2. Dell Technologies Inc. (NYSE:DELL)

Forward Price-to-Earnings Ratio: 14.93

Number of Hedge Fund Holders: 88

Dell Technologies Inc. (NYSE:DELL) designs, develops, manufactures, markets, sells, and supports information technology infrastructure such as laptops, desktops, mobiles, workstations, storage devices, software, cloud solutions, and notebooks, serving a diverse customer base, including businesses, government agencies, and consumers.

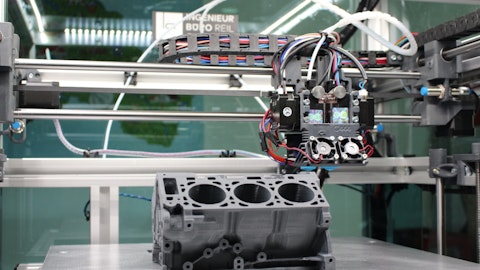

In late August, Elon Musk announced that the company, along with Super Micro Computer, would manufacture servers for his AI startup xAI. The company is also expanding other partnerships. AI servers now account for 12.4% of total revenue, up from 2.2% three quarters ago. Earlier this year, it expanded its AI factory with NVIDIA to include the new PowerEdge XE9680L server, as well as storage, edge, and workstation solutions.

In the second quarter of fiscal 2025, Dell Technologies Inc. (NYSE:DELL) made $25.03 billion in revenue, up 9.12% from a year-ago period, including the headwinds from the exit of VMware resale business. Combined CSG and ISG business grew 12%.

ISG revenue alone was up 38% year-over-year. Server and networking revenue rose 80%. Storage revenue was down 5%, while CSG revenue declined 4%. Commercial revenue was flat and consumer revenue was also down 22%.

Orders demand was $3.2 billion, primarily driven by Tier-2 cloud service providers. The company shipped $3.1 billion of AI servers this recent quarter. Management also took a $328 million charge for workforce reduction.

A year ago in FQ2, the firm had essentially no AI revenue. However, in the most recently reported FQ2, AI accounted for 40% of the company’s server and networking revenues. AI is moving incredibly fast, as in the past 12 months, the company sold nearly $9.5 billion of AI infrastructure and shipped $6.5 billion of AI infrastructure.

AI will play a key role in increasing productivity for the rest of fiscal 2025. Dell Technologies Inc.’s (NYSE:DELL) strong financial performance, including increased revenue and profitability, demonstrates its ability to capitalize on emerging trends.

Carillon Scout Mid Cap Fund stated the following regarding Dell Technologies Inc. (NYSE:DELL) in its Q2 2024 investor letter:

“Dell Technologies Inc. (NYSE:DELL) was a top contributor despite reporting disappointing first-quarter earnings results, because investors looked through the near-term disappointment and expected strong growth from AI-related servers and personal computers. We expect Dell to participate in the growth of artificial intelligence hardware, especially as enterprises invest more aggressively. We like the company’s depth and breadth of products and services, as well as its focus on keeping costs low.”