In this article, we will discuss the 7 Best Semiconductor Stocks to Buy Now.

In an updated forecast, The World Semiconductor Trade Statistics (WSTS) revised its 2024 projections upward, expecting a strong 19.0% YoY growth in the broader semiconductor market. The global market value for 2024 is now pegged at $627 billion, demonstrating improvement in performance in Q2 2024 and Q3 2024, mainly in the computing sector. Growth in 2024 is expected to be aided by 2 Integrated Circuit segments- Memory, which can increase by 81.0%, and Logic, which is expected to grow by 16.9%.

Region-wise, the Americas and Asia Pacific are well-placed to lead the recovery, with expected growth rates of 38.9% and 17.5%, respectively.

What Lies Ahead for The Semiconductor Market?

WSTS expects broad-based improvement for the semiconductor market in 2025, with an 11.2% growth, resulting in an estimated $697 billion in global market valuation. This growth is expected off the back of the Logic and Memory sectors, which together are expected to surpass $400 billion in value. This consists of a YoY growth of more than 17% for Logic and 13% for Memory. Notably, other semiconductor categories are projected to grow at more modest, single-digit rates, demonstrating a steady expansion for the broader industry.

WSTS believes that, in 2025, all the regions will be well-placed for continued expansion. The Americas and Asia Pacific regions will maintain their double-digit growth year over year.

READ ALSO: 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In.

Key Trends Likely to Aid Semiconductor Market in 2025

IDC predicted some critical trends in the semiconductor market. While AI-driven rapid growth continues to be on top of the list, the Asia-Pacific IC (Integrated Circuits) design market will continue to heat up. The memory segment is expected to be aided by the increased penetration of high-end products including HBM3 and HBM3e, which are needed for AI Accelerator, and the new generation of HBM4, which is expected to be rolled out in H2 2025. The non-memory segment is expected to be supported by healthy demand for advanced node ICs for AI servers, high-end mobile phone ICs, and WiFi7.

As per IDC, Asia-Pacific IC design product lines remain rich and diversified. Since inventory levels have been stabilizing, demand for personal devices is picking up, and AI computing continues to extend to a wide range of applications, the overall demand for IC design is expected to increase. Mature nodes (22nm-500nm) continue to have a wide range of applications spanning consumer electronics, industrial control, automotive, and other industry segments. Looking ahead, the demand is anticipated to improve after the correction and oversupply. This is expected to be aided by consumer electronics and periodical inventory replenishment across automotive and industrial control sectors.

With this in mind, let us now have a look at the 7 Best Semiconductor Stocks to Buy Now.

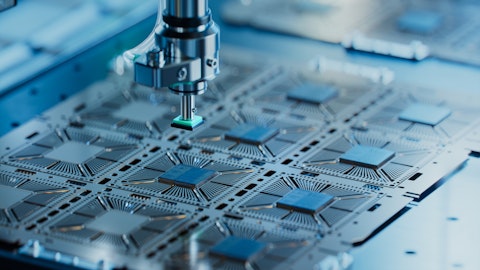

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

Our Methodology

To list the 7 Best Semiconductor Stocks to Buy Now, we used a screener and sifted through several online rankings. After getting an initial list of 12-15 stocks, we chose the ones that were popular among hedge funds. Finally, the stocks were arranged in ascending order of their hedge fund sentiment, as of Q3 2024.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

7 Best Semiconductor Stocks to Buy Now

7) Applied Materials, Inc. (NASDAQ:AMAT)

Number of Hedge Fund Holders: 74

Applied Materials, Inc. (NASDAQ:AMAT) is engaged in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. The company has a strong position in the semiconductor equipment market, mainly in deposition technologies. Its product portfolio remains well-aligned with areas of incremental spending in the broader semiconductor industry. This strategic positioning can contribute to market share gains and revenue growth in 2025.

