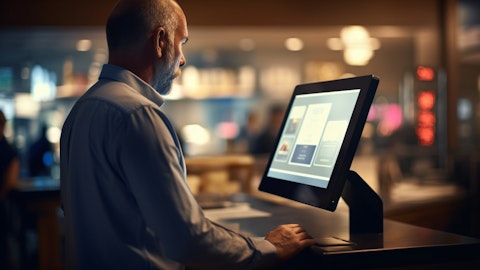

5. Fidelity National Information Services Inc. (NYSE:FIS)

Forward Price-to-Earnings Ratio: 14.95

Number of Hedge Fund Holders: 59

Fidelity National Information Services Inc. (NYSE:FIS) engages in the business of technology, solutions, and services for merchants, banks, and capital markets businesses, operating through Merchant, Banking, and Capital Markets segments. It provides a range of software and technology solutions to financial institutions, including banks, credit unions, and insurance companies.

The company is on track for a record year of new core signings, signing almost as many cores in half year 2024 as in the full year 2023. The digital business had new sales increasing by over 30% in the first half of 2024. This highlights the success of cross-selling efforts, which itself grew 15%, to existing core customers and the ability to displace competitors.

Revenue for Q2 2024 ended up being $2.49 billion, reflecting a 33.56% decline year-over-year. However, in adjusted revenue terms, there was a growth of 4% in revenue from the year prior, with recurring revenue also growing 4% in the quarter. Non-recurring revenue rose 21%.

The capital markets alone drove a lot of this growth, with adjusted revenue growing 7%, led by recurring revenue growth of 7%, excluding acquisitions. Other non-recurring revenue grew 15%, primarily reflecting growth in license revenue, and professional services increased by 2% in line with expectations.

The company recently partnered with Curinos to offer FIS core banking clients access to Curinos’ data and analytics. It also partnered with Lendio to streamline SMB loan processing for financial institutions. In Capital Markets, it launched the Climate Risk Financial modeler, a SaaS-based solution designed to help clients assess and quantify climate risk.

While the company has shown consistent profitability, it has focused on shifting its business model towards higher-value software-based solutions to drive sustainable growth.

Invesco Growth and Income Fund stated the following regarding Fidelity National Information Services, Inc. (NYSE:FIS) in its Q2 2024 investor letter:

“Given that many equity indexes reached record highs, valuation opportunities were limited and portfolio activity was somewhat muted. We purchased new holdings in financials, health care and IT. Fidelity National Information Services, Inc. (NYSE:FIS): The company is a leading global provider of financial services technology solutions for financial institutions, businesses and developers. The company has lagged its peers in recent years due to numerous acquisitions that increased its debt. However, a new CEO and CFO have made efforts to right size the firm and refocus on its core banking and capital market businesses by selling a partial stake in a recent acquisition. As a result, we believe the company should be able to increase selling opportunities, grow earnings and potentially return capital to shareholders.”