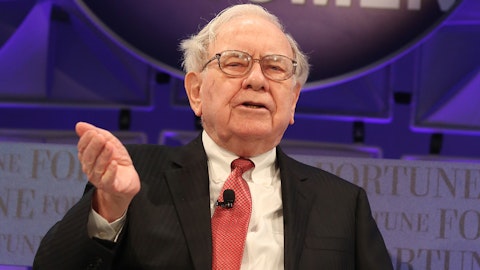

In this piece, we will take a look at the five cheapest stocks that Warren Buffett owns. If you want to learn more about the legendary investor, then take a look at 15 Cheapest Stocks Warren Buffett Owns.

5. The Liberty SiriusXM Group (NASDAQ:LSXMA)

Berkshire Hathaway’s Latest Investment: $1.4 billion

TTM P/E Ratio: 7.59

The Liberty SiriusXM Group (NASDAQ:LSXMA) is an entertainment company headquartered in Englewood, Colorado. Mr. Buffett owns several blocks of shares of the firm, out of which the most valuable is worth $1.4 billion making him the largest shareholder. The Liberty SiriusXM Group (NASDAQ:LSXMA) had a disastrous second quarter as it missed analyst EPS estimates by a whopping $1.29 which led the shares to drop by 30% on the market in the aftermath.

Cumulatively, 43 of the 910 hedge funds part of Insider Monkey’s Q2 2023 database had invested in The Liberty SiriusXM Group (NASDAQ:LSXMA).

Follow Liberty Media Corp (NASDAQ:FWONK)

Follow Liberty Media Corp (NASDAQ:FWONK)

Receive real-time insider trading and news alerts

4. Occidental Petroleum Corporation (NYSE:OXY)

Berkshire Hathaway’s Latest Investment: $13.2 billion

TTM P/E Ratio: 7.32

Occidental Petroleum Corporation (NYSE:OXY) is an American oil and gas exploration and production firm headquartered in Texas. Its earnings per share have dropped from $2.44 in Q3 2022 to 68 cents in Q2 2023, highlighting the scope of normalization that has taken place in the oil industry this year.

As June 2023 ended, 73 of the 910 hedge funds surveyed by Insider Monkey had held a stake in the company. Mr. Buffett’s firm is Occidental Petroleum Corporation (NYSE:OXY)’s biggest shareholder in our database since it owns 224 million shares that are worth $13.2 billion.

Follow Occidental Petroleum Corp (NYSE:OXY)

Follow Occidental Petroleum Corp (NYSE:OXY)

Receive real-time insider trading and news alerts

3. Citigroup Inc. (NYSE:C)

Berkshire Hathaway’s Latest Investment: $2.5 billion

TTM P/E Ratio: 6.7

Citigroup Inc. (NYSE:C) is one of the largest banks in America, with close to a quarter of a million employees. The bank created a bit of controversy in August when it was revealed that it had bought $160 million of Russian aluminum, motivated by perhaps a steep discount in global aluminum prices.

Insider Monkey scoured through 910 hedge funds for their second quarter of 2023 shareholdings and discovered that 75 had invested in Citigroup Inc. (NYSE:C). Citigroup Inc. (NYSE:C)’s largest hedge fund investor is Berkshire Hathaway courtesy of a $2.5 billion investment.

Follow Citigroup Inc (NYSE:C)

Follow Citigroup Inc (NYSE:C)

Receive real-time insider trading and news alerts

2. Ally Financial Inc. (NYSE:ALLY)

Berkshire Hathaway’s Latest Investment: $783 million

TTM P/E Ratio: 6.58

Ally Financial Inc. (NYSE:ALLY) is a financial firm that provides a variety of services for customers seeking insurance, mortgage, car loans, and other products. Warren Buffett’s Berkshire Hathaway owned 79 million shares that were worth $783 million as of 2023’s June quarter.

During the same time period, 46 out of the 910 hedge funds polled by Insider Monkey had bought and owned the company’s shares. Out of these, Ally Financial Inc. (NYSE:ALLY)’s second largest stakeholder is Natixis Global Asset Management’s Harris Associates since it owns a $703 million investment.

Follow Ally Financial Inc. (NYSE:ALLY)

Follow Ally Financial Inc. (NYSE:ALLY)

Receive real-time insider trading and news alerts

1. General Motors Company (NYSE:GM)

Berkshire Hathaway’s Latest Investment: $848 million

TTM P/E Ratio: 5.12

General Motors Company (NYSE:GM) is one of the largest car manufacturers in America. Berkshire Hathaway reduced its stake in the firm by a large 45% in Q2, with the latest investment now sitting at $848 million. A shift in the auto sector towards electric vehicles has put traditional car manufacturers on the back foot, injecting uncertainty into their prospects of a smooth transition.

As of Q2 2023 end, 72 of the 910 hedge funds surveyed by Insider Monkey had held a stake in General Motors Company (NYSE:GM). The biggest shareholder among these is Natixis Global Asset Management’s Harris Associates through a $1.4 billion stake.

Follow General Motors Co (NYSE:GM)

Follow General Motors Co (NYSE:GM)

Receive real-time insider trading and news alerts

Disclosure: None. You can also take a look at 12 Undervalued Blue Chip Stocks To Buy According to Wall Street Analysts and 15 Best Consumer Discretionary Stocks to Buy According to Hedge Funds.

Insider Monkey focuses on uncovering the best investment ideas of hedge funds and investors. Please subscribe to our daily free newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.