The semiconductor industry continues to see increased adoption of gate-all-around (GAA) transistors. In fiscal 2024, Applied Materials, Inc. (NASDAQ:AMAT) generated more than $2.5 billion in revenue from GAA-related products, and the company anticipates this figure to double by 2025. With the continuous growth in GAA adoption, the company’s addressable market expands, leading to growth opportunities. Therefore, Applied Materials, Inc. (NASDAQ:AMAT)’s strong position in GAA technology and Advanced Packaging demonstrates significant growth opportunities.

Applied Materials, Inc. (NASDAQ:AMAT) believes that the semiconductor industry is expected to reach a $1 trillion market by 2030 and the company sees healthy demand in leading-edge logic and ICAPS nodes. Vltava Fund, an investment management company, released its Q4 2024 investor letter. Here is what the fund said:

“In the quarter just ended, we added to the portfolio two new companies from the technology sector: Applied Materials, Inc. (NASDAQ:AMAT) and Lam Research. Both are in the same industry as is another of our investments that we have held for some time, KLA Corporation. This industry is termed semiconductor devices and materials. One chapter in Hidden Investment Treasures is devoted to investing in technology companies and, among other things, the controversy over what really constitutes a technology company. As investors, we try to view technology companies not according to the industry into which they are formally classified but by whether the technologies and technological processes used in the production of their products and services are an essential element in value creation or if they are a source of long-term, sustainable competitive advantage. Among the companies that are formally categorized as technology-based and fall into either the Information Technology or the Communications Services sector, we find some that can be said to be just that but also others for which this classification is at least debatable. Similarly, among companies that do not formally belong to these two sectors, we find many that clearly are built to a large extent on technology and base their market positions and competitiveness on it. In the cases of Applied Materials and Lam Research, there can be no doubt that these are technology companies not only as a formality but also in fact.

Applied Materials provides manufacturing equipment, services, and software for the semiconductor, display, and related industries. Its principal business activities are semiconductor systems and Applied Global Services. Its largest customers are Samsung and Taiwan Semiconductors, but its overall clientele is more diversified than is that of Lam Research. At first glance, it would appear that Applied Materials has a somewhat less tangible and definable competitive advantage compared to KLA Corporation and Lam Research, but the numbers do not support such a view. Net margins likewise in the neighborhood of 27% and ROCE around 30% are outstanding. Basically, it can be said that all three companies we own have very similar underlying profitability metrics. Even their valuations, growth, and potential are similar. All have strong free cash flow and strong balance sheets, and they are regularly buying back their own shares over the long term and in large volumes…” (Click here to read the full text)

6) QUALCOMM Incorporated (NASDAQ:QCOM)

Number of Hedge Fund Holders: 74

QUALCOMM Incorporated (NASDAQ:QCOM) is a significant player in the semiconductor industry, with a strong focus on the design, development, and supply of chips and related technologies powering wireless communication and mobile devices. The growth of the semiconductor industry is expected to fuel the company’s expansion across several areas as demand for advanced mobile, wireless, and AI-driven technologies increases. Moving forward, connected and autonomous vehicles are expected to fuel the next leg of QUALCOMM Incorporated (NASDAQ:QCOM)’s growth.

With the broader automotive industry embracing connected vehicles, advanced driver-assistance systems, and autonomous driving technologies, the company’s automotive solutions are expected to see strong demand. QUALCOMM Incorporated (NASDAQ:QCOM)’s expertise in wireless communication, infotainment systems, together with AI processing will place it well to capitalize on ever-evolving automotive semiconductor market. With vehicles continuing to integrate in-car connectivity and entertainment systems, the company’s automotive chips are expected to power such systems.

As per QUALCOMM Incorporated (NASDAQ:QCOM)’s President and CEO, GenAI-enabled devices and applications have been evolving to understand natural language and images, which is fueling a new generation of AI-first experiences. This has the potential to create a new cycle of semiconductor innovation and content, and the company remains well-placed to capitalize on this opportunity across devices at the edge.

