In this article, we discuss the 5 top hedge funds focusing on ESG and impact investing. If you want to read our detailed analysis of these hedge funds, go directly to the 10 Top Hedge Funds Focusing on ESG and Impact Investing.

5. CQS Cayman LP

CQS Cayman LP is placed fifth on our list of the 10 top hedge funds focusing on ESG and impact investing. It is a hedge fund based in Cayman Islands and has a portfolio value of more than $1.4 billion. It is managed by Michael Hintze and concentrates on investments related to the technology and services sectors. Hintze has recently renewed focus on impact investing and has been a vocal supporter of the Global Warming Policy Foundation, a United Kingdom-based lobby group that aims to urge world governments to adopt climate-friendly policies.

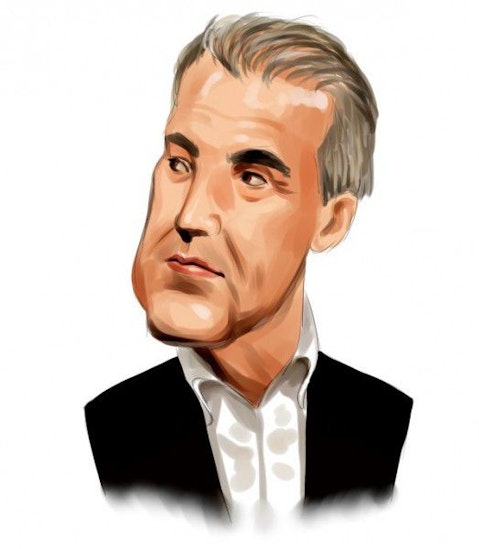

Michael Hintze of CQS Cayman LP

CQS Cayman LP has invested a lot of money in Discovery, Inc. (NASDAQ: DISCA), the media firm famous for nonfiction content. Out of the hedge funds being tracked by Insider Monkey, New York-based investment firm Renaissance Technologies is a leading shareholder in Discovery, Inc. (NASDAQ: DISCA) with 3.8 million shares worth more than $167 million.

In its Q1 2021 investor letter, Mayar Capital, an asset management firm, highlighted a few stocks and Discovery, Inc. (NASDAQ: DISCA) was one of them. Here is what the fund said:

“We also sold most of our holdings in Discovery as the stock price continued to increase to new highs. However, in late March the stock declined considerably when brokers liquidated holdings by Archegos Capital (see above in General Commentary) to satisfy margin calls. That brought the stock price down to levels that we found attractive, and we bought back a significant amount of the shares that we had sold earlier that month.”

4. Avenue Capital

Avenue Capital is a New York-based investment firm. It is ranked fourth on our list of 10 top hedge funds focusing on ESG and impact investing. The fund has a portfolio value of more than $144 million and is managed by Marc Lasry. The fund has previously announced plans to raise close to $600 million for a fund solely focused on impact investing. The fund, named Avenue Sustainable Solutions Fund, aims to provide flexible capital and other services to impact-focused firms primarily in North America.

One of the top investments of Avenue Capital is Vistra Corp. (NYSE: VST), the electric power company headquartered in Texas. The company is a good investment option for income investors. On April 29, it declared a quarterly dividend of $0.15 per share, in line with previous. The forward yield was 3.52%.

At the end of the first quarter of 2021, 90 hedge funds in the database of Insider Monkey held stakes worth $6.9 billion in Vistra Corp. (NYSE: VST), down from 95 the preceding quarter worth $7.1 billion.

3. TCI Fund Management

TCI Fund Management is a hedge fund run from London. It is managed by Chris Hohn. It is placed third on our list of 10 top hedge funds focusing on ESG and impact investing. The fund has more than $34 billion in assets under management. Most of the investments of the fund are concentrated in the technology, services, and finance sectors. Hohn is a vocal advocate of environmental protection and lobbies for reduction of greenhouse gases around the world, pushing companies he has invested in to reduce their carbon footprint.

Chris Hohn

One of the biggest holdings of TCI Fund Management is Alphabet Inc. (NASDAQ: GOOG), the technology company that operates from California. Out of the hedge funds being tracked by Insider Monkey, London-based investment firm TCI Fund Management is a leading shareholder in Alphabet Inc. (NASDAQ: GOOG) with 2.9 million shares worth more than $6.1 billion.

