In this article, we’re going to talk about the 7 best cheap technology stocks to buy according to hedge funds.

Another Surge in Tech Stocks

Recent analysis indicates a reset in tech stocks as the Fed has not adjusted rates quickly enough for investors. However, following this week’s rate cut, there is a renewed connection between tech stocks and market sentiment. A 50 basis point reduction can ease borrowing and spending, potentially leading to increased mergers and acquisitions activity, and heightened investments in technology, particularly AI.

Lower interest rates are expected to accelerate the shift towards AI computing by making capital more accessible. As rates decrease, expected returns on investments become more attractive, fostering greater confidence among companies to invest in AI. There is actually a relationship between how tech stocks are driving utility stocks now due to a global increase power demand thanks to electrification and AI. Michael Khouw, OpenInterest.PRO Chief Strategist, talked about this in detail earlier this week. Here’s an excerpt from the 10 Worst AI Stocks to Buy According to Reddit article that covered him:

“Khouw discussed the current state of utilities and acknowledged that while it may seem daunting to invest in a sector that has seen substantial gains, over 7.5% total return since the beginning of last year, it is still an opportune time to consider utilities as an investment. Historically, utilities have not been perceived as a growth sector, but Khouw emphasized that they are currently trading at about 19 times forward earnings, which is relatively high compared to their usual discount to the market…. He predicts that a new phase of growth in electricity demand is on the horizon, driven primarily by two factors: the rise of electric vehicles (EVs) and the increasing need for data centers fueled by artificial intelligence (AI)…. This landscape indicates a promising rise in AI stocks, driven by the increasing recognition of AI’s transformative potential across various sectors. As electricity demand surges, fueled by the rise of EVs and the expansion of data centers necessary for AI operations, investors are likely to see significant growth opportunities in AI stocks as well.”

In recent market updates, the NASDAQ Composite emerged as the best-performing major index, despite not reaching any record highs, unlike the Dow Jones and S&P 500. The NASDAQ’s resilience can largely be attributed to a rally in chip stocks, with notable contributions from big tech companies, which have been instrumental in helping recover some of its declines. The Fed’s recent interest rate cut has sparked renewed enthusiasm in the semiconductor sector, leading to significant gains for exchange-traded funds (ETFs) focused on this industry.

On September 20, CNBC’s Seema Mody reported that the VanEck Semiconductor ETF was surging post the Fed’s rate cut, driven by positive sentiment surrounding chip manufacturers. Notably, British semiconductor giant Arm has gotten attention following a meeting with management from a major financial institution, where analysts expressed confidence that the designer could achieve 20% revenue growth over the next few years. This anticipated growth is largely attributed to the increasing demand for CPUs driven by AI workloads in data centers.

Meanwhile, Nvidia saw an uptick of about 5%, marking a 10% rebound over the past couple of weeks. This resurgence coincided with CEO Jensen Huang’s active media presence, promoting the potential of accelerated computing at various conferences, including a recent event with Salesforce’s CEO Marc Benioff.

Additionally, Intel clarified that it would not sell its stake in Mobileye, which provided relief for the shares of that subsidiary, contributing to a notable 17% increase on that day. The semiconductor industry is currently awaiting earnings reports from Micron and Taiwan Semi, which could further influence market dynamics.

The combination of favorable economic conditions spurred by the Fed’s rate cut and optimistic outlooks from industry leaders has rekindled interest in semiconductor stocks. Investors are closely monitoring developments within this sector as companies position themselves to meet the growing demand of businesses and consumers for AI-powered products and services. As the outlook remains bullish for tech stocks, we’re here with a list of the 7 best cheap technology stocks to buy according to hedge funds.

Methodology

We sifted through ETFs, online rankings, and internet lists to compile a list of 20 tech stocks with a forward P/E ratio under 20. We then selected the 7 cheapest stocks that were the most popular among elite hedge funds and that analysts were bullish on. The stocks are ranked in ascending order of the number of hedge funds that have stakes in them, as of Q2 2024.

Note: The data is sourced as of September 20, 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

7 Best Cheap Technology Stocks To Buy According to Hedge Funds

7. Flex Ltd. (NASDAQ:FLEX)

Forward Price-to-Earnings Ratio: 13.5

Number of Hedge Fund Holders: 46

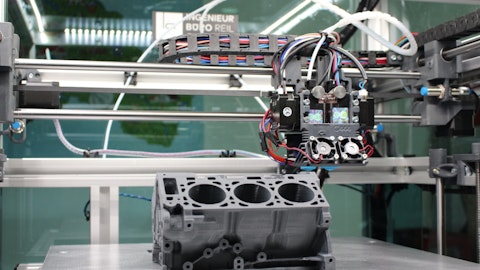

Flex Ltd. (NASDAQ:FLEX) is a multinational diversified manufacturing company that offers manufacturing solutions that incorporate advanced manufacturing capabilities, such as AI and ML, in its fabrication, assembly, and testing processes. It provides end-to-end manufacturing services, including design, engineering, manufacturing, and supply chain solutions for a range of industries.