5) Micron Technology, Inc. (NASDAQ:MU)

Number of Hedge Fund Holders: 107

Micron Technology, Inc. (NASDAQ:MU)’s is a significant player in the semiconductor business that specializes in memory and storage solutions. Despite facing significant competition from other major semiconductor manufacturers, the company has been maintaining a competitive advantage because of its focus on innovation, technological leadership, and strategic investments. With global supply chain disruptions and economic tensions impacting production and profitability, Micron Technology, Inc. (NASDAQ:MU) has been maintaining a geographically diverse manufacturing footprint and proactively managing its supply chain.

With the company’s major patent portfolio and globally distributed manufacturing facilities, there is optimism about Micron Technology, Inc. (NASDAQ:MU)’s long-term growth prospects. It plans to invest up to $2.17 billion to expand its operation in the City of Manassas. As per the company’s Chief, its investments in domestic semiconductor manufacturing capabilities, aided by the bipartisan CHIPS Act and the incentives provided by the Commonwealth of Virginia and the City of Manassas, are expected to fuel economic growth and ensure that the US maintains its leading position in technological advancements.

Furthermore, the broader semiconductor industry continues to grow because of an increasing volume of data generated worldwide. This fuels demand for Micron Technology, Inc. (NASDAQ:MU)’s DRAM and NAND flash memory, which are important for processing and storing significant datasets in cloud computing, AI, and big data applications.

4) Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of Hedge Fund Holders: 107

Advanced Micro Devices, Inc. (NASDAQ:AMD) is a renowned semiconductor company that specializes in designing and developing advanced processors, graphic cards, and associated technologies. With strong prospects for the broader semiconductor industry, the company remains well-placed to expand its market share, enhance innovation, and improve revenues throughout product lines. Advanced Micro Devices, Inc. (NASDAQ:AMD)’s remarkable transformation demonstrates strategic focus, managerial excellence, and innovative adaptability, which places it well amidst the competitive semiconductor market.

Furthermore, the semiconductor’s industry expansion throughout multiple sectors, such as data centers, gaming, AI, 5G, and automotive results in significant opportunities for Advanced Micro Devices, Inc. (NASDAQ:AMD). The strong demand for cloud services and hyperscale data centers directly supports the company’s EPYC processors and Instinct GPUs, which provide high performance and energy efficiency for compute-intensive workloads. Rosenblatt Securities gave a “Buy” rating on the shares of Advanced Micro Devices, Inc. (NASDAQ:AMD), setting a price objective of $250.00 on 28th October.

The company made numerous strides over the past few years, enhancing its market share in central processing units (CPUs) and graphics processing units (GPUs), while placing itself to capitalize on the ever-evolving AI accelerators’ demand. The growth in AI and ML applications is expected to fuel demand for Advanced Micro Devices, Inc. (NASDAQ:AMD)’s hardware optimized for parallel processing, like GPUs and accelerators. Notably, AI workloads are fueling the semiconductor industry by creating demand for high-performance, energy-efficient, and AI-optimised chips.

3) Broadcom Inc. (NASDAQ:AVGO)

Number of Hedge Fund Holders: 128

Broadcom Inc. (NASDAQ:AVGO) is a leading global semiconductor company, which is engaged in designing, developing, and supplying a range of semiconductor and infrastructure software solutions. In FY24, Broadcom Inc. (NASDAQ:AVGO)’s semiconductor revenue came at a record $30.1 billion, driven by AI revenue of $12.2 billion. AI revenue, which increased 220% YoY, was fueled by its leading AI XPUs and Ethernet networking portfolio. The fundamentals of the company’s cyclical semiconductor businesses are now stabilizing, with most sectors well-placed for recovery in fiscal year 2025.

The infrastructure software business continues to see positive momentum, with healthy conversions and upsells to its VCF full-stack solution. Broadcom Inc. (NASDAQ:AVGO) has maintained a stable revenue growth trajectory despite fluctuating revenues due to delayed deals. Furthermore, the analysts are optimistic about the company’s expanding Serviceable Addressable Market (SAM). Morgan Stanley upped its price target on the company’s shares from $233.00 to $265.00, giving an “Overweight” rating on 20 December.

