We will take a look at the 5 most valuable pre-IPO companies in the world. To read our analysis of the recent market trends, you can go to the 15 Most Valuable Pre-IPO Companies in The World.

5. Stripe

Valuation: $50 billion

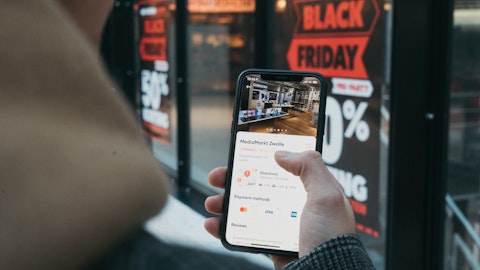

Founded in 2010, Stripe, Inc. is a leading software technology company offering a suite of APIs powering online payment processing and commerce solutions for internet businesses of all sizes including online and in-person retailers, subscriptions businesses, software platforms and marketplaces, and everything in between. The company is dual headquartered in Dublin, Ireland, and San Francisco, California, and employs more than 7,000 personnel.

Stripe supports more than 135 currencies and payment methods and offers services across more than 45 countries across the world. More than $640 billion of payments were processed by the businesses using Stripe services in 2021.

In March 2021, Stripe announced that it had raised $600 million in a funding round at a valuation of $95 billion. Investors including Allianz X, Axa, Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital, and Ireland’s National Treasury Management Agency, participated in the round.

According to some media reports, Stripe is seeking a multi-billion funding round which is expected to value the company at nearly $50 billion.

4. Shein

Valuation: $64 billion

Founded in 2008, Shein is a Chinese global fashion and lifestyle e-retailer with products sold in more than 150 countries and territories worldwide. Shein uses on-demand manufacturing technology to connect suppliers to its supply chain, reducing inventory wastage and enabling cheaper products. Its annual sales reportedly exceeded $10.0 billion in 2020.

Shein was reportedly valued at more than $100 billion in a funding round raised during the first half of 2021. The company is backed by investors including General Atlantic, Tiger Global Management, and Sequoia Capital China, among others. Shein was seeking additional multi-billion dollar funding for the company earlier this year, reportedly, at a valuation of $64 billion.

3. Ant Group Co., Ltd.

Valuation: $64 billion

Ant Group Co., Ltd. is a leading financial technology company based in Hangzhou, China. The company provides financial services including wealth management, micro-financing, and insurance, and operates financial services brands like Alipay, Ant Fortune, Zhima Credit, MYbank, and Ant Financial Cloud. Alipay has more than 1bn users, including 711mn monthly active users, as well as over 80mn monthly active merchants and over 2,000 partner financial institutions.

Ant Group obtained a $150 billion valuation in May 2018 with the raise of a $14 billion funding round. In late 2020, the company attempted to raise more than $34 billion in an IPO through a dual-listing on Hong Kong and Shanghai stock exchanges, and was seeking a valuation of nearly $312 billion.

The IPO had to be shelved amid regulatory concerns from the Chinese authorities and the valuation of the company has since taken a massive nosedive. According to a Bloomberg report, Boston-based Fidelity Investments lowered its valuation for Ant Group to $64 billion.

2. SpaceX

Valuation: $137 billion

Founded in 2002 by Elon Musk, Hawthorne, California-based Space Exploration Technology Corp, commonly known as SpaceX, designs, manufactures and launches rockets and spacecraft. Its projects include Dragon, Falcon 9, Falcon Heavy, Starlink and StarShip, among others.

According to a CNBC report in January 2023, SpaceX is raising $750 million in a new funding round at a valuation of $137 billion. Potential investors include Andreessen Horowitz, Founders Fund, Sequoia, Gigafund and many others.

1. ByteDance

Valuation: $300 billion

ByteDance is the most valuable pre-IPO technology company as per latest available valuation reports. The China-based company, founded in 2012, operates a range of multiple content platforms that are available across more than 150 markets in more than 75 languages. Its portfolio of products includes famous global short-form video platform TikTok, China’s leading short-form video platform Douyin, Toutiao, Helo, Xigua Video, Lark, and BytePlus.

ByteDance platforms had a combined total of 1.9 billion monthly active users as of December 2020, according to a report. During 2020, its revenue reached $34 billion while gross profit was recorded at $19 billion.

ByteDance’s shares were being traded in the secondary markets at valuations ranging from $275 billion to $300 billion, late last year. The company is backed by investors including Coatue, Hillhouse, SoftBank, KKR & Co., Sequoia Capital, and General Atlantic, among others.

You may also like to read 15 Most Shorted Stocks Right Now on Wall Street and 12 Biggest Battery Manufacturers in the World