Its unique power products and services offer value to customers and fuel growth, positioning it well for the AI-driven technology transition. It expects to outperform the market in automotive, despite concerns about EV adoption. The advanced compute solutions and power products provide a competitive edge. In digital health, the company sees strong medical device demand but a soft medical equipment market. A near-term supply-demand equilibrium is anticipated.

The company is focused on the AI sector, serving 80% of large and hyper-scale data center needs. It is one of the few AI industrial stocks with global reach and exposure to the automotive sector. Its power pods for data centers offer lower costs and shorter lead times, providing a competitive advantage. In FQ1 2025, there was significant progress in various large programs across its cloud, power, and automotive sectors.

In the fiscal first quarter of 2025, the company’s revenue fell 13.93% year-over-year, although it was up 2% sequentially. Datacenter and power revenues made up 25% of the total revenue. Reliability revenue was $2.9 billion more favorable than anticipated, led by stronger demand for power and medical devices. The sequential improvement was also driven by a reduction in net inventory by 6% sequentially and 21% year-over-year.

The company repurchased ~15 million shares totaling about $460 million of buyback this quarter. Flex Ltd. (NASDAQ:FLEX) is confident in meeting its full-year guidance and is well-prepared to capitalize on long-term opportunities in the automotive and healthcare sectors.

Artisan Small Cap Fund stated the following regarding Flex Ltd. (NASDAQ:FLEX) in its first quarter 2024 investor letter:

“We initiated new GardenSM positions in Flex Ltd. (NASDAQ:FLEX), On Holding and Onto Innovation during the quarter. Flex provides outsourced electronic manufacturing services to a diverse set of end markets. The company hired a new CEO in 2020, who has been driving a strategic pivot toward manufacturing high-value products in areas such as health care, industrial, automotive and cloud infrastructure. Today, these higher value items account for ~60% of revenues, and we believe they will continue to tick higher. We also believe an improving business mix, along with the reshoring of supply chains, will lead to faster growth and higher margins.”

6. TD Synnex Corp. (NYSE:SNX)

Forward Price-to-Earnings Ratio: 9.07

Number of Hedge Fund Holders: 46

TD Synnex Corp. (NYSE:SNX) brings together solutions for every type of ecosystem partner with global technology distribution and solution aggregation capabilities, providing a comprehensive range of IT products and services, including hardware, software, networking solutions, and cloud services to a diverse customer base, including businesses, government agencies, and educational institutions.

As of the recent quarter, management believes that its markets have stabilized, and there’s optimism about revenue and gross billings growth in the second half of the fiscal year. The company believes that AI presents significant opportunities for growth.

Despite this outlook, there was a year-over-year decline of 0.81% in revenue in Q2 2024, although gross billings were up 3%. The earnings per share were $0.36. The growth came from all areas of business, including Endpoint Solutions, Advanced Solutions, and Strategic Technologies, which represent 25% of total business.

Strategic technologies now represent 25% of total gross billings, up from 22% in the year-ago period. 75% of gross billings were from hardware, 19% from software, and 6% from services. There were overall improvements in the IT spending market, but the main drivers of growth were the Endpoint Solutions and the Advanced Solutions, up 1% and 5% year-over-year respectively.

Higher growth is expected for the rest of 2024, driven by the PC refresh cycle, customer investments in data centers and cloud deployments, increased hyperscale capital spending, and expansion in software, security, and data analytics.

It launched the IBM Watsonx Gold 100 program to accelerate AI opportunities for partners in the second quarter, aiming to recruit 100 partners to help them achieve IBM Gold-tier status and expand AI opportunities through the IBM Watsonx platform. It was also named Microsoft’s Global Copilot Seats Champion.

It is well-positioned to capitalize on these opportunities through its strong market presence and focus on innovation.

FPA Queens Road Small Cap Value Fund stated the following regarding TD SYNNEX Corporation (NYSE:SNX) in its Q2 2024 investor letter:

“TD SYNNEX Corporation (NYSE:SNX) is an information technology (IT) distributor formed through the merger of Tech Data and Synnex in 2021. IT distribution is an attractive business model that grows at a GDP+ rate with the opportunity for margin improvement through selling more software and services, although with some cyclicality. The IT distributors have historically traded cheaply, usually at less than 10x earnings.22 We have owned Synnex since 2012 and Tech Data from 2010 until it was taken private by Apollo in 2020. SNX has performed well on the back of a strengthening IT market, particularly for PCs.”