Broadcom Inc. (NASDAQ:AVGO) has 3 hyper-scale customers who have developed their own multi-generational AI XPU roadmap to be deployed at different rates during the upcoming 3 years. As per the company’s CEO, in 2027, the company believes each of them plans to deploy 1 million XPU clusters throughout a single fabric. Therefore, Broadcom Inc. (NASDAQ:AVGO) anticipates this to represent an AI revenue SAM (serviceable addressable market) for XPUs and networking of between $60 billion – $90 billion in fiscal 2027.

2) Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM)

Number of Hedge Fund Holders: 158

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) manufactures, packages, tests, and sells integrated circuits and other semiconductor devices. Its advanced nodes, mainly N3 and N5, have been witnessing full utilization, demonstrating robust demand for cutting-edge semiconductor technologies. Therefore, a high utilization rate not only results in improved margins but strengthens Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM)’s market position as a go-to manufacturer for advanced chips. The company’s capex strategy demonstrates its commitment to maintaining technological leadership and meeting growing demand.

The company’s management expects a 2025 capital budget of between US$38 billion and US$42 billion. The semiconductor industry has been evolving rapidly, with AI and high-performance computing coming out as critical growth drivers. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM)’s healthy position in such segments should fuel its growth trajectory. The supply/demand imbalance in the semiconductor industry is expected to persist until at least 2026, benefiting the company’s pricing power and market position.

ClearBridge Investments, an investment management company, released its Q3 2024 investor letter. Here is what the fund said:

“While the Strategy continues to have a significant position in Nvidia, we are underweight semiconductors versus the benchmark. We added to our semiconductor positioning during the quarter with the purchase of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). TSM, an out-of-benchmark name, is the world’s fabrication production provider of choice. The criticality and sophistication of its manufacturing footprint powers all of the leading edge fabless global semiconductor companies, including Apple, Nvidia, Qualcomm, AMD and Broadcom. While AI has driven upside in data centers, PCs and handsets are at cycle lows, positioning half of the company’s business for a recovery.”

1) NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 193

NVIDIA Corporation (NASDAQ:NVDA) is one of the leading players in the semiconductor business, with expertise in designing and manufacturing advanced graphic processing units (GPUs) and related technologies. The semiconductor industry’s growth is being driven by the global adoption of AI and ML, with the company’s GPUs, such as A100 and H100, critical for AI model training and inference. With the broader industry scaling to meet AI demand, NVIDIA Corporation (NASDAQ:NVDA) is expected to benefit from supplying cutting-edge hardware and software.

Furthermore, the expansion of data centers and analysis needs more powerful and efficient semiconductors. Thus, NVIDIA Corporation (NASDAQ:NVDA)’s leadership in data center GPUs places it well to capture this increasing demand. The company continues to make strides in the AI and semiconductor sectors. It launched new generative AI models and blueprints to further enhance its Omniverse platform, targeting advancing robotics, AVs (autonomous vehicles), and vision AI applications.

Robert W. Baird upped its target price on the shares of NVIDIA Corporation (NASDAQ:NVDA) from $150.00 to $190.00, giving an “Outperform” rating on 21st November. Infuse Asset Management, an investment management company, released its Q4 2024 investor letter. Here is what the fund said:

“We do still own some NVIDIA Corporation (NASDAQ:NVDA) as the forward multiple isn’t egregious and it powers over 90% of AI workloads. This company is only becoming increasingly important though the hyperscalers are actively trying to save money through their own ASIC programs. The moat CUDA provides has been underestimated time and time again. While I don’t think Nvidia has quite the upside as some of the other companies in the portfolio, it has a product that the best companies in the world literally can’t get enough of.”

While we acknowledge the potential of NVDA as an investment, our conviction lies in the belief that some deeply undervalued AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for a deeply undervalued AI stock that is more promising than NVDA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and investors. Please subscribe to our daily free newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.