Since went public in 2007, the stock has faced relentless skepticism regarding its growth strategy and ability to fend off competitors. More recently, bears prematurely started their victory laps when management provided less-than-stellar earnings guidance.

Memo to shorts: Lululemon Athletica inc. (NASDAQ:LULU)’s fundamentals are in great shape, and the stock isn’t as expensive as you make it out to be.

Let’s walk through the bears’ thesis, and break down their argument point by point.

Bear argument: Lululemon has little brand recognition internationally, and expansion efforts will likely be unsuccessful.

Lululemon has the human and financial resources in place to execute its growth strategy.

CEO Christine Day is one of the best executives in retail. Before taking over the yoga apparel company in 2008, Day served a 20-year tenure Starbucks, where she led the company’s successful Asian expansion. Day has a knack for fostering loyal customer relationships and strong corporate cultures.

The company also boasts a clean balance sheet with no long-term debt. Growth is financed entirely through cash flows from operations, ensuring Lululemon has the financial flexibility needed for expansion.

Slowing Growth

Bear argument: Lululemon’s same-store sales growth is falling, and the company is close to saturating the North American market.

Ultimately, management’s conservative guidance has reset the market’s expectations lower, which could set up the stock for an earnings beat in upcoming quarters.

Lululemon has the potential to deliver respectable high-single-digit same-store sales growth with product line expansions into men’s apparel, children’s clothing, and road cycling equipment. Lululemon also continues to innovate with new products and fabrics which will continue to drive sales.

In addition, Lululemon still has lots of growth runway in the United States. Assuming the company can penetrate the U.S. market to a same degree it has in Canada, Lululemon has room to more than triple its U.S. store count.

Falling Margins

Bear argument: Lululemon’s gross margins are threatened by new players encroaching on the company’s lurcative niche.

Lululemon does face new competitive threats.

Under Armour Inc (NYSE:UA) and NIKE, Inc. (NYSE:NKE) recently entered the yoga apparel space, aggressively undercutting Lululemon’s prices by 20%-30%. Both companies have been able to enter the market quickly by taking advantage of their large distribution networks rather than building entirely new retail outlets from scratch. These efforts appear to be paying off, with both companies reporting 25% growth in their women’s active-wear segments.

The Gap Inc. (NYSE:GPS) is also making inroads. In 2008, the company acquired catalog and e-tailer Athleta for $150 million to extend its position in the women’s active-wear market. As of the company’s third quarter, Gap operated 30 Athleta stores reporting $89 million in sales.This represents less than 3% of Gap’s total revenue, and compares to a $317 million top-line figure Lululemon reported over the same period. By fiscal year-end 2012, Gap plans to operate 50 Athleta locations and also projects 30% year-over-year revenue growth.

Will these efforts be successful? There’s no evidence to suggest Under Armour Inc (NYSE:UA), Nike, and The Gap can steal market share by simply cutting prices. Lululemon has already fended off low-priced competitors. Target Corporation (NYSE:TGT) and Victoria’s Secret entered the yoga apparel space years ago, yet this has done little to deter Lulu’s self-described cultlike following.

Lululemon has built up an incredibly loyal fan base, with customers willing pay a premium for the brand name regardless of cheaper alternatives.

Expensive Valuation

Bear argument: Lululemon is the most expensive stock in retail on a P/S and P/E basis.

Yes, Lululemon is one of the most expensive stocks the apparel space on several trailing metrics:

But context is everything.

Lululemon’s P/S ratio is skewed because the company is so profitable. Given that the company’s gross margins are the highest in the apparel space, it stands to reason that investors would pay a premium for every revenue dollar.

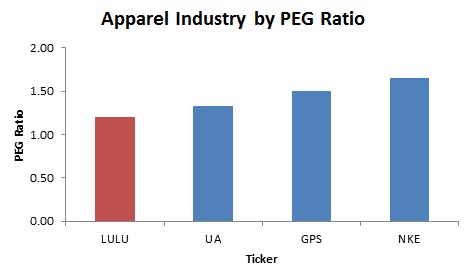

Lululemon’s trailing P/E ratio is also a bit misleading. Yes, the stock looks expensive at 42 times trailing profits, well above The Gap, Nike, and Under Armour. But Lululemon’s valuation is much more reasonable once we take into account the company’s growth potential, and value the stock on a PEG basis.

In fairness, there are potential holes in the bulls’ thesis, too. Fashion customers are fickle. Investors must keep a close eye on the marketplace to ensure that Lululemon maintains its top spot in women’s fitness apparel.

Yet despite the bears’ claims to the contrary, Lululemon is a great investment opportunity, thanks to the company’s compelling growth story, strong moat and reasonable valuation.

The article 4 Mistaken Reasons to Sell Lululemon originally appeared on Fool.com and is written by Robert Baillieul.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.