Here’s the new list. Do you think these stocks will reach, or even exceed, their target price?:

1. Alnylam Pharmaceuticals, Inc. (ALNY, Earnings, Analysts, Financials): Focuses on the discovery, development, and commercialization of novel therapeutics based on RNA interference (RNAi). Market cap at $845.24M. Of the 5 analysts that have set a target price on the stock, the lowest price target stands at $20. This implies a potential upside of 24.3%. From current levels around $16.09.

2. AVEO Pharmaceuticals, Inc. (AVEO, Earnings, Analysts, Financials): Engages in the discovery and development of cancer therapeutics. Market cap at $309.62M. Of the 6 analysts that have set a target price on the stock, the lowest price target stands at $9. This implies a potential upside of 27.11%. From current levels around $7.08.

3. Idenix Pharmaceuticals Inc. (IDIX, Earnings, Analysts, Financials): Engages in the discovery and development of drugs for the treatment of human viral and other infectious diseases in the United States and Europe. Market cap at $522.13M. Of the 10 analysts that have set a target price on the stock, the lowest price target stands at $4.5. This implies a potential upside of 22.95%. From current levels around $3.66.

4. Medivation, Inc. (MDVN, Earnings, Analysts, Financials): Focuses on the development of small molecule drugs for the treatment of castration-resistant prostate cancer, Alzheimer’s disease, and Huntington disease. Market cap at $3.36B. Of the 12 analysts that have set a target price on the stock, the lowest price target stands at $61. This implies a potential upside of 28.42%. From current levels around $47.5.

5. NPS Pharmaceuticals, Inc. (NPSP, Earnings, Analysts, Financials): Engages in the development specialty therapeutics for gastrointestinal and endocrine disorders. Market cap at $772.83M. Of the 10 analysts that have set a target price on the stock, the lowest price target stands at $11. This implies a potential upside of 20.87%. From current levels around $9.1.

6. Questcor Pharmaceuticals, Inc. (QCOR, Earnings, Analysts, Financials): Provides prescription drugs for central nervous system and inflammatory disorders. Market cap at $1.48B. Of the 8 analysts that have set a target price on the stock, the lowest price target stands at $30. This implies a potential upside of 26.05%. From current levels around $23.8.

7. Sequenom Inc. (SQNM, Earnings, Analysts, Financials): Provides products, services, diagnostic testing, applications, and genetic analysis products that translate the results of genomic science into solutions for biomedical research, translational research, molecular medicine applications, and agricultural and livestock research. Market cap at $364.33M. Of the 9 analysts that have set a target price on the stock, the lowest price target stands at $4. This implies a potential upside of 29.03%. From current levels around $3.1.

This article was originally written by Freda Ding, and posted on Kapitall.