In its Q1 2021 investor letter, Artisan Partners, an asset management firm, highlighted a few stocks and Alphabet Inc. (NASDAQ: GOOG) was one of them. Here is what the fund said:

“Large-cap tech companies have been resilient through the pandemic—Alphabet among them. A top contributor, Alphabet’s Play Store and Google Cloud are in demand as businesses accelerate online activity which, along with strong YouTube user growth, is helping stabilize temporarily weaker search ad revenue trends. Through the lens of our disciplined bottom-up research process, we view Alphabet as one of the best businesses in the world, capable of expanding revenues at a rapid rate for years to come, with a bullet proof balance sheet and an average asking price. It’s a name we’ve owned since 2012 and for which we continue to have high hopes regarding future prospects.”

2. ValueAct Capital

ValueAct Capital is a hedge fund based in California. It is ranked second on our list of 10 top hedge funds focusing on ESG and impact investing. The fund has a portfolio value of over $8.5 billion. The finance and technology sectors comprise the majority of investments of the hedge fund. The fund was managed by Jeffrey Ubben till last year when he left to start his own venture. ValueAct has a strong ESG-focused approach to investments, a legacy left behind by Ubben who managed the fund for close to twenty years.

A top holding of ValueAct Capital is Citigroup Inc. (NYSE: C), the investment banking firm based in New York. At the end of the first quarter of 2021, 90 hedge funds in the database of Insider Monkey held stakes worth $6.9 billion in Citigroup Inc. (NYSE: C), down from 95 the preceding quarter worth $7.1 billion.

In its Q1 2021 investor letter, Artisan Partners Limited Partnership, an asset management firm, highlighted a few stocks and Citigroup Inc. (NYSE: C) was one of them. Here is what the fund said:

“We fully exited position in Citigroup. Global financial services company Citigroup made a $900 million clerical error and received a public reprimand from federal regulators. This, after a decade focused on process control, information technology and risk systems, makes the error substantially more costly than just the $900 million mistake. Regulators believe the company’s risk management improvements have fallen short of expectations. To rectify the situation, a process and technology spending surge could negatively affect 2021-2022 profits by 10% to 20%. Trust and confidence are important in large financial institutions, and this incident combined with the CEO’s sudden retirement shook ours.”

1. Generation Investment Management

Generation Investment Management is placed first on our list of 10 top hedge funds focusing on ESG and impact investing. It is a hedge fund headquartered in London with a portfolio value of close to $24 billion. Most of the investments of the fund are concentrated in the technology, healthcare, and finance sectors. The fund is managed by David Blood And Al Gore. Al Gore, a former US presidential candidate, is one of the leading climate rights activists in the world and his hedge fund has a keen focus on firms working in this area.

David Blood of Generation Investment Management

One of the top holdings of Generation Investment Management is Cisco Systems, Inc. (NASDAQ: CSCO), the technology based in California. Out of the hedge funds being tracked by Insider Monkey, London-based investment firm Generation Investment Management is a leading shareholder in Cisco Systems, Inc. (NASDAQ: CSCO) with 23 million shares worth more than $1.2 billion.

In its Q1 2021 investor letter, ClearBridge Investments, an asset management firm, highlighted a few stocks and Cisco Systems, Inc. (NASDAQ: CSCO) was one of them. Here is what the fund said:

“Also in IT, we added Cisco Systems, which provides IT and networking services in the form of network security, software development and cloud computing. Cisco continues to derive over 50% of its sales from on-premise deployments of its products of enterprise and small and midsize customers, while recurring revenues from software are becoming a larger part of the mix. Return-to-office enterprise spending should offer upside to its core campus business. Cisco was an early technology leader in sustainability over two decades ago, through its Internet-connecting capabilities which supported live concerts in partnership with the United Nations Development Program to raise awareness and funds to fight poverty. Cisco has very strong environmental standards (including driving lower energy consumption in IT departments through new product innovations and a longstanding goal to reduce emissions and reliance on non-renewable energy sources). Its data privacy and supply chain management policies are best in class.”

You can also take a peek at 10 Biggest Hedge Fund Casualties of Reddit WallStreetBets’ Short Squeezes and 10 Best EV Startups to Watch.