In this piece, we will take a look at the five best 3D printing and additive manufacturing stocks to buy. For a deeper dive into the industry, read 10 Best 3D Printing and Additive Manufacturing Stocks To Buy.

5. AMETEK, Inc. (NYSE:AME)

Q2 2023 Hedge Fund Holdings: 38

AMETEK, Inc. (NYSE:AME) enables users to scan objects in 3D to aid them in the product design and fabrication process. The firm has also partnered up with a German firm to print helmets using 3D technologies. The shares are rated Buy on average and analysts have penned in a sizeable $23 in share price upside.

By the end of this year’s second quarter, 38 out of the 910 hedge funds that were part of Insider Monkey’s database had bought a stake in AMETEK, Inc. (NYSE:AME) . Out of these, the firm’s largest investor is Israel Englander’s Millennium Management since it owns 941,086 shares that are worth $152 million.

Follow Ametek Inc (NYSE:AME)

Follow Ametek Inc (NYSE:AME)

Receive real-time insider trading and news alerts

4. HP Inc. (NYSE:HPQ)

Q2 2023 Hedge Fund Holdings: 46

HP Inc. (NYSE:HPQ) is one of the most iconic personal computing companies in the world. It is directly involved in the 3D printer manufacturing industry, as it sells 3D printers and also works with other players. The firm’s shares dropped in September after filings revealed that Warren Buffett, one of its largest investors, had reduced holdings by 4.5%.

During Q2 2023, 46 out of the 910 hedge funds polled by Insider Monkey were the firm’s investors. During this period, HP Inc. (NYSE:HPQ)’s biggest shareholder was Warren Buffett’s Berkshire Hathaway through a $3.7 billion stake.

Follow Hp Inc (NYSE:HPQ)

Follow Hp Inc (NYSE:HPQ)

Receive real-time insider trading and news alerts

3. Autodesk, Inc. (NASDAQ:ADSK)

Q2 2023 Hedge Fund Holdings: 54

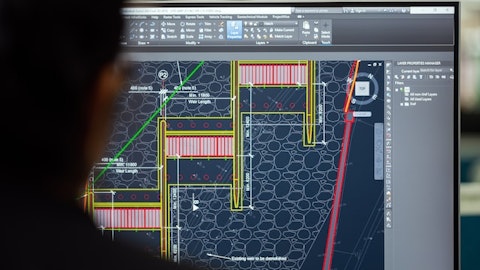

Autodesk, Inc. (NASDAQ:ADSK) operates on the software end of additive manufacturing. 3D printing a product requires printing it first and the firm’s products allow enthusiast and professional users to do so. Autodesk, Inc. (NASDAQ:ADSK) made a flash in the industry earlier this year when a pedestrian bridge designed through its software was unveiled.

After digging through 910 hedge funds for their June quarter of 2023 shareholdings, Insider Monkey found that 54 had invested in Autodesk, Inc. (NASDAQ:ADSK). Out of these, the largest investor was William Von Mueffling’s Cantillon Capital Management since it owns $258 million worth of shares.

Follow Autodesk Inc. (NASDAQ:ADSK)

Follow Autodesk Inc. (NASDAQ:ADSK)

Receive real-time insider trading and news alerts

2. Apollo Global Management, Inc. (NYSE:APO)

Q2 2023 Hedge Fund Holdings: 62

Apollo Global Management, Inc. (NYSE:APO) is one of the largest private equity and global investment firms in the world. It has stakes in hundreds of companies and brings in billions of dollars in revenue each year. It is currently seeking to expand its business in Oceania, take up stakes in a gambling company, and a key August investment was a majority stake in Composite Advanced Technologies, Inc – a transportation and fuel gas storage products provider.

During the previous quarter, 62 out of the 910 hedge funds tracked by Insider Monkey had bought Apollo Global Management, Inc. (NYSE:APO)’s shares.

Follow Apollo Global Management Inc. (NYSE:APO)

Follow Apollo Global Management Inc. (NYSE:APO)

Receive real-time insider trading and news alerts

1. General Electric Company (NYSE:GE)

Q2 2023 Hedge Fund Holdings: 71

If you’d read the introduction to our piece, you’d understand the depth of General Electric Company (NYSE:GE)’s presence in the 3D printing industry. The firm has been manufacturing jet engine blades through 3D printing for quite a while and has specialized business divisions in Europe to help aid it in the process.

As of Q2 2023, 71 out of the 910 hedge funds part of Insider Monkey’s database had invested in the company. General Electric Company (NYSE:GE)’s biggest stakeholder among these is Chris Hohn’s TCI Fund Management courtesy of its $4.5 billion investment.

Follow General Electric Co (NYSE:GE)

Follow General Electric Co (NYSE:GE)

Receive real-time insider trading and news alerts

Disclosure: None. You can also take a look at 13 Spin-off Companies in 2023 and 30 Happiest Countries in the World.