Moore Capital Management, the New York-based asset management firm founded by billionaire trader Louis Bacon, recently revealed its U.S equity portfolio as of the end of September via a 13F filing submitted with the SEC. Mr. Bacon holds an MBA from Columbia Business School and started Moore Capital Management in 1989 after quitting his job as the senior vice president of futures trading at the now-defunct investment bank Shearson Lehman Brothers. A year after founding Moore Capital, Mr. Bacon launched his flagship fund Moore Global Investments with $25,000 that he inherited from his mother. In the years since, Moore Capital has grown to become an investment powerhouse, managing over $50 billion in regulatory assets, and is considered one of the best global macro-focused hedge funds on the Street.

According to Moore Capital’s latest 13F filing, its public equity portfolio was worth $2.91 billion at the end of September, with its top-10 equity holdings amassing over 45% of that value. The filing also revealed that during the third quarter the fund’s portfolio experienced a quarterly turnover of around 80%, and that the sector whic the fund had the highest exposure towards was the financial sector, stocks from which accounted for more than half of the value of its portfolio. Though the fund had a fairly top-heavy portfolio and high exposure towards financial stocks at the end of September, in this article, we are going to focus on a different aspect of its portfolio. We will take a look at five notable bets the fund made in the derivatives segment by using options and will discuss how the underlying assets of those options have performed lately.

At Insider Monkey, we track around 750 hedge funds and institutional investors. Through extensive backtests, we have determined that imitating some of the stocks that these investors are collectively bullish on can help retail investors generate double digits of alpha per year. The key is to focus on the small-cap picks of these funds, which are usually less followed by the broader market and allow for larger price inefficiencies (see more details about our small-cap strategy).

American Airlines Group Inc (NASDAQ:AAL)

– Option Type: Call (Bullish)

– Shares Covered Under The Options Held By Moore Capital Management (as of September 30): 250,000

– Value of the Holding (as of September 30): $9.15 Million

Moore Capital Management boosted the number of Call Options on American Airlines Group Inc (NASDAQ:AAL) that it held by 400% during the third quarter, to cover 250,000 underlying shares. Considering that shares of the airline holding company have appreciated by over 20% in the current quarter, the fund appears to have made a strong bet. On November 7, American Airlines Group Inc (NASDAQ:AAL) declared a quarterly dividend of $0.10 per share, which was in-line with its previous dividend and translates into a forward yield of 0.89%. The International Air Transport Association recently released a report in which it forecast that the number of airline passengers will double by 2035 to 7.2 billion and that the North American market will have a CAGR of 2.8% in the coming years. According to analysts, this bodes well for American Airlines, which has already been performing well over the last few quarters.

Follow American Airlines Group Inc. (NASDAQ:AAL)

Follow American Airlines Group Inc. (NASDAQ:AAL)

Receive real-time insider trading and news alerts

Monsanto Company (NYSE:MON)

– Option Type: Put (Bearish)

– Shares Covered Under The Options Held By Moore Capital Management (as of September 30): 147,000

– Value of the Holding (as of September 30): $15.02 Million

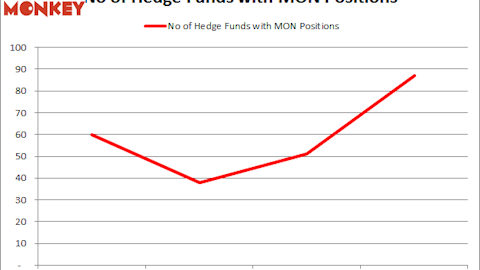

Although Moore Capital Management reduced the number of Put Options of Monsanto Company (NYSE:MON) that it held by 51% during the third quarter, it also closed its Call Options holding in the agro products manufacturer during that time, while also increasing its long position in the company by 66% to 250,000 shares. In September, Bayer AG announced that it will be acquiring Monsanto Company (NYSE:MON) in a deal that values the latter at $66 billion. Interestingly, instead of moving up, shares of Monsanto have been on a downtrend since the deal was announced and are currently trading up by 2.66% year-to-date. On November 15, Bayer revealed that it will be issuing 4 billion Euros ($4.3 billion) worth of mandatory convertible notes as part of its measures to fund the acquisition. The German drug and crop chemical maker had finalized the syndication of a $57 billion bridge loan to support its acquisition last month.

– Related Reading: Top 10 Agriculture Producing Countries in the World

Follow Monsanto Co W (NASDAQ:MON)

Follow Monsanto Co W (NASDAQ:MON)

Receive real-time insider trading and news alerts

We’ll check out Louis Bacon’s options trading activity regarding three other stocks on the next page.